The forex markets remain unusually quiet today, with Dollar staying soft despite multiple attempts to rebound. The greenback has only managed meaningful gains against the weaker Yen and the struggling Canadian Dollar, while failing to build momentum against other major currencies. With little in the way of significant economic data on the calendar today, trading is expected to remain subdued. However, volatility could resurface, probably just temporarily, later in the week, with BoJ’s anticipated rate hike and key PMI releases from major economies slated for Friday.

Loonie, nonetheless, could see movement today, with retail sales data due. BoC is widely expected to cut rates by 25 bps at its upcoming meeting next Wednesday, a view supported by a Reuters survey where 25 out of 31 economists forecast such a move. Additionally, median expectations point to another 25 bps cut in March, followed by a further reduction later in the year, bringing the overnight rate to 2.50%.

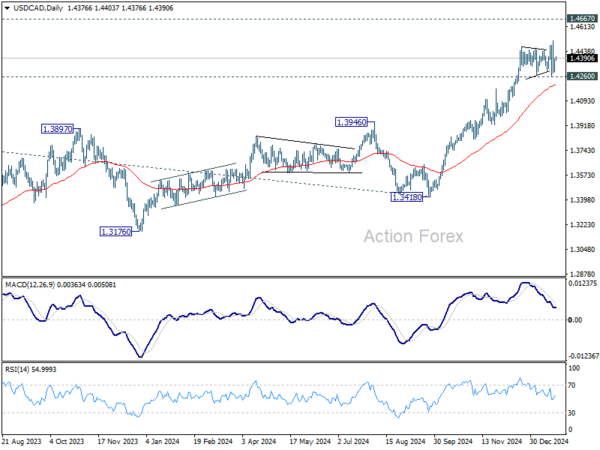

For USD/CAD, however, the real driver for a decisive range breakout, beyond brief jitters, would lie in developments surrounding US-Canada trade relations. The market awaits details of tariffs expected to be announced on February 1, including their scope and which products will be affected.

So far this week, Yen has been the weakest performer, followed by Dollar and Loonie. At the other end of the spectrum, the Kiwi remains the strongest, while Euro and Aussie. Sterling and Swiss are still stuck in middle positions.

A key development this week has been the sharp decline in USD/CNH, which is viewed as a sign of a stabilizing risk sentiment toward global trade. Technically, a short term top should be formed at 7.3694, just ahead of 7.3745 key resistance (2022 high). More consolidative is expected in the near term with risk of deeper pull back. But downside should be contained by 38.2% retracement of 6.9709 to 7.3694 at 7.2172. Eventual upside break remains in favor.

Gold surges on Dollar weakness, Silver lags

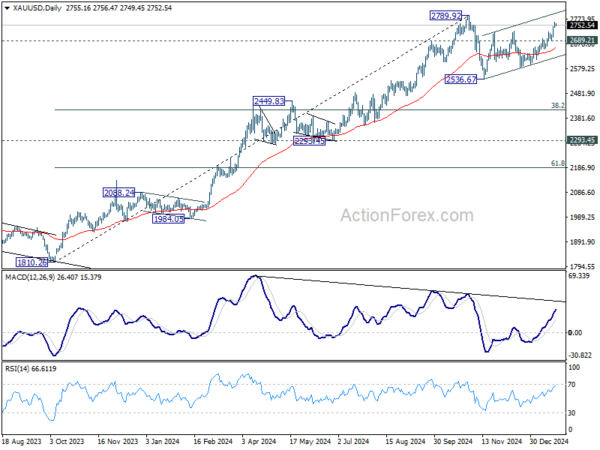

Gold prices surged past 2750 mark this week, supported largely by a weaker Dollar. The overall market sentiment is on a relatively calmer backdrop, with US President Donald Trump’s decision to delay tariff implementations contributed to easing trade-related fears. Additionally, geopolitical tensions receded as a ceasefire between Israel and Hamas took hold earlier in the week.

Hence, as whether Gold can break its record high of 2789 will depend largely on the depth of Dollar’s correction in the coming days.

