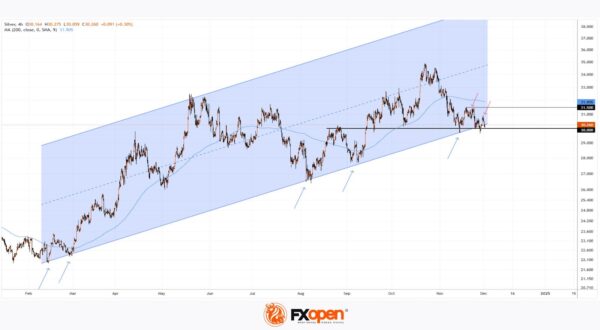

As reflected in the XAG/USD chart, the price of silver this morning is trading near $30.2, just above a critical support zone formed by:

→ The psychological level of $30.00;

→ The lower boundary of the ascending channel. As indicated by the blue arrows, this lower boundary has consistently provided support, enabling bullish reversals in silver prices throughout 2024.

However, the price is currently below the 200-day moving average (MA), which is trending downward. An examination of price action in November reveals a lack of sustained growth following two breaches of the psychological level. As the red arrows illustrate:

→ On the first occasion, the price encountered resistance near $31.50;

→ On the second, it failed to rise above $31.

This could indicate weak demand, increasing the risk of a bearish breakout below the key support zone, potentially breaking the 2024 uptrend.

Meanwhile, analysts remain optimistic, citing strong fundamentals. According to media reports:

→ ANZ Research analysts forecast silver prices reaching $35.4 in 2025;

→ JP Morgan analysts predict silver at $36;

→ Saxo Bank analysts anticipate prices climbing to $40 by 2025.

Start trading commodity CFDs with tight spreads. Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.