Euro tumbled earlier today in knee-jerk reaction to news that German Chancellor failed to form coalition government. But the common currency quickly recovered as markets perceive that the economy won’t be hurt by the current political uncertainty. DAX dipped to as low as 1926.13 but is now back above 13000 handle at the time of writing, up 0.25%. Elsewhere, trading is very quiet today. Sterling is lifted by news that UK is ready to give an improved offer on the divorce bill to EU. Dollar trades mildly firmer today except versus Sterling and Kiwi. Swiss Franc is indeed trading as the weakest one, indicating followed by Canadian Dollar and then Yen. So far, markets are not in risk aversion mode.

German President Steinmeier urged parties to reconsider

German President Frank-Walter Steinmeier met with Chancellor Angela Merkel today after the latter declared failure in forming coalition. Steinmeier issued a statement following the meeting and said he will meet the parties this week. He also urged the parties to reconsider their positions in forming the new government. Steinmeier added that "there would be incomprehension and great concern inside and outside our country, and particularly in our European neighborhood, if the political forces in the biggest and economically strongest country in Europe of all places didn’t fulfill their responsibility."

The coalition talk collapsed at over time after pro-business Free Democrats pulled out of talk with Merkel’s CDU and Greens. Social Democrats reiterated their stance on not joining the new government to reform the grand coalition". For now, Steinmeier and Merkel had decided not to call a new election immediately and opt for putting more efforts in negotiating with the parties.

Chancellor Hammond: UK ready to offer Brexit bill before Dec summit

Chancellor of Exchequer Philip Hammond indicated that UK could be ready to break the negotiation "logjam" with EU and make a divorce bill offer before December summit. Hammond said on BBC that UK is "on the brink of making some serious movement forward". And, "we will make our proposals to the European Union in time for the council. I am sure about that." Meanwhile he also insisted that "It’s not about demands, it’s about what is properly due from the U.K. to the European Union under international law in accordance with European treaties." He added that "we’ve always been clear it won’t be easy to work out that number. But whatever is due, we will pay."

IMF: RBA monetary policy "appropriately accommodative"

IMF said that RBA’s monetary policy is "appropriately accommodative". The fund published a report after visiting Australia. It noted that "with stronger momentum in domestic demand and inflation close to the mid-point of the target range not yet secured, continued macroeconomic policy support will remain essential." Also, "with Australia’s recovery lagging that of other major advanced economies, monetary policy should remain firmly focused on ensuring stronger sustained momentum in domestic demand and inflation." Regarding the economy, IMF believed the government’s infrastructure spending would have positive spillovers. It added that "further increases in investment have the potential to improve physical and digital interconnectivity, both internally and with Australia’s trading partners, thereby contributing to higher growth."

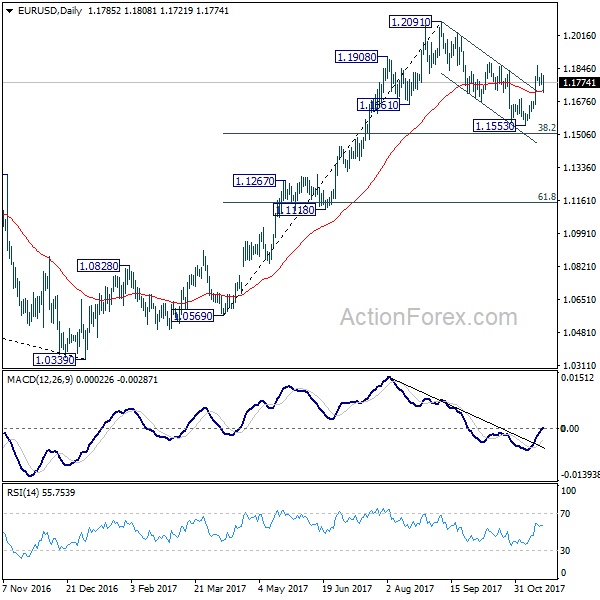

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1760; (P) 1.1791 (R1) 1.1817; More….

EUR/USD rebounds strongly after drawing support from 4 hour 55 EMA. Intraday bias remains neutral at this point. Also, with 1.1677 minor support intact, further rally is expected. As noted before, corrective fall from 1.2091 has completed at 1.1553 already, ahead of 38.2% retracement of 1.0569 to 1.2091 at 1.1510. Above 1.1860 will turn bias to the upside for retesting 1.2091 high. However, break of 1.1677 will dampen this bullish view and turn focus back to 1.1553 low instead.

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be cautious on 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1373) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Oct | 0.32T | 0.21T | 0.24T | 0.27T |

| 7:00 | EUR | German PPI M/M Oct | 0.30% | 0.30% | 0.30% | |

| 7:00 | EUR | German PPI Y/Y Oct | 2.70% | 2.70% | 3.10% | |

| 15:00 | USD | Leading Index Oct | 0.60% | -0.20% |