Market Picture

The cryptocurrency market is down 0.5% in 24 hours to $3.08 trillion. The market has paused after rallying since the end of last week. Ethereum and Litecoin have pulled back from recent highs, while XRP is stabilising. Bitcoin and Solana are hovering near recent highs and are getting ready to update them.

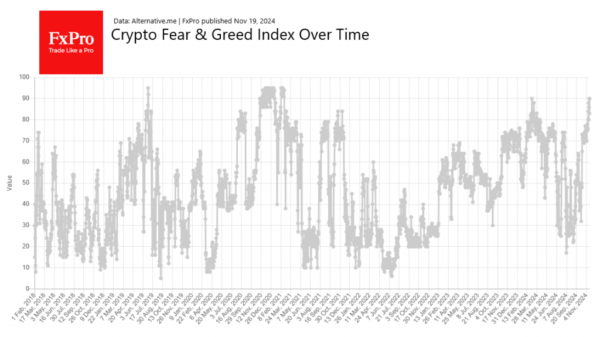

As a result, the sentiment index reached 90 for only the third time this year—it was only higher at the end of 2020. This sentiment confirms that traders are sticking to the four-year halving cycles. In 2020, price records attracted companies to buy the first currency in reserve to support market interest in equities. By 2024, even politicians seem to be scoring PR points by showing their commitment to Bitcoin.

Bitcoin is trading at nearly $92K. A break above the 13th’s highs of $93.3K would signal an entry into a growth extension with a target of $110K after a corrective pullback to 76.4% of the initial momentum. Such shallow corrections are typical of strong bull markets when buyers quickly return.

News Background

According to CoinShares, global crypto fund investments rose by $2.193 billion last week, following inflows of $1.978 billion the week before. Investments in Bitcoin rose by $1.481 billion, Ethereum by a significant $646 million, and Solana by $24 million. Investments in funds that allow bitcoin shorts rose sharply by $49 million. Investments in funds with multiple crypto assets fell by $19 million.

BCA Research noted that the value of one of the fractal analysis metrics signals a possible rise in Bitcoin above $200K in the current cycle.

Bernstein expects key catalysts in 2025 to push Bitcoin towards the $200K target level. These include the appointment of a new SEC chairman and treasury secretary, regulatory easing, progress on creating a US strategic bitcoin reserve, creating a powerhouse for BTC mining in the US, and creating a regulatory framework for stablecoins. Another driver will be coin purchases in ETFs, as well as by miners and companies such as MicroStrategy.

From the 11th to the 17th of November, MicroStrategy purchased an additional 51,780 BTC (~$4.6 billion) using proceeds from the issuance and sale of shares. The average purchase price was approximately $88,627. MicroStrategy now reserves 331,200 BTC at an average price of $49,874 per coin.

Record daily fees pushed Solana to a peak of over $245 in December 2021. The return of meme coin hype fuelled high network activity.