- ECB will meet on Thursday; markets expect a 25bps rate cut

- Doves are likely to push for a more aggressive rate cut

- President Lagarde’s negotiating skills will be put to the test

- The euro could suffer from a 50bps cut; muted impact likely from a smaller move

ECB will meet on Thursday

The ECB will hold its final meeting for 2024 on Thursday, one week before the Fed. Since the previous ECB gathering on October 17, several developments have occurred both domestically and externally.

The political turmoil continues in the eurozone’s two biggest economies. French President Macron remains under pressure to find a new PM and get the 2025 budget approved, and the German campaign for the February general election is fully underway. Meanwhile, President-elect Trump, in anticipation of his White House return on January 20, has already announced tariffs on the closest trade partners of the United States. Additionally, a regime change in Syria and a ceasefire in Lebanon have been added to the numerous changes on the geopolitical landscape.

Amidst these developments, the eurozone economy continues to experience a very soft patch with the PMI surveys painting a rather bleak picture. Considering the political situation, the burden once again falls on the ECB to keep the eurozone economy moving forward.

Four market moving factors on Thursday

Focusing on Thursday’s ECB meeting, there are four factors that could probably prove market moving. The size of the rate cut, the press statement, President Lagarde’s press conference, and the quarterly staff forecasts could increase the subdued volatility seen in euro/dollar over the past week.

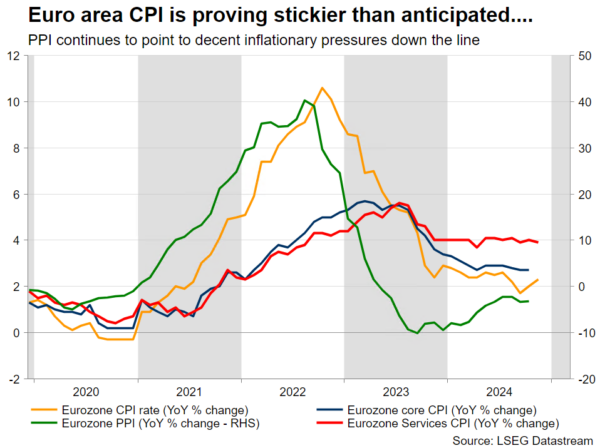

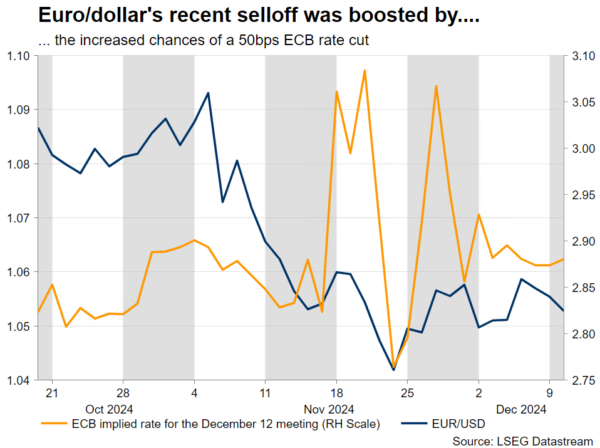

In more detail, leading up to the ECB meeting, market expectations fluctuated between 25bps and 50bps rate cuts. Inflation has proven stickier than anticipated, with services inflation edging only a tad lower in November to 3.9%. Both rate cut options have merit, with the doves pushing for a stronger move ahead of Trump’s second term and highlighting the eurozone economy’s need for extra accommodation.

The December staff forecast could point to the future path of ECB rates, with the market focusing on any downward revisions to the 2026 inflation figures. In September, the headline and core inflation forecast for 2026 were kept stable at 1.9% and 2% respectively, thus keeping the door open to further rate cuts. Interestingly, the 2027 figure will be printed for the first time, with the market keen to see how far below the 2% target this forecast could fall. Similarly, another downward revision to growth rates for both 2025 and 2026 could play a role in the discussion about the size of the rate cut.

Additionally, the press statement and, more importantly, Lagarde’s rhetoric at the Q&A session could reveal the thinking process behind Thursday’s decision. A unanimous rate decision could be seen as a personal success for Lagarde, especially since the doves are really worried about Trump’s trade strategy.

Finally, the ECB has adopted a voting pattern in the past few years. Interestingly, on December 12 three hawks, including uber-hawks Nagel and Wunsch, will not have a vote, making Thursday’s gathering one of the most dovish meetings of 2024.

Two main scenarios for the ECB meeting

Putting everything together, investors are faced with two main scenarios:

Scenario 1: The ECB announces a 25bps rate cut, maintains dovish rhetoric and signals its readiness for more aggressive actions if incoming President Trump kicks off a new trade war. The doves will be moderately pleased, with the euro suffering just a tad. The initial disappointment from the lack of a more aggressive rate cut could cause a small upleg against the US dollar, but the move will most likely quickly reverse as President Lagarde holds the press conference.

Scenario 2: Concerned about the underlying economic conditions and the increased possibility of tariffs imposed by Trump on eurozone products, the ECB cuts rates by 50bps and adopts an even more dovish stance. Boosted by the quarterly forecasts showing inflation in both 2026 and 2027 comfortably below 2%, Lagarde comments that the rate cuts will continue, with the ECB deposit rate potentially being pushed well below the neutral rate in 2025.

In this scenario, the euro will probably suffer across the board, with euro/dollar dropping like a stone below the 1.0481-1.0571 range and potentially retesting the 1.0315 level.