Commodity currencies are set to end the week as the weakest ones. While WTI crude oil seems to have defended 55 handle and recovered, Canadian Dollar stays soft after mixed inflation data. Dollar follows closely and continues to display softness against Euro and Yen. Dollar could be supported by progress in tax plan after both House and Senate Finance Committee approved their own versions. Though, strength in the greenback is limited as there are still huge work to reconcile the tax plan between House and Senate. Also, there is some pressure from news that Special Counsel Robert Mueller issued subpoean to President Donald Trump for Russia related documents.

Release from US, housing starts rose to 1.29m annualized rate in October, above expectation of 1.19m. Building permits also rose to 1.30m, above expectation of 1.25m. Canada CPI slowed to 1.4% yoy in October, meeting expectation. CPI core – common accelerated to 1.6% yoy. CPI core trim was unchanged at 1.5% yoy. CPI core median slowed to 1.7% yoy. Elsewhere, Eurozone current account surplus widened to EUR 37.8b in September. New Zealand business manufacturing index dropped to 57.2 in October. PPI input rose 1.0% qoq in Q3, PPI output rose 1.0% qoq too.

ECB Draghi: Recalibration signaled our growing confidence

ECB President Mario Draghi said in a conference in Frankfurt that last month’s recalibration of policy aimed to "signal our growing confidence in the euro area economy, while also acknowledging that we must be patient and persistent for inflation to return sustainably to our objective." But he insisted that the asset purchase program could run before the deadline line of next September "if necessary, and in any case until we see a sustained adjustment in the path of inflation." He emphasized that "despite this progress on the real side of the economy, from a monetary policy perspective our task is not complete, as we have not yet seen a sustained adjustment in the path of inflation.

Germany coalition talk could enter into overtime

In Germany, it’s reported that the negotiations on the coalition between Chancellor Angela Merkel’s CDU/CSU, the Greens and FDP stalled ahead of the self imposed deadline of today. Disagreement on migration policy is believed to be the main show-stopper. The exploratory talks could extend into overtime and even through the weekend. Merkel is set to miss the EU social summit in Sweden. If the so called Jamaica coalition could be approved, the parties will then enter into formal negotiations on the details, including dividing up cabinet posts. However, if the talk failed, Merkel could opt for forming a minority government with Greens. Another choice is to call on Social Democrats again for a reincarnation of the Grand Coalition. Or worst come to worst, a new national elections could be called.

UK Davis: We offered some creative compromises

UK Brexit Secretary David Davis said that UK has been "offering some creative compromises" in negotiations with EU. But UK "not always got them back. He also warned EU not to "put politics above prosperity". Some noted that Davis’s comments indicated UK’s frustration regarding EU’s attitude in the talks. But then, UK has so far refused to respond to EU’s request of settling the past before talking about the future. That is, Davis himself has asked EU not to expect any number or formula on the divorce bill before moving on to trade talks. While Davis said that it’s "incredibly unlikely" there will be a no-deal Brexit, the gap between the two sides is still huge.

Former BoJ Shirai: Abe’s win makes BoJ hard to exit

Former BoJ board member Sayuri Shirai said that Prime Minister Shinzo Abe’s recent landslide win in the snap election would make it very difficult for BOJ to exit stimulus. She noted that "when the economy is in good shape like now, the BOJ needs to normalize monetary policy so it has the tools available to fight the next recession." She added that "the BOJ probably wants to slow its asset purchases." However, "that may be difficult because the government puts a high priority on keeping stock prices high and the yen weak."

USD/CAD Mid-Day Outlook

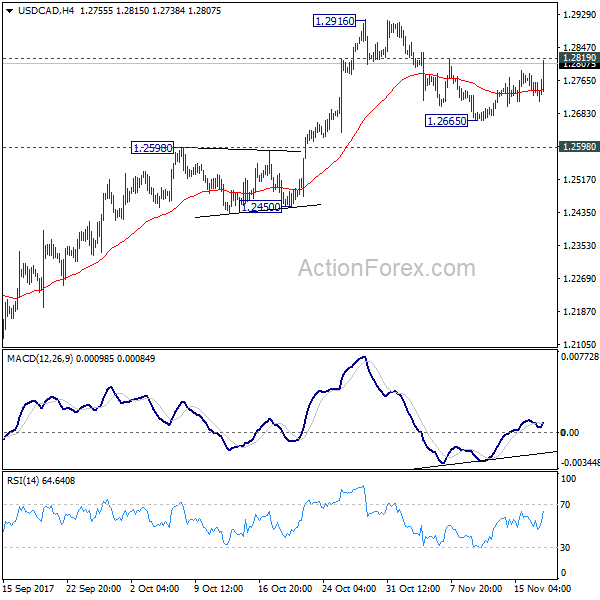

Daily Pivots: (S1) 1.2728; (P) 1.2755; (R1) 1.2783; More….

USD/CAD rises sharply in early US session and focus is back on 1.2819 minor resistance. Break there will argue that correction from 1.2916 has completed at 1.2665 already. Intraday bias will be turned back to the upside for 1.2916 high first. Break there will extend the rise from 1.2061 to 38.2% retracement of 1.4689 to 1.2061 at 1.3065. In case the correction from 1.2916 extends with another fall, overall outlook will remain bullish as long as 1.2598 resistance turned support holds.

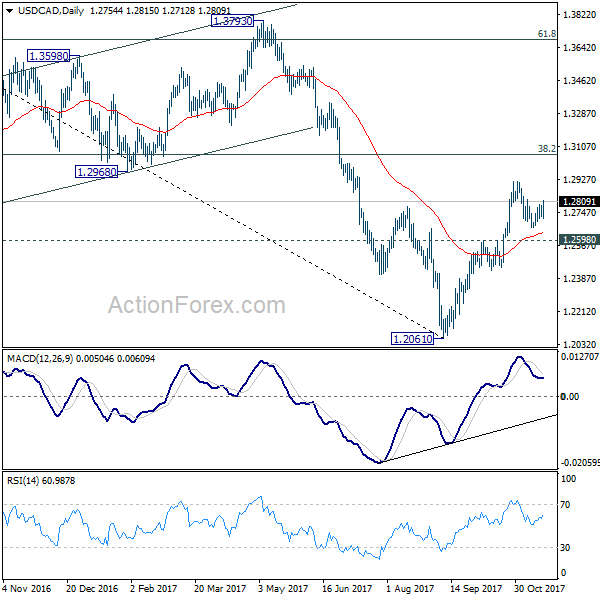

In the bigger picture, USD/CAD should have defended 50% retracement of 0.9406 (2011 low) to 1.4689 (2016 high) at 1.2048. And with 1.2048 intact, we’d favor the case that fall from 1.4689 is a correction. Rise from 1.2061 medium term bottom should now target 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Firm break there will target 1.3793 key resistance next (61.8% retracement at 1.3685). We’ll now hold on to this bullish view as long as 1.2450 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ Manufacturing PMI Oct | 57.2 | 57.5 | 57.6 | |

| 21:45 | NZD | PPI Input Q/Q Q3 | 1.00% | 1.20% | 1.40% | |

| 21:45 | NZD | PPI Output Q/Q Q3 | 1.00% | 1.40% | 1.30% | |

| 09:00 | EUR | Eurozone Current Account (EUR) Sep | 37.8B | 30.2B | 33.3B | 34.5B |

| 13:30 | CAD | CPI M/M Oct | 0.10% | 0.10% | 0.20% | |

| 13:30 | CAD | CPI Y/Y Oct | 1.40% | 1.40% | 1.60% | |

| 13:30 | CAD | CPI Core – Common Y/Y Oct | 1.60% | 1.50% | ||

| 13:30 | CAD | CPI Core – Trim Y/Y Oct | 1.50% | 1.50% | ||

| 13:30 | CAD | CPI Core – Median Y/Y Oct | 1.70% | 1.80% | ||

| 13:30 | USD | Housing Starts Oct | 1.29M | 1.19M | 1.13M | |

| 13:30 | USD | Building Permits Oct | 1.30M | 1.25M | 1.23M |