US equities generally lower overnight as the global market rout continued, but sentiments stabilized in Asian session. DOW lost -138.19 pts, or -0.59% to end at 23271.28. It breached 23251.11 near term support during the day, which could seen as a sign of near term reversal. 10 year yield also followed lower, down -0.046 at 2.335 but it s held well above 2.273 structural support so far. Meanwhile, Dollar is trying to recovery after the deep selloff, in particular against Euro, earlier in the week. Overall, the sell off in oil is seen as a factor driving risk aversion. But WTI might now be stabilizing around 55 handle. Another risk averse factors emerges as US politicians are raising doubts on the legislation of the tax plan.

Senator Johnson and Collins oppose Republican tax bill

In US, Republican effort to push through the tax cuts before year end suffered serious setbacks yesterday. Republican Senator Ron Johnson openly expressed his opposition to both the Senate and House versions of the tax bill. He criticized that the plan benefits large corporations at the expense of the others, including smaller companies. Republican Senator Susan Collins also criticized the move to include the never-ending repeal of Obamacare in the tax bill.

Boston Fed Rosengren supports December hike

Boston Fed President Eric Rosengren, a hawk, said yesterday that "it is quite likely that unemployment will fall below 4 percent, which is likely to increase pressures on inflation and asset prices." And, "that suggests the need to continue to gradually remove monetary policy accommodation, which is quite consistent with market expectations of another increase in December."

ECB Praet talked the move back to conventional measures

ECB Chief Economist Peter Praet laid out the path that the central bank is moving from unconventional measures to conventional measures in policy setting. He noted that "as we progress towards a sustained adjustment in the path of inflation and approach the time when net purchases will gradually come to an end, the residual monetary support needed to assist the economy in its transition to a new normal will increasingly come from forward guidance on our policy rates." Then, "policy rates will eventually regain their status as the main instrument of policy, and our forward guidance will revert to a singular approach."

ECB Hansson: The world looks better to us

ECB Governing Council member Ardo Hansson sounded optimistic as he said "the world looks better to us" and the economy is enjoying "strong growth". Also, "with greater confidence in the outlook for the real economy there is some scope for a prudent but obvious recalibration of policies." Regarding policy, he emphasized that "one of my colleagues always likes to say monetary policy is not a solo, it’s a quartet: you have the asset purchases, the accumulated stock of purchases, the re-investment policy and forward guidance."

AU job growth missed, unemployment rate at 4.5 year low

Australian Dollar recovers mildly today after job data, but stays near term bearish. Employment market grew 3.7k in October, slowed from prior month’s 26.6k and missed expectation of 18.9k. Nonetheless, full time jobs grew 24.3k while part time jobs dropped -20.7k. Also, Unemployment rate, dropped to 5.4%, down from 5.5%. That’s also the lowest reading since February 2013. Also from Australia, consumer inflation expectation rose 3.7% in November.

RBA Assistance Governor Luci Ellis said yesterday that there more growth engines in the country other than mining. She pointed out that infrastructure spending, tourism and services as some examples. Also, the economy would be supported by relatively fast population growth and pickup in participation. In addition, there will be "indirect effects" from better infrastructure that boost productivity.

Looking ahead

UK retail sales will be the main focus in European session. Eurozone will release CPI final. Later in the data. US will release jobless claims, Philly Fed survey, import price index, industrial production and NAHB housing index. Canada will release manufacturing sales and international securities transactions.

AUD/USD Daily Outlook

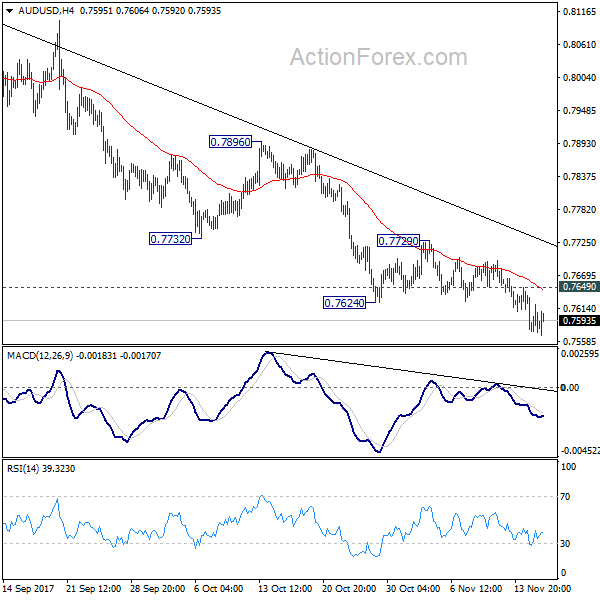

Daily Pivots: (S1) 0.7563; (P) 0.7598; (R1) 0.7622; More…

Intraday bias in AUD/USD remains on the downside with 0.7649 minor resistance intact. Current fall from 0.8124 is expected to target next key cluster level at 0.7322/8. On the upside, above 0.7649 minor resistance will turn intraday bias neutral. But outlook will stay bearish as long as 0.7729 resistance holds.

In the bigger picture, corrective rise from 0.6826 medium term bottom is likely completed at 0.8124, after hitting 55 month EMA (now at 0.8067). Decisive break of 0.7328 key cluster support (61.8% retracement 0.6826 to 0.8124 at 0.7322) will confirm. And in that case, long term down trend from 1.1079 (2011 high) will likely be resuming. Break of 0.6826 will target 61.8% projection of 1.1079 to 0.6826 from 0.8124 at 0.5496. This will now be the favored case as long as 0.7896 near term resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:00 | AUD | Consumer Inflation Expectation Nov | 3.70% | 4.30% | ||

| 0:30 | AUD | Employment Change Oct | 3.7K | 18.9K | 19.8K | 26.6K |

| 0:30 | AUD | Unemployment Rate Oct | 5.40% | 5.50% | 5.50% | |

| 9:30 | GBP | Retail Sales M/M Oct | 0.20% | -0.80% | ||

| 10:00 | EUR | Eurozone CPI M/M Oct | 0.10% | 0.40% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Oct F | 1.40% | 1.50% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct F | 0.90% | 0.90% | ||

| 13:30 | CAD | Manufacturing Sales M/M Sep | -0.20% | 1.60% | ||

| 13:30 | CAD | International Securities Transactions (CAD) Sep | 9.85B | |||

| 13:30 | USD | Initial Jobless Claims (NOV 11) | 234k | 239k | ||

| 13:30 | USD | Philly Fed Manufacturing Index Nov | 24.1 | 27.9 | ||

| 13:30 | USD | Import Price Index M/M Oct | 0.40% | 0.70% | ||

| 14:15 | USD | Industrial Production M/M Oct | 0.50% | 0.30% | ||

| 14:15 | USD | Capacity Utilization Oct | 76.30% | 76.00% | ||

| 15:00 | USD | NAHB Housing Market Index Nov | 67 | 68 | ||

| 15:30 | USD | Natural Gas Storage | 15B |