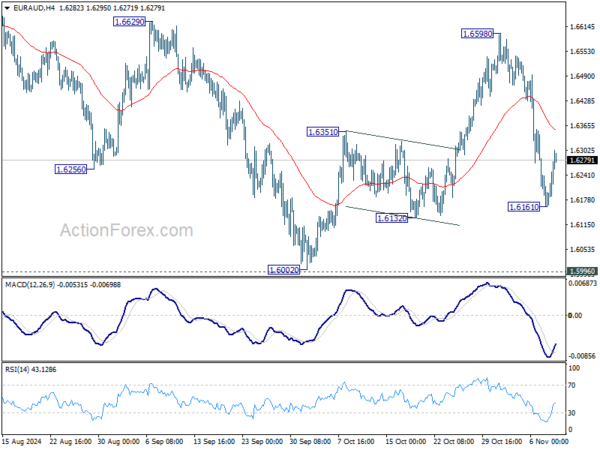

EUR/AUD’s steep decline last week suggests that rebound from 1.6002 has completed with three waves up to 1.6598. But as a temporary low was then formed at 1.6161, initial bias is neutral this week first. On the downside, below 1.6161 will target a test on 1.5996/6002 key support zone. For now, risk will stay mildly on the downside as long as 1.6598 holds, in case of stronger rebound.

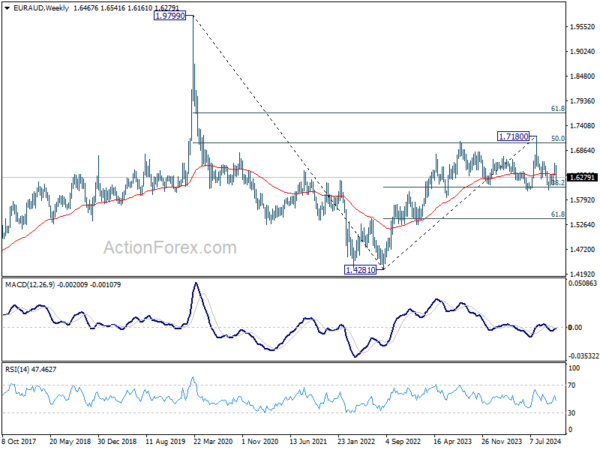

In the bigger picture, as long as 1.5996 cluster support , up trend from 1.4281 (2022 low) is still expected to resume through 1.7180 at a later stage. However decisive break of 1.5996 will argue that the medium term trend might have reversed. Deeper fall would be seen to 61.8% retracement of 1.4281 (2022 low) to 1.7180 at 1.5388, even as a correction.

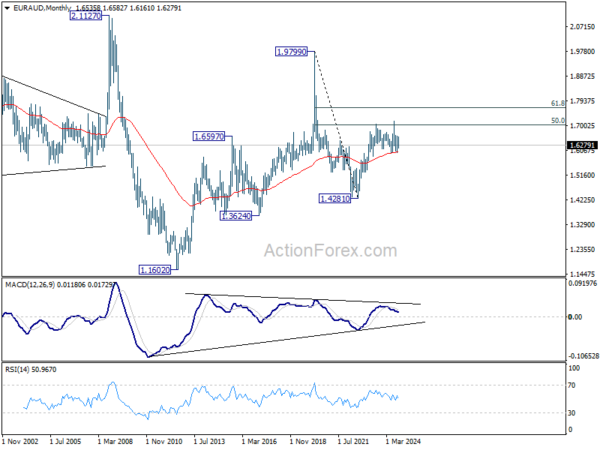

In the longer term picture, rise from 1.4281 is seen as the second leg of the pattern from 1.9799 (2020 high), which is part of the pattern from 2.1127 (2008 high). As long as 55 M EMA (now at 1.6031) holds, this second leg could still extend higher. However, sustained trading below 55 M EMA will open up the bearish case for extending the decline through 1.4281 low.