- AUDCAD rebounds after consolidating near key uptrend line

- RSI and MACD are suggesting that momentum may be turning positive

- A break above 50-day EMA could confirm more advances

- For the outlook to darken, a dip below 0.9015 may be needed

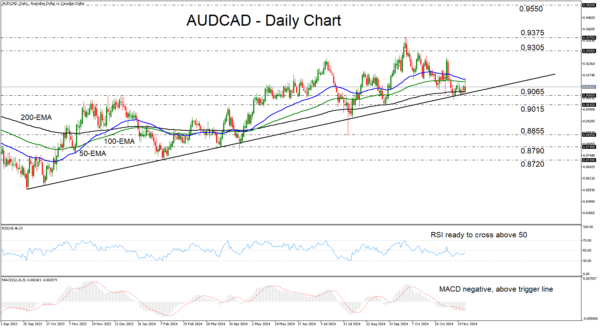

AUDCAD rebounded on Tuesday, after hitting support near the uptrend line drawn from the low of September 27, 2023, and the 200-day exponential moving average (EMA). Although the pair corrected decently after hitting a 21-month high of 0.9375 on September 30, the latest rebound keeps the broader uptrend intact.

The RSI and the MACD support the case for some more advances in the short run. The former has turned up and looks ready to cross above 50, while the latter, although negative, has already crossed above its trigger line.

If the bulls manage to climb above the 50-day EMA, they may feel confident to push the action towards the 0.9305 zone, or the 21-month high of 0.9375. That said, a break higher may be a stronger bullish signal as it would confirm a higher high on the weekly chart. Such a move could pave the way towards the 0.9550 zone, marked as resistance by the high of January 26, 2023.

For the outlook to turn bearish, the price may need to fall below 0.9015. Such a dip would not only solidify the break of the aforementioned uptrend line, but also confirm a lower low. The bears may then be encouraged to dive all the way down to the low of August 5 at 0.8855.

To recap, AUDCAD has been trading above a solid uptrend line since September 2023, and just this week, it rebounded after consolidating for a while near that zone. This keeps the broader outlook cautiously positive.