While Dollar extends recent gains following stronger than expected PPI data in early US session, it’s upward momentum was somewhat capped by the retreat in treasury yields as their correlation continues. Nevertheless, the greenback is still staying as the strongest one for the day and the week. It remains to be seen if there is sustainable selling, or profit-taking, to indicate that the greenback has topped.

For now, Yen remains the worst performer for the week. The unusually quietness of Japanese authorities suggests that they might allow Yen to depreciate further towards 160 mark before coming back for verbal intervention again. Sterling is currently the second worst, followed by Aussie. On the other hand, Canadian Dollar is the second best, followed by Swiss Franc. Euro and Kiwi are positioning in the middle.

Technically, US 10-year yield is still struggling to break through 61.8% retracement of 4.997 to 3.603 at 4.465, as well as medium term falling trendline decisively. There is still prospect of a near term pull back. Break of 4.264 support will bring deeper fall back to 55 D EMA (now at 4.127). If that happens, it would be accompanied by corresponding correction in Dollar.

In Europe, at the time of writing, FTSE is up 0.51% DAX is up 1.48%. CAC is up 1.38%. UK 10-year yield is down -0.0178 at 4.505. Germany 10-year yield is down -0.037 at 2.359. Earlier in Asia, Nikkei fell -0.48%. Hong Kong HSI fell -1.96%. China Shanghai SSE fell -1.73%. Singapore Strait Times rose 0.48%. Japan 10-year JGB yield rose 0.0214 to 1.063.

US initial jobless claims falls to 217k vs exp 224k

US initial jobless claims fell -4k to 217k in the week ending November 9, below expectation of 224k. Four-week moving average of initial claims fell -6k to 221k.

Continuing claims fell -11k to 1873k in the week ending November 2. Four-week moving average of continuing claims rose 1k to 1875k, highest since November 27, 2021.

US PPI up 0.2% mom, 2.4% yoy in Oct

US PPI for final demand rose 0.2% mom in October, matched expectations. Most of the rise can be traced to a 0.3% mom advance services. Prices of goods inched up 0.1% mom. PPI less foods, energy, and trade services increased 0.3% mom.

For the 12 month period, PPI accelerated notably from 1.9% yoy to 2.4% yoy, above expectation of 2.3% yoy. PPI less foods, energy, and trade services rose 3.5% yoy, up from prior month’s 3.3% yoy.

Fed’s Kugler notes significant disinflation amid steady cooling in labor market

In a speech today, Fed Governor Adriana Kugler said the US sees “considerable disinflation” paired with a “cooling” yet “resilient” labor market. This dual scenario means Fed must continue “paying attention to both sides of our mandate,” referring to price stability and maximum employment.

On the inflation side, Kugler acknowledged recent moderation in wage growth and inflation expectations, noting these factors support further progress on inflation. However, she cautioned that persistent inflation in housing and specific goods and services sectors could “stall progress”.

Meanwhile, she highlighted rebalancing in the labor market, attributing this to increased labor supply from immigration and a stronger pool of prime-age workers, alongside lower demand resulting from tight monetary policy.

Kugler indicated that if risks arise that impede progress or cause inflation to reaccelerate, it would be appropriate to pause policy rate cuts. Conversely, if the labor market slows down suddenly, Fed should consider continuing to gradually reduce the policy rate.

ECB accounts: Earlier path to 2% inflation, downside risks increase

In reviewing the October meeting accounts, ECB policymakers broadly agreed that the disinflationary trend in the Eurozone is progressing “well on track”.

While “upside risks” to inflation persist, they are now viewed as less significant, whereas “downside risks” have increased, influenced by slower economic activity.

This shift in balance suggests that inflation may reach the 2% target “somewhat earlier” than anticipated, with projections potentially indicating a lower inflation rate in 2025 than previously forecast.

Divergent views emerged regarding the precise impact of weaker economic growth on inflation, with members agreeing to revisit a more detailed assessment in December when updated projections become available.

A critical element behind the decision to cut rates was “risk management.” Members widely agreed that if the current economic slowdown proves “temporary”, cutting rates now could be seen as “having brought forward” a December cut. However, if data reveals “persistent weakness,” the move would constitute a “timely adjustment”.

In light of this economic environment, ECB Governing Council reached a consensus to lower rates by 25 basis points.

ECB’s de Guindos: Inflation easing, but growth falls short of expectations

ECB Vice President Luis de Guindos shared a mixed outlook today, highlighting progress in inflation but tempered growth prospects.

“There’s good news with inflation and not so good news on economic growth,” he remarked, noting ECB’s expectation that services inflation will ease over the coming months.

