Dollar’s rally extended its rally, bolstered by stronger-than-expected ISM manufacturing data. The notable jump in new orders and easing prices suggest an improving outlook for the US manufacturing sector. In the background, the greenback had a head start for the week after US President-elect Donald Trump adopted a firm stance on maintaining the Dollar’s dominance, demanding that BRICS nations abandon plans to develop a competing currency, or face 100% tariffs on non-compliant nations, marking a sharp pivot from his previous preference for a weaker Dollar.

Meanwhile, Euro faced additional pressure amid political turmoil in France, where Prime Minister Michel Barnier’s government is at risk of collapse. Reports suggest Barnier plans to invoke article 49.3 to bypass parliamentary approval on parts of the budget, potentially triggering a no-confidence vote. Opposition parties, including far-left groups and the far-right Rassemblement National, have signaled their intention to support the motion, raising the stakes for Barnier’s leadership.

Overall for the day so far, Dollar is currently the strongest one, but trailed closely by Yen, while Loonie is a distant third. Euro is the runaway loser, followed by Aussie and then Kiwi. Sterling and Swiss Franc are positioning in the middle, as both are supported somewhat by buying against Euro.

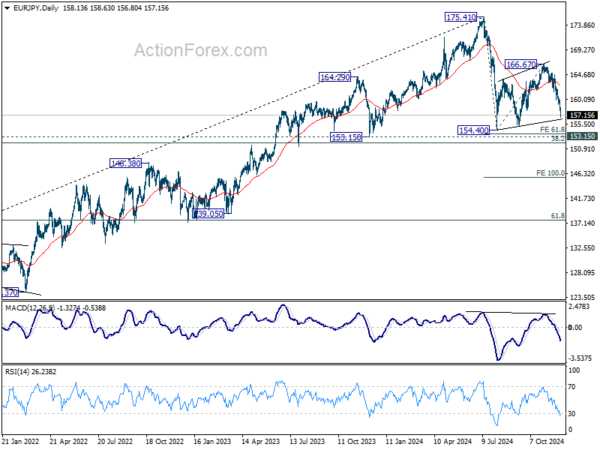

Technically, EUR/JPY’s current downside acceleration now raises the chance that whole decline from 175.41 is resuming through 154.40 low. Yet, the cross will face an important cluster support zone ahead at 153.15, which is close to 61.8% projection of 175.41 to 154.40 from 166.67 at 153.65, and 38.2% retracement of 114.42 to 175.41 at 152.11. Strong support is still in favor at this zone to contain downside. But decisive break there indicate that deeper medium term correction is underway, with increased risk of long term bearish reversal.

In Europe, at the time of writing, FTSE is up 0.39%. DAX is up 0.88%. CAC is down -0.67%. UK 10-year yield is down -0.0005 at 4.247. Germany 10-year yield is down -0.042 at 2.049. Earlier in Asia, Nikkei rose 0.80%. Hong Kong HSI rose 0.65%. China Shanghai SSE rose 1.13%. Singapore Strait Times rose 1.13%. Japan 10-year JGB yield closed flat at 1.077.

US ISM manufacturing rises to 48.4, new orders jump, prices ease sharply

US ISM Manufacturing PMI rose to 48.4 in November, up from October’s 46.5 and exceeding expectations of 47.5. While still in contraction territory (below 50), the improvement reflects signs of stabilization in the manufacturing sector.

New orders led the gains, climbing from 47.1 to 50.4, signaling expansion after seven consecutive months in contraction. Production edged up from 46.2 to 46.8, and employment saw a notable rise from 44.4 to 48.1, though both remain below the neutral threshold. Prices, however, declined sharply from 54.8 to 50.3, indicating easing inflationary pressures within the sector.

ISM noted that the November reading aligns with a projected annualized GDP growth of 1.7%, suggesting moderate economic expansion despite ongoing headwinds in manufacturing.

UK PMI Manufacturing finalized at 48.0, to 48.0, high costs, low demand and raised uncertainty

UK PMI Manufacturing was finalized to 48.0 in November, marking a nine-month low and reflecting a deepening contraction in the sector. The decline from October’s 49.9 underscores persistent challenges, including high costs, subdued demand, and a “bleak” export environment.

Rob Dobson, Director at S&P Global Market Intelligence, noted that conditions “deteriorated again” as manufacturers faced falling output, reduced orders, and cutbacks in purchasing, jobs, and inventories.

Exports remained under pressure, with weaker demand from key markets in the US, China, and the EU driving a further decline in new export business. Supply chain disruptions also intensified, fueled by the ongoing Red Sea crisis, port delays, and border regulation challenges.

Looking ahead, the manufacturing sector faces additional headwinds. Recent UK budget measures, including higher labor costs and employer national insurance contributions, are expected to increase operational expenses in 2025.

Combined with rising geopolitical tensions and the threat of heightened global protectionism, manufacturers are bracing for an extended period of “high costs, low demand and raised uncertainty”.

Eurozone PMI manufacturing finalized at 45.2, recession looks never going to end

Eurozone Manufacturing PMI slipped to 45.2 in November, down from October’s 46.0, reflecting deepening contraction in the sector.

