Key Highlights

- USD/JPY started a consolidation phase above the 154.00 zone.

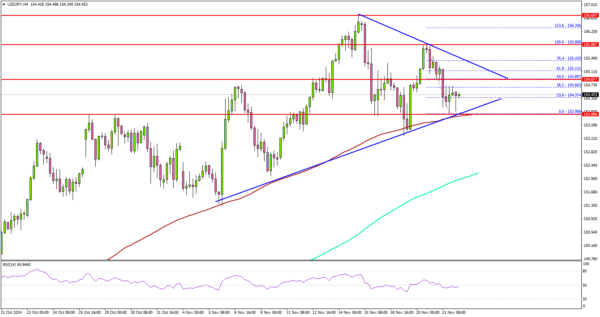

- A major contracting triangle is forming with resistance at 155.30 on the 4-hour chart.

- Bitcoin remains in a strong uptrend and traded to a new all-time high above $95,000.

- EUR/USD dipped further and traded below the 1.0500 support zone.

USD/JPY Technical Analysis

The US Dollar started a downside correction below 156.00 against the Japanese Yen. USD/JPY traded below the 155.50 support to enter a short-term bearish zone.

Looking at the 4-hour chart, the pair dipped below the 154.20 support and tested the 100 simple moving average (red, 4-hour). The pair remained stable above 154.00 and is currently well above the 200 simple moving average (green, 4-hour).

A low was formed at 153.90 and the pair is now trading in a range. On the upside, the pair could face resistance near the 154.90 level.

The first major resistance is near the 155.30 level. There is also a major contracting triangle forming with resistance at 155.30 on the same chart. A close above the 155.30 level could set the tone for another increase.

The next major resistance could be 155.85, above which the price could climb higher toward the 156.50 resistance. Any more gains might send USD/JPY toward 158.00.

On the downside, immediate support sits near the 154.00 level. The next key support sits near the 153.60 level. Any more losses could send the pair toward the 153.00 level or even 152.40 in the near term.

Looking at Bitcoin, the price extended gains, traded to a new all-time high above $94,000 and might continue to move up.

Upcoming Economic Events:

- Euro Zone Manufacturing PMI for Oct 2024 (Preliminary) – Forecast 46.0, versus 46.0 previous.

- Euro Zone Services PMI for Oct 2024 (Preliminary) – Forecast 51.8, versus 51.6 previous.

- US Manufacturing PMI for Oct 2024 (Preliminary) – Forecast 48.8, versus 48.5 previous.

- US Services PMI for Oct 2024 (Preliminary) – Forecast 55.3, versus 55.0 previous.