Key Highlights

- Gold started a fresh increase from the $2,535 support.

- It broke a major bearish trend line with resistance at $2,630 on the 4-hour chart.

- Oil prices are recovering and might rise toward the $72.50 resistance.

- EUR/USD is consolidating losses near the 1.0520 level.

Gold Price Technical Analysis

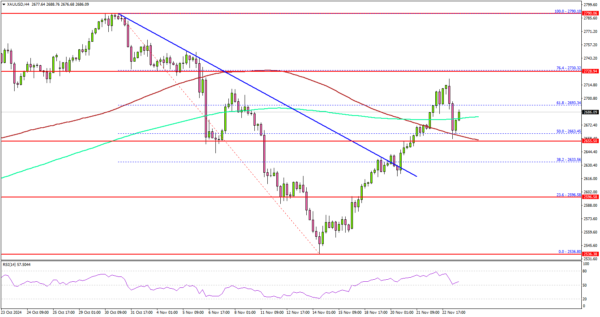

Gold prices remained well-bid near the $2,535 zone against the US Dollar. The price formed a base and started a fresh increase above $2,600 and $2,620.

The 4-hour chart of XAU/USD indicates that the price surpassed the 50% Fib retracement level of the downward move from the $2,790 swing high to the $2,536 low. It broke a major bearish trend line with resistance at $2,630.

The price climbed above the 100 Simple Moving Average (red, 4 hours) and the 200 Simple Moving Average (green, 4 hours). However, the bears are active near the $2,715 level.

The first major resistance sits near the $2,730 level. It is near the 76.4% Fib retracement level of the downward move from the $2,790 swing high to the $2,536 low. A clear move above the $2,730 resistance could open the doors for more upsides.

The next major resistance could be $2,750, above which the price could rally toward the $2,780 level. On the downside, initial support is near the $2,660. The first major support is near the $2,620 level.

The main support is now $2,600. A downside break below the $2,600 support might call for more downsides. The next major support is near the $2,535 level.

Looking at EUR/USD, the pair started a short-term recovery wave above the 1.0450 level but upsides might be limited above 1.0550.

Economic Releases to Watch Today

- US New Home Sales for Oct 2024 (MoM) – Forecast -1.1% versus +4.1% previous.