Direction in the forex markets is rather unclear today. Euro pares back some gains after this week’s strong rally. Sterling makes use of EUR/GBP’s rejection of 0.9032 resistance and strengthens broadly. The pound is additionally supported by better than expected retail sales data. But momentum in Sterling is unconvincing. Similarly, Dollar also tries to rebound today but lacks conviction. House’s expected passage of its own version of the tax bill might give the greenback a temporary lift. But the determining factor of the success of the tax bill will lie in how united the Senate Republicans are. And that’s remain a big question.

Released from US, initial jobless claims rose to 249k in the week ended November 11, exceeding expectation of 234k. The four week moving average rose 6.5k to 237.75k. Meanwhile, continuing claims dropped -44k to 1.86m, hitting the lowest level since December 1973. Philly Fed manufacturing index dropped to 18.9, below expectation of 24.1. Import price index rose 0.2% mom in October. Industrial production rose 0.9% in October while capacity utilization rose to 77.0%. From Canada, manufacturing sales rose 0.5% mom in September. International securities transactions rose to CAD 16.81b in September.

House to vote on tax bill

The House would vote on the highly anticipated tax plan today. So far only around 10 House Republicans had declared to vote no. And the Republicans could still spare 22 votes without support from the Democrats. Hence, there shouldn’t be any problem in passing the bill today. However, many see the House version as dead on arrival as it doesn’t comply with Senate budge rules that prevent adding to federal deficit after 10 years. Much efforts are still needed to reconcile the two versions before effecting the final by year end. And that will also very much depend on how much drama will there be in the Senate. Ron Johnson has already voiced out his opposition to the current Senate proposal. Susan Collins also sounded alarm with the idea to include Obamacare individual mandate’s repeal.

Yield curve flattening to continue

Flattening of yield curve is recently a hot topic. Spread between the 10-year and 2-year US yields fell to 64 bps, the lowest level since November 2007, today. Meanwhile, the spread between 30-year and 5-year yields also dropped below 75 bps, the lowest in about 2 week. Flattening yield curve has raised concerns as this is probably also a reason of diminished risk appetite this week, apart from disappointing global macro data.

Textbook knowledge suggests a normal yield curve is upward-sloping as yields for longer-dated investments are higher than shorter-dated ones. An inverted yield curve (short-dated yields exceed those of long-dated) is usually a signal of upcoming economic recession. A flat yield curve is the transitory period from a normal to an inverted curve. However, this interpretation does not necessarily hold true. For instance, US’ economic growth managed to avoid recession, despite a series of global economic crisis from 1995-2000, years after the sharp yield curve flattening from 1994 to 1995.

More in Flattening Of US Yield Curve Likely Continues As Fed’s Tightening Has Just Started

May reported to double Brexit divorce bill offer

It is reported that UK Prime Minister Theresa May is close to offering a deal to EU to settle the Brexit divorce bill. This is the total opposite of what Brexit Secretary David Davis said. That is, Davis warned EU that no number nor formula on the bill would be provided before moving on to trade talks. Moreover, it’s reported that May would double the offer to GBP 40b, that is, raises it by GBP 20b. However, the news was denied by May’s spokesman, who said that "we want to make progress as quickly as possible and we want to move onto talks about the future relationship as quickly as possible." Also, the spokesman noted that the reported GBP 20b is "yet more speculation".

Released from UK, retail sales rose 0.3% mom in October, above expectation of 0.2% mom.

ECB Mersch: Don’t expect to further increase asset purchase

ECB Executive Board member Yves Mersch said today that market wouldn’t be right to expect a "further increase in our asset purchases at the end of our program". He added that "as the situation improves, there will be a gradual normalization out of unconventional monetary policy instruments…but this gradual path is not there to disrupt the market." Also, he sounded optimistic on the outlook and said "no-one would be overly surprised if we would again slightly revise upwards our projections for growth." Also, the projected slowdown inflation at the turn of 2017/18 would be "less pronounced" as earlier feared.

ECB Governing Council member Bostjan Jazbec said that "inflation rates are moving in line with the expectations and projections of the European Central Bank." Meanwhile, the changes in oil price "do not have a major influence unless there is a long-term movement of prices." And, oil price is "just one of the factors that are being used by the ECB in forecasts and projections,"

ECB Chief Economist Peter Praet said today in Brussels that "the recalibration of our asset purchases (last month) reflects growing confidence in the gradual convergence of inflation rates towards our inflation aim." Yesterday, Praet laid out the path that the central bank is moving from unconventional measures to conventional measures in policy setting. He noted that "as we progress towards a sustained adjustment in the path of inflation and approach the time when net purchases will gradually come to an end, the residual monetary support needed to assist the economy in its transition to a new normal will increasingly come from forward guidance on our policy rates." Then, "policy rates will eventually regain their status as the main instrument of policy, and our forward guidance will revert to a singular approach."

Released from Eurozone, CPI was finalized at 1.4% yoy in October, CPI core at 0.9% yoy.

AU job growth missed, unemployment rate at 4.5 year low

Australian Dollar recovers mildly today after job data, but stays near term bearish. Employment market grew 3.7k in October, slowed from prior month’s 26.6k and missed expectation of 18.9k. Nonetheless, full time jobs grew 24.3k while part time jobs dropped -20.7k. Also, Unemployment rate, dropped to 5.4%, down from 5.5%. That’s also the lowest reading since February 2013. Also from Australia, consumer inflation expectation rose 3.7% in November.