The downturn remains widespread, with manufacturing activity deteriorating across major economies. Germany and France recorded PMI readings of 43.0 and 43.1 (a 10-month low), respectively, indicating severe weaknesses. Italy followed closely at 44.5, hitting a 12-month low, while the Netherlands posted a reading of 46.6, an 11-month low. Spain and Greece maintained levels above 50, but both fell to two-month lows at 53.1 and 50.9, respectively.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, described the figures as “terrible,” suggesting the manufacturing recession “is never going to end.”

De la Rubia forecasted a -0.7% contraction in manufacturing output for Q4, with the slump likely “going to drag into next year”. The capital goods sector is bearing the brunt of the downturn, while companies continue to trim staff, signaling rising unemployment ahead.

ECB’s Lane signals shift to forward-looking policy approach ahead

In an interview with the Financial Times, ECB Chief Economist Philip Lane indicated that the central is preparing to adjust its monetary policy approach as inflation moves closer to the 2% target.

While acknowledging that inflation has fallen near the desired level, Lane noted that “there is a little bit of distance to go,” especially with services inflation needing further reduction.

However, Lane emphasized that once the disinflation process is complete, monetary policy decisions will need to become “essentially forward-looking,” focusing on upcoming risks rather than relying on past data. He highlighted the importance of scanning the horizon for “new shocks” that could impact inflation pressures.

Over the course of next year, Lane expects a “transition to a more sustainable neighborhood of 2%,” signifying a shift from combating high inflation to maintaining price stability on a sustainable basis.

ECB’s Kazaks calls for further rate cut as inflation problem will soon end

Latvia’s ECB Governing Council member Martins Kazaks indicated his support for an interest rate cut at next week’s ECB meeting, citing the belief that inflation problem “will soon end.”

However, Kazaks acknowledged the high level of uncertainty following the widely expected rate cut. He pointed to risks tied to US President-elect Donald Trump’s upcoming administration, noting that new tariffs could further weigh on Europe’s economy.

Despite these concerns, Kazaks maintained a cautiously optimistic view, stating that “Europe’s economy is going from its lowest point upwards.”

Japan’s PMI manufacturing finalized at lowest since March, but optimism grows for 2025 recovery

Japan’s Manufacturing PMI was finalized at 49.0 in November, down from October’s 49.2, marking its lowest reading since March. The decline reflects ongoing challenges, with weaker demand leading to sustained declines in new orders and production levels.

S&P Global Market Intelligence’s Usamah Bhatti described the sector’s performance as “downbeat,” noting subdued capacity pressures and firms reducing employment for the first time in nine months due to the lack of demand-driven growth.

Cost inflation remained elevated in November, prompting manufacturers to increase selling prices at a stronger rate to protect margins.

However, firms remain optimistic about the future, with confidence reaching its highest level since August. Optimism is supported by expectations of domestic and global economic recovery, alongside planned new product launches that could drive future sales.

Separately, capital spending rose 8.1% yoy in Q3, exceeding expectations of 6.7% yoy and accelerating from Q2’s 7.4% yoy growth. This marks the fastest annual growth in investment since Q4 last year, providing a silver lining amid subdued manufacturing activity.

Australia’s retail sales beat expectations with 0.6% mom growth in Nov

Australia’s retail sales increased by 0.6% month-on-month to AUD 36.7B in November, surpassing the forecasted 0.4% mom rise. On a year-on-year basis, sales grew 3.4% yoy, supported by early Black Friday promotions.

Strong gains were seen in non-food categories, with other retailing up 1.6% and household goods retailing rising 1.4%, driven by demand for electronics like televisions. However, declines were noted in clothing, footwear, and personal accessories (-0.6%) and department stores (-0.3%).

Food-related sectors also performed well, with cafes, restaurants, and takeaway services rising 0.3% for the third consecutive month. Food retailing rebounded 0.3%, led by a 1.7% jump in liquor sales, returning turnover to July 2024 levels.

China’s Caixin PMI manufacturing rises to 51.5, confidence grows but challenges in jobs persist

China’s Caixin Manufacturing PMI climbed to 51.5 in November, up from 50.3 in October and surpassing expectations of 50.5. This marks the fastest pace of growth since June, driven by a rebound in new orders, which rose at their quickest pace since February 2023, alongside renewed export growth. Output price inflation reached a 13-month high, and business confidence strengthened to its highest level in eight months.

Wang Zhe, Senior Economist at Caixin Insight Group, highlighted that manufacturers increased supply to meet expanded demand, with businesses purchasing more to build inventories. Input costs and output prices also rose, while supply chains remained stable.

However, employment continued to contract, underscoring lingering challenges. Wang noted that the economy faces “prominent downward pressure,” with the government’s stimulus measures yet to significantly impact the labor market and workforce expansion.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0548; (P) 1.0572; (R1) 1.0603; More…

Intraday bias in EUR/USD stays neutral at this, despite today’s dip. Outlook remains bearish with 1.0609 resistance intact. On the downside, break of 1.0330 will resume the fall from 1.1213. Also, sustained trading below 1.0404 key fibonacci level will carry larger bearish implication. Nevertheless, firm break of 1.0609 will confirm short term bottoming, and turn bias back to the upside for 1.0760 support turned resistance first.

In the bigger picture, immediate focus is now on 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404. Strong rebound from this level will keep price actions from 1.1273 (2023 high) as a medium term consolidation pattern only. However, sustained break of 1.0404 will raise the chance that whole up trend from 0.9534 has reversed. That would pave the way to 61.8% retracement at 1.0199 first. Firm break there will target 0.9534 low again.