- The recent movement of the USD/JPY has been influenced primarily by political factors.

- The JPY has weakened significantly due to the growing risk that the current LDP-led coalition may lose its majority seats after this Sunday, 27 October snap election.

- Watch the 151.10 key short-term support on the USD/JPY.

Since our last publication, the bears have continued to gain a foothold in the Japanese yen as it weakened further against the US dollar and burst above the 151.95 key long-term pivotal resistance of the USD/JPY and its 200-day moving average.

Growing internal political risk is inflicting damage on the JPY outlook in the near term

There is now a growing risk that Japan may end up with a minority coalition government after this Sunday, 27 October snap general election for the lower house.

Recent polls have indicated the possibility of the ruling Liberal Democratic Party (LDP)-Komeito coalition losing its majority in parliament and may also cause the newly appointed Prime Minister Ishiba to lose his premiership or force the LDP to look for additional coalition partner to stay in power.

All in all, such political risk is likely to hamper the Bank of Japan (BoJ) current monetary policy normalisation plan to hike interest rates gradually after it ended its decades-long of negative interest rate in March and increased the overnight short-term interest rate to 0.25% in July.

At this juncture, the main opposition party, the Constitutional Democratic Party of Japan has ruled out the prospect of forming a coalition with the LDP.

Thus, smaller opposition parties, Japan Innovation Party and Democratic Party for the People are the only choices that LDP has as potential coalition partners to secure its power base.

Both opposition parties favour expansionary fiscal and monetary policies to achieve sustained economic and wage growth. Hence, BoJ is likely to face a hurdle in enacting additional interest rate hikes next year if such economic proposals are taken into consideration by a newly formed LDP-led coalition.

Fundamentals are still supporting further interest rate hikes in Japan

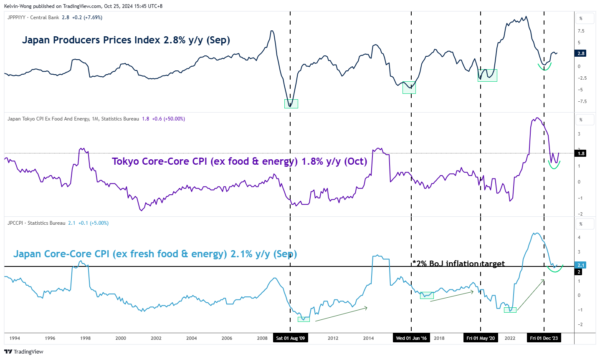

Fig 1: Monthly Japan PPI, CPI & Tokyo CPI trends (y/y) as of Sep & Oct 2024 (Source: TradingView, click to enlarge chart)

Even though the latest headline inflation in Tokyo slowed to 1.8% y/y in October, down from 2.2% a month earlier, the Tokyo core-core inflation rate (excluding food and energy) came in strong-than-expected as it rose to 1.8% y/y from 1.2% printed in September (see Fig 1).

The Tokyo inflation data are considered a leading inflationary trend for the nationwide Japan CPI which BoJ will take into consideration at next week’s monetary policy meeting on 31 October when it also releases its latest quarterly growth and inflation trend forecasts.

The market consensus is looking for BoJ to keep its short-term interest rate unchanged at 0.25% due to uncertainties surrounding the upcoming US presidential election on 5 November.

Watch the 151.10 key short-term support on USD/JPY

Fig 2: USD/JPY minor trend as of 25 Oct 2024 (Source: TradingView, click to enlarge chart)

The pull-back of the USD/JPY that took form on Thursday, 24 October from a three-month high of 153.19 printed on Wednesday, 23 October has managed to stall at its 200-day moving average and slightly above the lower boundary of its minor ascending channel from 30 September 2024 low of 141.65 (see Fig 2).

Watch the 151.10 key short-term pivotal support to maintain its current streak of impulsive upmove sequence for the next intermediate resistances to come in at 153.80 and 154.70/80 next.

However, failure to hold at 151.10 invalidates the bullish tone to kickstart a potential mean reversion decline to expose the intermediate supports of 150.30 and 148.95 (also the 20-day moving average).