Technically, Gold’s rebound from 2536.67 is currently seen as the second leg of the corrective pattern from 2789.92 high. Strong resistance could be seen from this resistance to limit upside. Break of 2689.21 support will argue that the third leg of the pattern has started back towards 2536.67 support. Nevertheless, decisive break of 2789.92 will confirm up trend resumption.

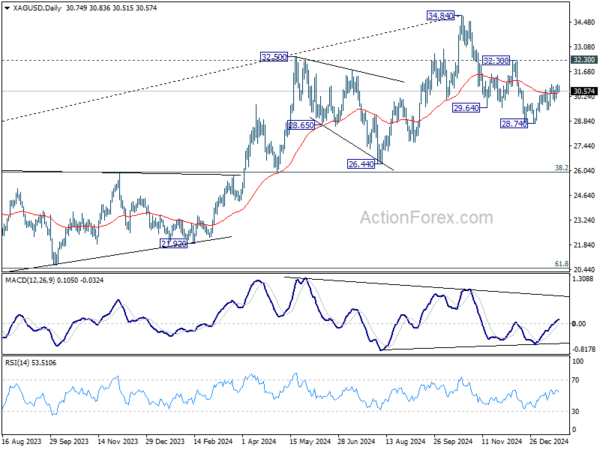

Silver’s performance, by comparison, has been relatively subdued. Its recovery from 28.74 remains weak and corrective in nature. For now, as long as 32.30 resistance holds, fall from 34.84 is still in favor to resume at a later stage, to 26.44 cluster support zone.

Japan posts first trade surplus in six months

Japan recorded a trade surplus of JPY 130.9B in December, the first surplus in six months, driven by a 2.8% yoy rise in exports to JPY 9.91T. Imports also jumped, rising 1.8% yoy to JPY 9.8T.

However, exports to the two largest trading partners saw declines, with shipments to China falling by -3.0% yoy and to the US by 2.1% yoy.

On a month-on-month seasonally adjusted basis, exports rose 6.3% mom to JPY 9.44T. Imports increased 2.2% mom to JPY 9.47T, resulting in a seasonally adjusted trade deficit of JPY 33B.

For the entirety of 2024, Japan’s trade deficit narrowed significantly, shrinking by 44% from the previous year to JPY -5.33T. Exports reached a record high of JPY 107.09T, up 6.2%, bolstered by strong demand for vehicles and semiconductor-related products. Imports also rose by 1.8% to JPY 112.42T.

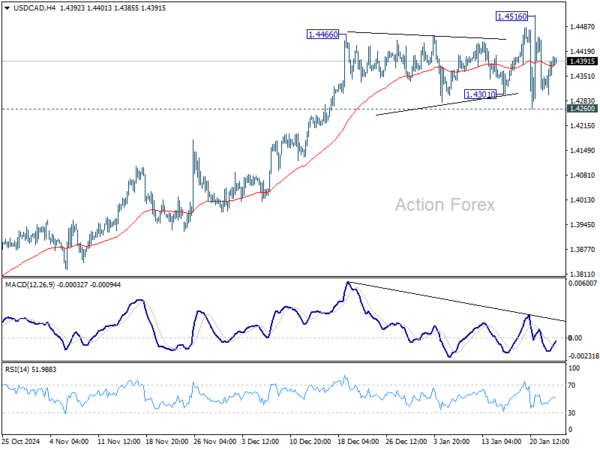

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.4322; (P) 1.4357; (R1) 1.4412; More…

Range trading continues in USD/CAD and intraday bias remains neutral. Further rise is expected as long as 1.4260 support holds. Break of 1.4516 will resume larger up trend to 1.4667/89 key resistance zone. Nevertheless, firm break of 1.4260 will turn bias to the downside for deeper pullback to 55 D EMA (now at 1.4205) and below.

In the bigger picture, up trend from 1.2005 (2021) is in progress for retesting 1.4667/89 key resistance zone (2020/2015 highs). Decisive break there will confirm long term up trend resumption. Next target is 100% projection of 1.2401 to 1.3976 from 1.3418 at 1.4993. Medium term outlook will remain bullish as long as 1.3976 resistance turned holds (2022 high), even in case of deep pullback.