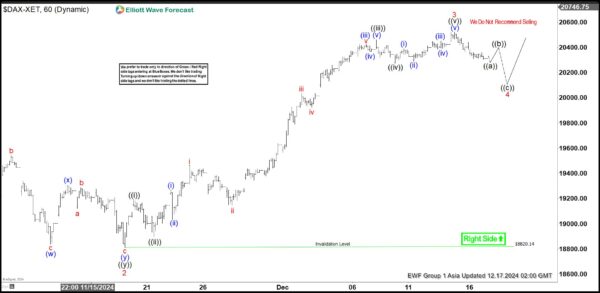

Short Term Elliott Wave View in DAX suggests cycle from 8.5.2024 low is in progress as a 5 waves impulse structure. Up from 8.5.2024 low, wave 1 ended at 19674.68 and pullback in wave 2 ended at 18812.53. Index has resumed higher in wave 3. Up from wave 2, wave ((i)) ended at 19198.74 and dips in wave ((ii)) ended at 18900.02. Index then resumes higher in wave ((iii)). Up from wave ((ii)), wave (i) ended at 19272.99 and pullback in wave (ii) ended at 19036.41. Wave (iii) higher ended at 20425.86 and pullback in wave (iv) ended at 20370.23. Final leg wave (v) ended at 20461.85 which completed wave ((iii)).

Pullback in wave ((iv)) ended at 20277.63. Up from there, wave (i) ended at 20393.86 and wave (ii) ended at 20292.86. Wave (iii) higher ended at 20453.44 and pullback in wave (iv) ended at 20393.24. Final leg wave (v) ended at 20522.82 which completed wave ((v)) of 3. Wave 4 pullback is now in progress to correct cycle from 11.19.2024 low in 3, 7, or 11 swing before it resumes higher again. Down from wave 3, wave ((a)) should end soon, then it should rally in wave ((b)) before turning lower again in wave ((c)). Wave 4 typically ends around 23.6 – 38.2% retracement of wave 3. This area comes at 19870.5 – 20120.5.

DAX 60 Minutes Elliott Wave Chart

DAX Elliott Wave Video

You are currently viewing a placeholder content from Default. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.