Oil closed the previous three weeks higher and is rising at the start of the new week, driven by various bullish factors. Most of them are temporary, but they are altering the long-term technical picture, changing speculators’ attitudes towards oil and attracting bulls.

Brent oil is moving steadily above $80, entering the peak area of October last year. Last week, Brent closed near its 50-week moving average. Further gains at the start of the week indicate the strength of buyers, who are not deterred by the general risk apprehension that is causing a sell-off in equities and bonds.

The main reason for this dynamic is the return of interest in oil. The US has tightened sanctions against Russia’s oil and gas sector, lifting demand for affordable alternatives. While these were sanctions of the outgoing Biden administration, Trump may continue this policy as he often promotes the interests of US producers in an attempt to turn around trade balance dynamics.

Extreme weather in parts of Europe and the US is pushing energy prices higher. Weather is a highly speculative factor; reports often have a greater impact on prices than actual changes in supply and demand. Nevertheless, market sensitivity to this factor should not be underestimated: it may continue to pull quotes upwards despite the headwinds in the form of risk sell-off.

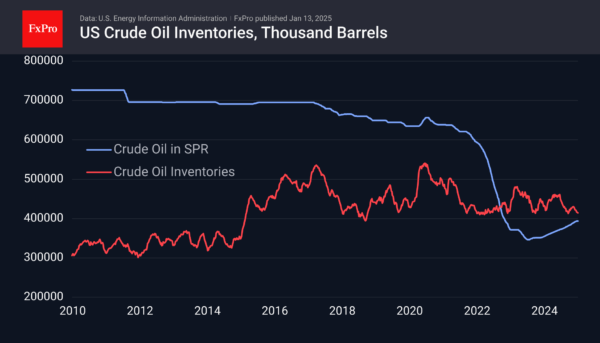

The dynamics of commercial inventories in the USA also temporarily support stock bulls. In the last seven weeks, a decline in inventories has been recorded, bringing their total level closer to 400 million barrels. This is not a magic line, but the impact of inventory levels on the oil price is growing as it approaches this mark, which has been the lower boundary of inventories for almost 10 years.

Brent is moving above the 50-week moving average, but the most important test will be the 200-week moving average, now at $83.60, which could be reached as early as this week. A rise above this level may not be an easy task. However, if the price confidently overcomes this level, it may become a prologue to the return of prices to the territory above $100.