De Guindos added that inflation is expected to “converge in a clear and stable manner towards price stability, 2%,” a target that reinforces the bank’s commitment to maintaining price control.

On the economic front, de Guindos admitted “recovery we were anticipating is not happening with the intensity we expected”. Although household incomes have seen some improvement, it has yet to translate into stronger consumer spending.

Eurozone industrial production falls -2.0% mom in Sep, EU down -2.0% mom too

Eurozone industrial production dropped significantly by -2.0% mom in September, underperforming market expectations of a -1.2% mom decline. Production for capital goods took a steep hit, falling by -3.8% mom, while energy output also dropped by -1.5% mom. Intermediate goods production stayed flat, and non-durable consumer goods saw increase of 1.6% mom, along with smaller rise of 0.5% mom in durable consumer goods.

The broader EU recorded a matching -2.0% mom fall in industrial output, with notable declines in countries like Ireland (-10.7%), Denmark (-5.0%), and the Netherlands (-2.9%). On the upside, Croatia, Portugal, and Slovenia saw increases of 5.8%, 2.7%, and 1.6%, respectively, although these gains were not enough to offset the overall downturn.

RBA’s Bullock: Policy to stay restrictive until demand cools to sustainable levels

RBA Governor Michele Bullock commented at a panel discussion today on Australia’s economic and labor market conditions, noting that the economy is still operating at a level that risks fueling inflation.

According to Bullock, while labor market tightness has eased slightly, “it’s still not easy to get staff,” indicating persistent hiring challenges for businesses.

Bullock attributed the resilience in the job market to strong “demand” and “population growth”. These factors, she noted, continue to support employment levels despite some easing in labor market constraints.

Comparing RBA’s policy stance with other central banks, Bullock remarked that while others have already moved to lower rates, RBA remains “not as restrictive.”

Nevertheless, she emphasized that the bank considers its policy “restrictive enough” to address inflation risks and is committed to maintaining this stance until there’s clear evidence of a sustained “downward trajectory in demand.”

Australia’s employment growth 15.9k in Oct, slowest rate in recent months

Australia’s employment grew modestly in October, rising by 15.9k or 0.1% mom, falling short of the anticipated 25k increase. This represents the slowest pace of employment growth in recent months, following a period of more robust gains averaging 0.3% per month over the last six months. Full-time positions rose by 9.7k, while part-time jobs increased by 6.2k, both contributing to the incremental rise.

Unemployment rate remained steady at 4.1%, matching expectations, although the participation rate saw a slight dip from 67.2% to 67.1%. The number of unemployed rose by 1.3% mom, adding 8.3k to the job-seeking pool. In terms of labor utilization, monthly hours worked inched up by 0.1% mom, reflecting only minimal expansion in total labor demand.

This marks the third consecutive month with an unemployment rate of 4.1%, which stands 0.6% points higher than June 2023 low of 3.5%. Nonetheless, this rate remains 1.1% below the pre-pandemic level of 5.2% in March 2020.

The deceleration in employment growth could indicate a stabilizing labor market, aligning with recent RBA commentary on maintaining a restrictive policy stance until clear demand cooling is observed.

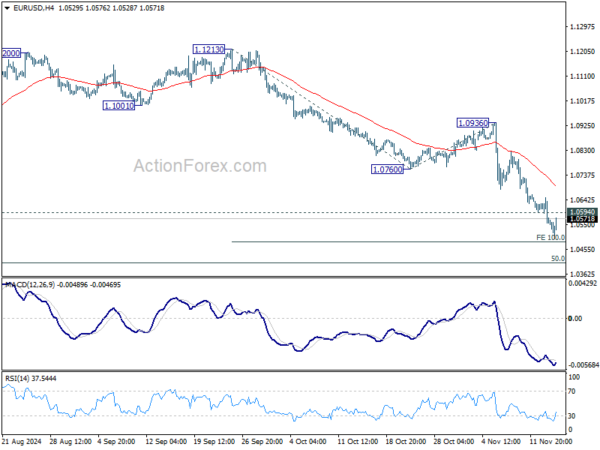

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0529; (P) 1.0591; (R1) 1.0627; More…

Intraday bias in EUR/USD stays on the downside for now, as fall from 1.1213 is in progress for 100% projection of 1.1213 to 1.0760 from 1.0936 at 1.0483. Break there will target 1.0404 key fibonacci level. On the upside, above 1.0594 minor resistance will turn intraday bias neutral again and bring consolidations. But outlook will stay bearish as long as 1.0760 support turned resistance holds, in case of recovery.

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage.