The forex and stock markets are holding steady today, with limited volatility as traders anticipate FOMC rate decision and updated economic projections. A 25bps rate cut, reducing the target range to 4.25–4.50%, is virtually certain. However, the market’s focus lies on the tone and guidance Fed delivers. Critical questions include whether a pause in easing could be on the table for January, the expected pace of rate cuts throughout 2025, and the revision of the neutral rate, which could indicate where Fed sees the terminal rate of the current cycle.

Tomorrow, attention will turn to BOJ and BoE, both expected to hold rates steady. For BoJ, markets are watching for any signs that further rate hikes could be planned for early 2025, particularly in January, amid ongoing efforts to manage inflation and normalize policy. Meanwhile, BoE’s MPC voting split will be a key focus. Traders will look to the statement for policymakers’ views on recent data surprises and how the Autumn Budget is shaping their outlook, especially as inflation remains persistent in key sectors like services.

Technically, some attention could be in S&P 500’s reaction to FOMC today. Recent up trend stalled after hitting 61.8% projection of 4103.78 to 5669.67 from 5119.26 at 6086.98. Selloff today could set up deeper correction to 55 D EMA (now at 5911.81) before resuming the up trend. On the other hand, clearing of 6086.98 will pave the way towards 100% projections at 6685.15 in early part of next year.

In Europe, at the time of writing, FTSE is up 0.21%. DAX is up 0.14%. CAC is up 0.26%. UK 10-year yield is up 0.0246 at 4.550. Germany 10-year yield is up 0.0118 at 2.245. Earlier in Asia, Nikkei fell -0.72%. Hong Kong HSI rose 0.83%. China Shanghai SSE rose 0.62%. Singapore Strait Times fell -0.53%. Japan 10-year JGB yield is down -09.0106 at 1.067.

ECB’s Lane stresses agility in rate path amid elevated uncertainty

ECB Chief Economist Philip Lane highlighted the importance of maintaining “agility” in monetary policy decisions during a speech today. Lane emphasized that in the current environment of elevated uncertainty, ECB’s “prudent” approach will be guided by a meeting-by-meeting strategy without pre-committing to any specific rate path.

Lane outlined that the pace of monetary easing will depend on the balance of risks. If the inflation outlook or economic momentum experiences upside shocks, “monetary easing can proceed more slowly ” compared to the December projections.

Conversely, in the case of downside shocks, the easing process could accelerate. He further noted that the rate path would also depend on ECB’s “ongoing assessment of underlying inflation dynamics and the strength of monetary policy transmission.”

Eurozone CPI finalized at 2.2% in Nov, core at 2.7% yoy

Eurozone headline inflation for November was finalized at 2.2% yoy, up from October’s 2.0%. Meanwhile, Core CPI, which excludes food, alcohol, and tobacco, eased to 2.7% yoy, down from October’s 2.9%.

Services contributed the most to the Eurozone annual inflation rate, adding +1.74 percentage points, followed by food, alcohol, and tobacco (+0.53 pp) and non-energy industrial goods (+0.17 pp). Energy, on the other hand, detracted -0.19 percentage points, reflecting subdued demand and easing energy prices.

At the broader EU level, headline inflation was finalized at 2.5% yoy. Among member states, Ireland registered the lowest annual inflation at 0.5%, followed by Lithuania and Luxembourg (both at 1.1%). On the high end, Romania recorded the highest inflation at 5.4%, with Belgium (4.8%) and Croatia (4.0%) close behind. Compared to October, inflation fell in four EU member states, remained unchanged in three, and rose in twenty.

UK CPI accelerates to 2.6% in Nov, core CPI up to 3.5%

UK CPI accelerated from 2.3% yoy to 2.6% yoy in November, matched expectations. Core CPI, (excluding energy, food, alcohol and tobacco), accelerated from 3.3% yoy to 3.5% yoy, below expectation of 3.6% yoy. CPI goods annual rate rose from -0.3% yoy to 0.4% yoy , while CPI services annual rate was unchanged at 5.0% yoy.

Japan’s export rises 3.8% yoy in Nov, while import falls -3.8% yoy

Japan’s exports rose 3.8% yoy in November to JPY 9.152T, supported by increased shipments of chip-making equipment to Taiwan and nonferrous metals to China, marking the second consecutive month of export growth. Imports, however, fell -3.8% yoy to JPY 9.270T, marking their first decline in eight months due to reduced demand for crude oil from Saudi Arabia and electronics parts from Taiwan.

The overall trade deficit stood at JPY -117.6B, extending its red streak to five months. On a seasonally adjusted basis, the deficit widened to JPY -384B from JPY -229B in October, as imports increased 1.9% mom, outpacing the 0.2% mom rise in exports.

Trade with key partners highlighted persistent imbalances. Japan recorded a JPY 664.03B trade surplus with the US, despite exports falling -8.0% yoy, while imports dipped slightly by -0.6% yoy.

Conversely, its trade deficit with China expanded to JPY 682B, as exports grew 4.1% yoy, and imports rose 4.2% yoy.

The trade gap with the EUR remained significant at JPY 210.19B, with exports plunging -12.5% yoy, while imports decreased -5.4% yoy.

USD/CHF Mid-Day Outlook

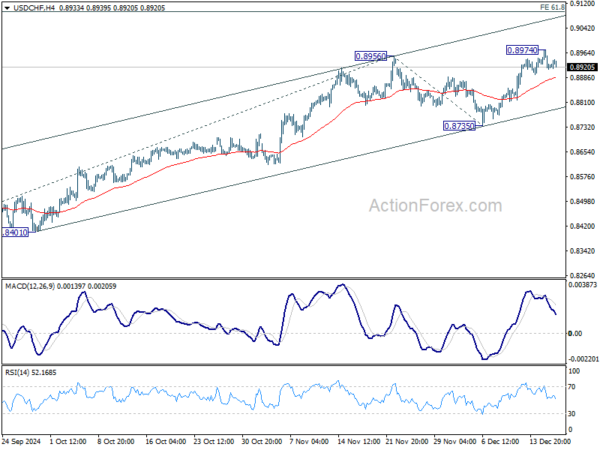

Daily Pivots: (S1) 0.8903; (P) 0.8939; (R1) 0.8963; More…

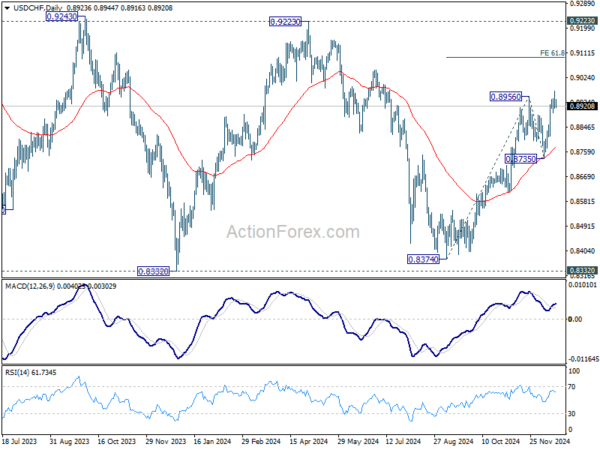

Intraday bias in USD/CHF remains neutral as consolidations continue below 0.8974 temporary top. While deeper pullback cannot be ruled out, outlook stay bullish as long as 0.8735 support holds. Break of 0.8974 will resume larger rise from 0.8374 to 61.8% projection of 0.8374 to 0.8956 from 0.8735 at 0.9095.

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with rise from 0.8374 as the third leg. Overall outlook will continue to stay bearish as long as 0.9223 resistance holds. Break of 0.8332 low is in favor at a later stage when the consolidation completes.