RBA Assistance Governor Luci Ellis said yesterday that there more growth engines in the country other than mining. She pointed out that infrastructure spending, tourism and services as some examples. Also, the economy would be supported by relatively fast population growth and pickup in participation. In addition, there will be "indirect effects" from better infrastructure that boost productivity.

GBP/USD Mid-Day Outlook

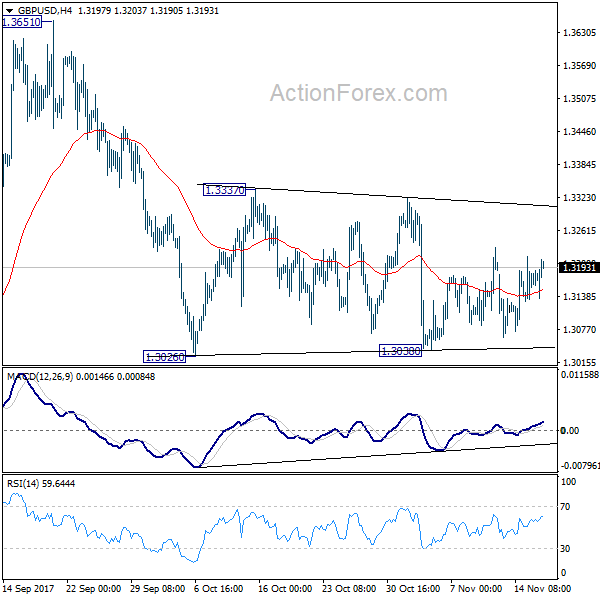

Daily Pivots: (S1) 1.3127; (P) 1.3171; (R1) 1.3212; More….

GBP/USD recovers today but stays at around middle of range of 1.3038/3337. Intraday bias remains neutral for the moment. In case of further rise, upside should be limited below 1.3337 resistance to bring fall resumption. Break of 1.3038 will now resume decline from 1.3651 to 1.2773 key support level. However, decisive break of 1.3337 will indicate that pull back from 1.3651 is completed and medium term rise from 1.1946 is resuming.

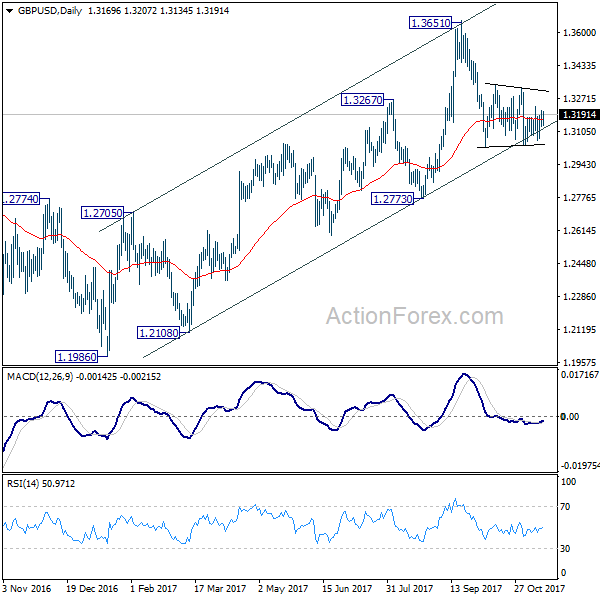

In the bigger picture, as noted before, GBP/USD hit strong resistance from the long term falling trend line. Current development is starting to favor that corrective rebound from 1.1946 low has completed at 1.3651. Decisive break of 1.2773 will confirm this bearish case and target a test on 1.1946 low next, with prospect of resuming the low term down trend. Nonetheless, break of 1.3320 resistance will restore the rise from 1.1946 for 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | Consumer Inflation Expectation Nov | 3.70% | 4.30% | ||

| 00:30 | AUD | Employment Change Oct | 3.7K | 18.9K | 19.8K | 26.6K |

| 00:30 | AUD | Unemployment Rate Oct | 5.40% | 5.50% | 5.50% | |

| 09:30 | GBP | Retail Sales M/M Oct | 0.30% | 0.20% | -0.80% | |

| 10:00 | EUR | Eurozone CPI M/M Oct | 0.10% | 0.10% | 0.40% | |

| 10:00 | EUR | Eurozone CPI Y/Y Oct F | 1.40% | 1.40% | 1.50% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct F | 0.90% | 0.90% | 0.90% | |

| 13:30 | CAD | Manufacturing Sales M/M Sep | 0.50% | -0.20% | 1.60% | 1.40% |

| 13:30 | CAD | International Securities Transactions (CAD) Sep | 16.81B | 10.68B | 9.85B | 9.77B |

| 13:30 | USD | Initial Jobless Claims (NOV 11) | 249K | 234k | 239k | |

| 13:30 | USD | Philly Fed Manufacturing Index Nov | 18.9 | 24.1 | 27.9 | |

| 13:30 | USD | Import Price Index M/M Oct | 0.20% | 0.40% | 0.70% | |

| 14:15 | USD | Industrial Production M/M Oct | 0.90% | 0.50% | 0.30% | 0.40% |

| 14:15 | USD | Capacity Utilization Oct | 77.00% | 76.30% | 76.00% | 76.40% |

| 15:00 | USD | NAHB Housing Market Index Nov | 67 | 68 | ||

| 15:30 | USD | Natural Gas Storage | 15B |