- EURCHF trades in a rather tight range

- The medium-term bearish trend remains valid

- Momentum indicators support the bearish trend

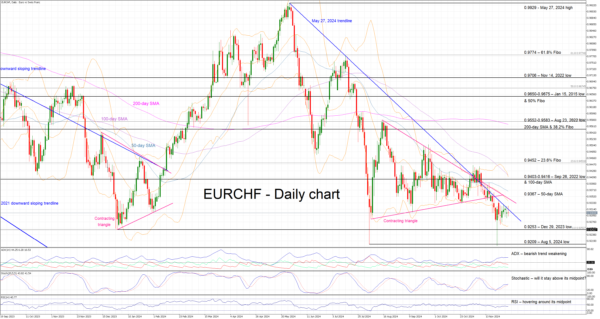

EURCHF is trading sideways today, testing once again the resistance set by the May 27, 2024 downward slopping trendline. EURCHF quickly rebounded from the November 22 low of 0.9204, but the bulls have failed to record another sizeable upleg. As a result, this pair has been trading in a very tight range over the past few sessions, despite the eurozone newsflow being extremely negative, both in terms of economic data and political developments.

This reduced volatility is reflected in the momentum indicators. In more detail, the Average Directional Movement Index (ADX) is moving sideways above its midpoint, and thus pointing to a weakening bearish trend in EURCHF. Additionally, the RSI continues to aimlessly hover below its midpoint, showing little appetite for a more forceful move lower. More importantly, the stochastic oscillator is preparing to test the support set by its moving average (MA). A bounce higher could reveal a buildup of bullish pressure in EURCHF, while a downwards break could open the door to another downleg in EURCHF.

If the bears remain confident, they could try to keep EURCHF below the May 27, 2024 trendline and then gradually push it towards the December 29, 2023 low at 0.9253. If successful, they could have the chance to retest the support set by the August 5, 2024 low at 0.9209 and record a new all-time low.

On the flip side, the bulls are craving a decent rally with the first obstacle being the May 27, 2024 trendline. If they manage to overcome both this trendline and the 50-day simple moving average (SMA) positioned at 0.9367, the next strong resistance could come at the 0.9430-0.9416 area. This region is populated by the 100-day SMA and the September 26, 2022 low, and a move above it could validate the bullish breakout.

To sum up, despite the negative eurozone newsflow, EURCHF bulls remain confident about staging an upleg, provided they manage to overcome a key trendline.