The Swiss Franc faces challenges as the Swiss National Bank (SNB) is now expected to cut interest rates by 50 basis points after recent inflation data showed continued weakness. In November, Swiss inflation remained flat at -0.1% month-on-month, the same as in October, while the annual rate rose slightly to 0.7%, still below expectations of 0.8%. This low inflation allows the SNB to lower interest rates further to support the economy.

Experts believe that Switzerland’s economy is underperforming, with sluggish growth in its export sector and low capacity utilization. Economists like Dr. Karsten Junius from Bank J. Safra Sarasin suggest that the SNB must cut rates decisively to counter these economic pressures. The bank predicts a 50 basis point rate cut in December, followed by two more in 2025 to bring rates to 0%.

Although negative interest rates are not currently on the table, SNB President Schlegel has warned they can’t be ruled out. Economists also suggest the SNB intervene in foreign exchange markets to weaken the Swiss Franc and prevent further deflation if needed. The Franc is struggling against major global currencies amid a challenging economic backdrop.

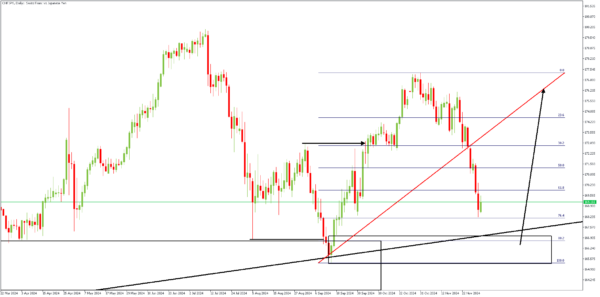

CHFJPY – W1 Timeframe

The weekly timeframe chart of CHFJPY shows a clear trendline support that the price is reaching. In addition, there is also a drop-base-rally demand zone that falls right within the 76% Fibonacci retracement region and aligns perfectly with the trendline support. Based on this, a long-term bullish sentiment can be established; however, let’s confirm this further on the daily timeframe.

D1 Timeframe

On the daily timeframe chart, we see an SBR (Swing-Break-Retest) pattern being formed, with the demand zone falling right on top of the 88% Fibonacci retracement level. This seems a clear indication of a likely reaction from the highlighted demand and a possible entry for the bulls.

Analyst’s Expectations:

- Direction: Bullish

- Target: 176.801

- Invalidation: 164.709