Aussie fell broadly today as pressured by a combination of factor. A significant contributor is the strengthening greenback, supported by expectations of slower-than-anticipated Fed easing cycle and rising yields driven by US presidential election considerations. Another factor weighing on Aussie is the waning enthusiasm for China’s stimulus measures, mirrored in sluggish performance in Chinese and Hong Kong equities.

Trader are probably also positioning ahead of Australia’s Q3 CPI data due tomorrow. Expectations are that the CPI will finally fall back within RBA target band of 2-3%. September’s monthly CPI could even dip below the midpoint of the band. Such an outcome would likely prompt the RBA to ease its inflation vigilance at its upcoming meeting and lay the groundwork for a rate cut in February. Traders are likely building up short positions in anticipation of this scenario.

Kiwi is also under pressure amid discussions that RBNZ would continue its aggressive policy easing in November. While a 50 bps rate cut is currently the expected baseline, Goldman Sachs has suggested that RBNZ might surprise markets with an even larger 75 bps reduction. In their note, Goldman attributes this expectation to the weak economic fundamentals, which support the need for more substantial cuts, particularly given weak labor market indicators. With inflation already within RBNZ’s 1-3% target band and likely to decrease further due to slowing growth and rising unemployment, the central bank may have room to act more decisively.

Meanwhile, Yen remains one of the weakest currencies this week so far, joining the Aussie and Kiwi as the bottom three. Verbal intervention from Japan’s officials have fallen into deaf ears due to Japan’s political instability. Finance Minister Katsunobu Kato reiterated that Japan will continue to “closely monitor foreign exchange moves, including those driven by speculators,” with a “higher sense of vigilance.” However, uncertainty persists over when the Liberal Democratic Party can form a coalition government, leaving markets skeptical about any immediate intervention action.

In contrast, Swiss Franc and Euro have emerged as the strongest performers so far this week, while Dollar is also performing well. Sterling and Loonie are positioning in the middle.

Technically, as follow up to yesterday’s post, GBP/AUD’s rally from 1.9123 extended through 1.9698 resistance. The development affirms the case that correction from 2.0034 has completed with three waves down to 1.9123 already. Further rally is now expected as long as 55 D EMA (now at 1.9442) holds. Retest of 2.0034 high should be seen first. Firm break there will resume larger up trend from 1.5925 (2022 low). Next target is 100% projection of 1.8909 to 2.0034 from 1.9123 at 2.0248.

In Asia, at the time of writing, Nikkei is up 0.59%. Hong Kong HSI is down -0.08%. China Shanghai SSE is down -0.65%. Singapore Strait Times is down -0.30%. Japan 10-year JGB yield is down -0.0005 at 0.974. Overnight, DOW rose 0.65%. S&P 500 rose 0.27%. NASDAQ rose 0.26%. 10-year yield rose 0.0460 to 4.278.

BoC’s Macklem open to larger cuts following substantial tightening cycle

BoC Governor Tiff Macklem indicated the central bank’s intent to continue cutting its policy rate if the economy aligns with central bank’s forecast. However, he acknowledged uncertainty regarding the precise pace and end-point of the easing cycle, remarking overnight, “We don’t know exactly the pace. We don’t exactly know where the landing is.”

Macklem also addressed speculation around the size of future rate cuts, clarifying that larger-than-quarter-point reductions are not limited to emergencies or economic downturns.

With the aggressive rate hikes in recent memory, he suggested that “it makes sense to take some bigger-than-normal steps”, signaling that larger steps on the way down could be reasonable as well.

ECB’s Guindos warns of risks despite progress in disinflation

ECB Vice President Luis de Guindos highlighted overnight that recent data confirms the disinflationary process is “well on track.” However, he cautioned that the outlook is clouded by “substantial risks.”

Key concerns include geopolitical conflicts that could raise energy and freight costs, extreme weather events, and persistent wage growth, all of which could prolong inflationary pressures.

On the downside, Guindos noted that previous rate hikes might impact demand and inflation more than anticipated, while a slowing global economy presents further risks.

He pointed out that economic performance has been weaker than expected, with risks skewed to the downside. “Lower confidence could prevent consumption and investment from recovering as fast as expected,” Guindos added, emphasizing that geopolitical tensions continue to threaten global trade and energy supplies.

Japan’s unemployment rate falls to 2.4%, job availability remains strong

Japan’s unemployment rate fell from 2.5% to 2.4% in September, below expectations of 2.5%.

While the total number of employed individuals declined slightly by -0.1% to seasonally adjusted 67.82m, the number of unemployed fell -2.3% to 1.68m, marking the second consecutive monthly decrease.

Additionally, job availability ratio rose 0.01 to 1.24, meaning there were 124 job openings for every 100 job seekers, reflecting strong demand for labor.

Looking ahead

Germany Gfk consumer sentiment, UK M4 money supply and mortgage approvals will be release in European session. Later in the day, US will publish goods trade balance, house price index, and consumer confidence.

AUD/USD Daily Report

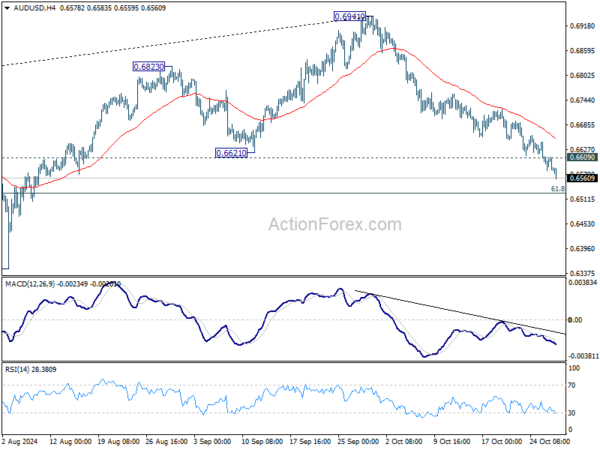

Daily Pivots: (S1) 0.6570; (P) 0.6593; (R1) 0.6607; More...

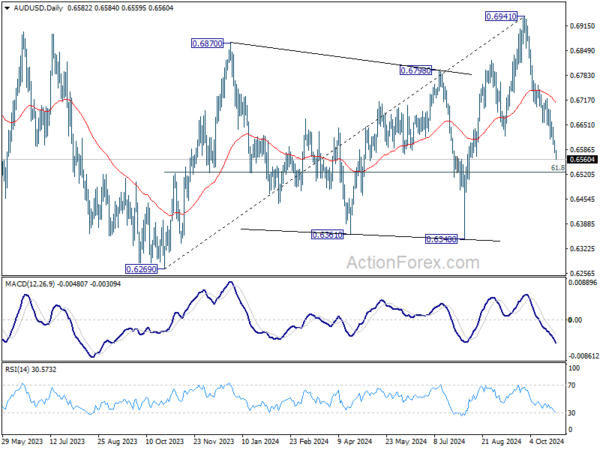

AUD/USD’s decline from 0.6941 is in progress and intraday bias stays on the downside for 61.8% retracement of 0.6269 to 0.6941 at 0.6526. Sustained break there will target 0.6348 support next. On the upside, above 0.6609 minor resistance will turn intraday bias neutral and bring consolidations first.

In the bigger picture, rise from 0.6269 (2023 low) should have completed with three waves up to 0.6941. Corrective pattern from 0.6169 (2022 low) is now extending with another falling leg. Deeper decline would be seen back to 0.6269 as sideway trading extends.