- A higher beta CAD/JPY cross pair can be considered as a macro theme play in line with a potential risk-averse environment triggered by Trump’s trade tariffs.

- Technical analysis suggests a potential new medium-term downtrend phase for CAD/JPY.

- Watch the 111.45 key medium-term resistance on the CAD/JPY.

US President-elect Trump’s latest trade tariffs salvo, a cornerstone of his “America First” policy has hit his northern neighbour where he threatened to impose 25% tariffs on all Canada’s exports to the US, in retaliation for illegal migration and drug trafficking into the US via Canada’s borders as alleged by Trump on his latest social media posts on his Truth Social site.

Canada is one of the largest trading partners with the US where its exports t are mostly energy-related. Hence if such tariff measures are followed through by the incoming Trump administration, Canda export revenues are likely to take a significant hit which in turn trigger a negative feedback loop in the Canadian dollar.

A higher beta trade can be expressed or played out using the yen crosses; CAD/JPY as a macro theme play to capture such potential adverse impact on the Canadian dollar where the Bank of Canada (BoC) may be forced to introduce more dovish monetary policy stance in 2025 to offset the “higher costs” of its oil-related exports to the US.

CAD/JPY is the weakest among the G-10 yen cross pairs

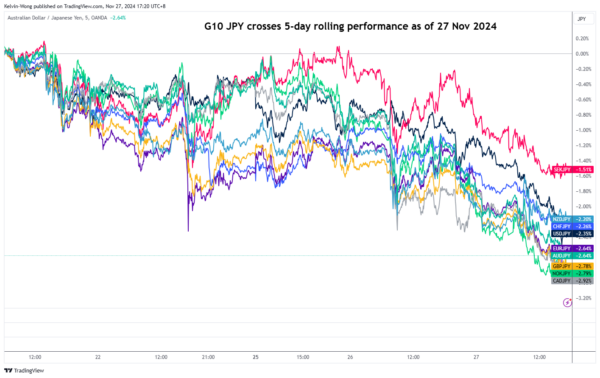

Fig 1: G10 JPY cross pairs 5-day rolling performance as of 27 Nov 2024 (Source: TradingView, click to enlarge chart)

The CAD/JPY cross pair has tumbled for two consecutive days with an intraday accumulated loss of 2.1% at this time of the writing and hit a six-week low of 107.82.

Based on a five-day rolling performance basis, the CAD/JPY is now the worst-performing major G-10 JPY cross pair with a loss of -2.9% (see Fig 1).

CAD/JPY at risk of starting a medium-term downtrend

Fig 2: CAD/JPY medium-term & major trends as of 27 Nov 2024 (Source: TradingView, click to enlarge chart)

Key technical analysis elements on the CAD/JPY have suggested an increased risk of a fresh medium-term downtrend phase after it hit a 52-week high of 118.86 on 10 July 2024.

Tuesday, 26 November price action has broken down its 50-day moving average, and the lower boundary of the bearish “Ascending Wedge” configuration.

In addition, the MACD trend indicator has continued to inch toward its zero centreline after a bearish divergence condition flashed out on 14 November 2024.

These observations suggest a potential growing downside momentum factor that may trigger the start of a medium-term downtrend phase for the CAD/JPY.

Watch the 111.45 key medium-term pivotal resistance and a clear break with a daily close below 104.85 exposes the next medium-term supports at 101.80 and 97.55.

On the flip side, a clearance above 111.45 invalidates the bearish scenario for a potential recovery towards the next medium-term resistances of 115.90 and 118.70 in the first step.