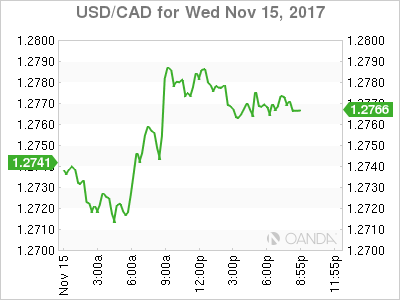

The Canadian dollar depreciated on Wednesday. The loonie lost 0.30 percent versus the greenback after solid inflation and strong retail sales data show the U.S. Federal Reserve is ready to announce a rate hike in December. Positive inflation growth and gains in retail sales will make it harder for the doves within the Federal Open Market Committee (FOMC) to vote against an interest rate lift at the end of the December monetary policy meeting. The meeting will mark the last influential decision of Fed Chair Janet Yellen’s helm at the central bank.

US core consumer prices rose 0.2 percent in October and an unexpected rise by retail sales by 0.2 percent when the forecast called for a flat reading boosted the USD across the board and validating the telegraphed announcement by the Fed that it would hike in December. The market focused on fundamentals on Wednesdays after a couple of weeks with little data to chew on with the tax overhaul in the US as the biggest factor in currencies.

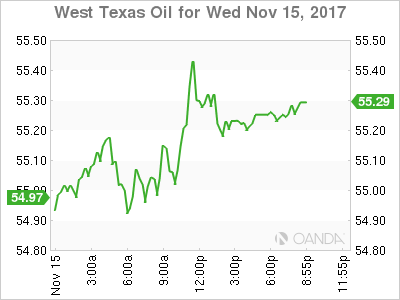

The fall in oil prices as US inventories showed a hefty buildup when a drawdown was expected put more pressure on the CAD. Oil prices surged after the Saudi Arabia Crown Prince Mohammed bin Salman triggered a power play that ended up with various prices and influential business men under arrest and raised questions on how well would the de facto leadership of the Organization of the Petroleum Exporting Countries (OPEC) handle rising diplomatic infighting between members.

The USD/CAD gained 0.30 percent on Wednesday. The currency pair is trading at 1.2769 after the December rate hike chances have been boosted by strong inflation and retail sales data in the US. The market has already priced in a rate move in December, but with a slowdown in inflation and incomplete data due to the tropical storms in September the Fed could keep from raising rates this year. The expected wider gap between Canadian interest rates and the Fed funds rate added pressure to a loonie that was slowly losing momentum due to the losses in oil prices.

Bank of Canada (BoC) Deputy Governor Wilkins spoke today in New York. She reiterated that the central bank will be cautious on its monetary policy decisions which was a departure from the comments in June when the BoC hiked rates in July with a hawkish tone to be followed by a surprise back to back hike in September. NAFTA unknowns remains a concern as it could negatively effect the Canadian economy with the fifth round getting underway in Mexico City.

The NAFTA renegotiation talks will be without the Trade Ministers and will hope to take on less contentious topics such as textiles, services, labor and intellectual property. The last round ended with little progress and Canadian and Mexican negotiators unhappy at the America first proposals from the Trump Administration.

NAFTA has been a target for Trump supporters, but the agreement has the backing of some republican congress members who have sided with their democrat counterparts urging the President to leave US requirements for autos as the original agreement. The move was considered a poison pill as it would unfairly favour US production in the detriment to the other two nations.

The price of oil is net weekly lows after for the second week in a row there was a surprise buildup of US crude inventories. The prices of West Texas Intermediate is trading at $55.20 after the Energy Information Administration (EIA) published a rise of 1.9 million barrels. The market was expecting a miss on the forecast after the API reported an overnight rise of 6.5 million barrels. The Industry group data and the US movement’s are not correlated 1 to 1. The market had already sold off crude, but since the scale of the official buildup was lower some investors reentered their long positions.

The IEA had cut demand forecasts earlier in the week contradicting the estimates form the Organization of the Petroleum Exporting Countries (OPEC). The price of oil has been trading higher after the events in Saudi Arabia but with no new or development, prices are discounting the political uncertainty in the Kingdom.

The battle between the rise in production in the US and the cut agreement between OPEC and other major producers will continue. The Russian Energy Minister Alexander Novak spoke today to reassure that Russian producers are committed to the agreement to cut output, but he did not mention if they will go ahead with an extension of said agreement. The OPEC and major producers will meet in Vienna on November 30.

Market events to watch this week:

Thursday, November 16

4:30am GBP Retail Sales m/m

8:30am USD Unemployment Claims

Friday, November 17

8:30am CAD CPI m/m

8:30am USD Building Permits