Key Highlights

- USD/JPY started a downside correction from the 153.85 zone.

- A connecting bullish trend line is forming with support at 151.45 on the 4-hour chart.

- Bitcoin trimmed gains and traded below the $70,000 level.

- Gold corrected gains sharply and traded below $2,780.

USD/JPY Technical Analysis

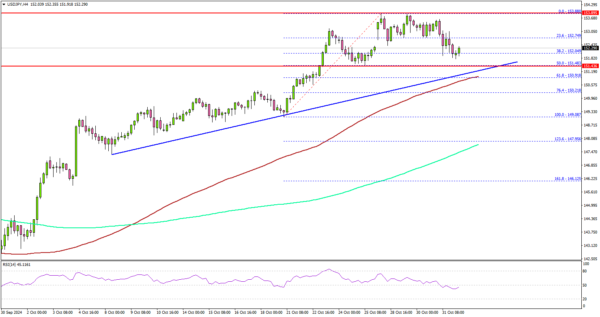

The US Dollar remained stable and extended gains above 152.50 against the Japanese Yen. USD/JPY even traded above 153.50 before the bears appeared.

Looking at the 4-hour chart, the pair traded as high as 153.88 and recently started a downside correction. There was a move below the 152.80 support, but the pair remained stable above the 100 simple moving average (red, 4-hour) and the 200 simple moving average (green, 4-hour).

On the downside, immediate support sits near the 152.00 level. The next key support sits near the 151.50 level. There is also a connecting bullish trend line forming with support at 151.45 on the same chart.

Any more losses could send the pair toward the 150.40 level. On the upside, the pair could face resistance near the 152.75 level.

The first key resistance is near the 153.20 level. A close above the 153.20 level could set the tone for another increase. The next major resistance could be 153.85, above which the price could accelerate higher toward the 154.50 resistance.

Looking at Gold, the price started a downside correction after trading to a new all-time high and traded below $2,750.

Upcoming Economic Events:

- US nonfarm payrolls for Oct 2024 – Forecast 113K, versus 254K previous.

- US Unemployment Rate for Oct 2024 – Forecast 4.1%, versus 4.1% previous.