- Sentiment remains fragile in China and Hong Kong stock market even China services activities have improved in December.

- Weak market breadth and a persistent bearish trend of the Chinese yuan since November has added to more woes to the Hang Seng Index.

- Watch the 19,700/20,130 key medium-term resistance on the Hang Seng Index.

Since our last publication, the Hong Kong benchmark stock indices (a proxy for international investors and traders to get exposure into China equities) have wobbled where market participants have lost patient over China’s top policy makers’ rhetoric of the “yet to materialise” forceful fiscal stimulus measures to negate the ongoing deflationary spiral in the Chinese economy.

The Hang Seng Index has broken below its 19,700 key medium-term support and shed 5% to print an intraday low of 19,111 at this time of the writing.

Start of the start of the new year, China and Hong Kong bench stock indices are the worst performers against the rest of the world as both of them recorded losses of 2.22% and 2.58% respectively despite services activities have started to show signs of growth in December as indicated by the latest the official NBS non-manufacturing PMI and privately complied Caixin services PMI data.

Weak market breadth

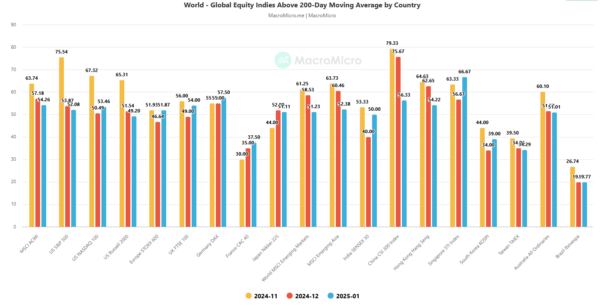

Fig 1: Major stock indices percentage of component stocks above 200-day MA as of 7 Jan 2025 (Source: MacroMicro, click to enlarge chart)

Sentiment has remained fragile as the number of component stocks of the two key benchmark stock indices; China’s CSI 300 and Hong Kong’s Hang Seng Index that are trading above their respective long-term 200-day moving averages have declined steadily since November 2024.

The percentage of CSI 300 component stocks trading above their respective 200-day moving averages have slipped to 56% in January from 79% previously recorded in November, and the Hang Seng Index also showed a similar dire fate where the percentage of its component stocks declined to 54% currently from 64% in November (see Fig 1).

A persistent weak yuan has more negative impact on China and Hong Kong stock markets

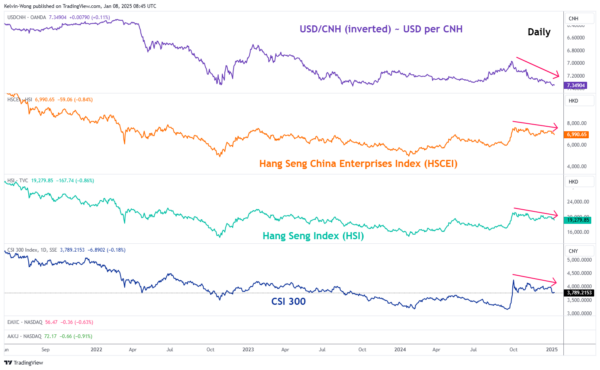

Fig 2: USD/CNH major trend with HSCEI, HSI & CSI 300 as of 8 Jan 2025 (Source: TradingView, click to enlarge chart)

Since the outcome of the US presidential election on 6 November, the offshore Chinese yuan has depreciated by 3.7% against the US dollar to a two-year low where the USD/CNH exchange rate its now coming close to a major swing high of 7.3750 printed on 25 October 2022.

China policy makers have “deliberately” allow the yuan to weaken to offset the potential incoming higher trade tariffs from US President-elect Trump’s hawkish trade policy towards US major trading partners that includes China where he has proposed to implement 60% additional tariffs on China’s exports to the US.

Even though, a weaker yuan on a trade weighed basis may allow China to maintain its share of exports but it may create a negative feedback loop into the stock markets of China and Hong Kong as hot capital flight can materialised. Further sparked by a potential regional currency war where other Asian trading hubs such as South Korea, Singapore, and Taiwan may be forced to weaken their respective domestic currencies to maintain export competitiveness (see Fig 2).

Bearish momentum in Hang Seng Index

Fig 3: Hang Seng Index medium-term trend as of 8 Jan 2025 (Source: TradingView, click to enlarge chart)

The Hang Seng Index has failed to reintegrate above its 50-day moving average and traded below it since the start of 2025.

In addition, the daily RSI momentum indicator has continued to exhibit bearish elements where it printed series of lower highs below the 50 level and has not reached its oversold region.

These observations suggest that bearish momentum is still intact. Key medium-term pivotal resistance at 19,700/20,130 and a break below 18,430/17,990 (also the 200-day moving average) may trigger a deeper corrective decline sequence to expose the next medium-term support at 16,610 in the first step (see Fig 3).

On the other hand, a clearance above 20,130 negates the bearish tone to revisit the next medium-term resistances at 21,420 and 22,690.