Japanese Yen saw a modest recovery today after briefly dipping below the 153 mark against Dollar, as Japanese officials finally broke silence on the currency’s recent decline. Finance Minister Katsunobu Kato stated that the government is closely monitoring exchange-rate movements with “heightened vigilance, including for any speculative moves.” He reiterated the need for exchange rates to “move stably.”

Nevertheless, Kato also mentioned that G20 finance leaders did not discuss currency rate movements at Wednesday’s meeting and are unlikely to do so during Thursday’s session. While his comments have provided temporary relief for Yen, they are unlikely to reverse the currency’s overall weakening trend.

Meanwhile, Euro is under selling pressure as markets await the release of the Eurozone’s PMI data. ECB officials have struck a notably dovish tone this week, confirming reports that policymakers are considering accelerating monetary easing with a 50bps rate cut in December. Although such a significant cut is not the current baseline, it is likely to be a topic of discussion at the upcoming meeting. Any further deterioration in economic activity, as indicated by the PMI data, could make a 25 or 50 bps a closer call.

In the broader currency markets, Dollar remains the strongest performer this week, supported by continued strength in US Treasury yields. Swiss Franc and Canadian Dollar follow closely, with Loonie showing resilience despite yesterday’s 50 bps rate cut by BoC. Yen remains the weakest currency despite today’s rebound, while Kiwi and Sterling are also under pressure. Euro and Aussie are positioned in the middle of the pack.

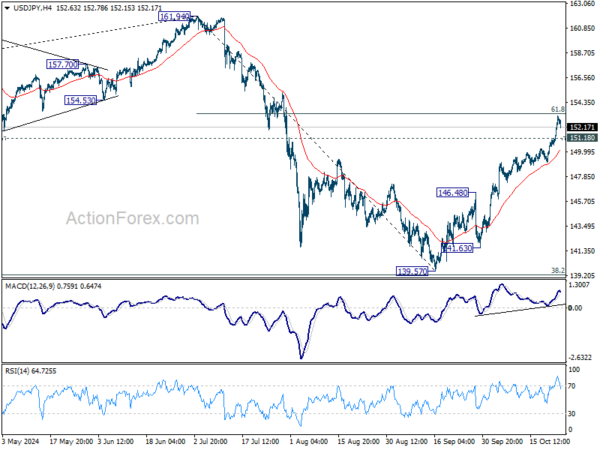

Technically, break of 151.18 minor support in USD/JPY will indicate initial rejection by 61.8% retracement of 161.94 to 139.57 at 153.39 and bring consolidations first, before staging another rally. Nevertheless, decisive break of 153.39 will extend the rally from 139.57 towards 161.94 high.

In Asia, at the time of writing, Nikkei is down -0.09%. Hong Kong HSI is down -0.99%. China Shanghai SSE is down -0.50%. Singapore Strait Times is up 0.54%. Japan 10-year JGB yield is down -0.005 at 0.974. Overnight, DOW fell -0.96%. S&P 500 fell -0.92%. NASDAQ fell -1.60%. 10-year yield rose 0.038 to 4.242.

BoJ’s Ueda warns gradual rate hikes could leading to Yen speculations

At the International Monetary Fund event, BoJ Governor Kazuo Ueda said “It’s still taking time for us to get to 2% in a sustainable way,” Ueda said, justifying the commitment to maintaining its accommodative monetary policy for the time being, even with this year’s rate hikes.

Ueda stressed that raising inflation expectations and supporting underlying inflation are crucial to moving the Japanese economy toward “a new equilibrium with 2% inflation in a sustainable way”.

However, he acknowledged the complexity of determining the pace and magnitude of future rate hikes. “I think about what would be the right size of normalization in total going forward, and how best to allocate that total rate hike across time,” he admitted, adding that this challenge keeps him “awake 24/7.”

A key concern for BoJ is the balance between cautious, gradual rate hikes and the risk of creating market distortions. Ueda warned that moving “very, very gradually” could lead to market participants assuming that rates will remain low for an extended period, resulting in a “huge build-up of speculative positions” in Yen.

Finding the “right balance” between caution and effective action is critical, Ueda emphasized, as BoJ continues to navigate a difficult path toward inflation normalization.

Japan’s private sector falls into contraction as PMI services plunges to 20-month low

Japan’s private sector slipped into contraction territory at the beginning of Q4, with PMI Manufacturing index declining from 49.7 to 49.0 in October. The services sector saw a much sharper fall, with PMI Services tumbling from 53.1 to 49.3, its worst reading since February 2022. As a result, PMI Composite also dropped from 52.0 to 49.4, the weakest figure since November 2022.

According to Usama Bhatti, economist at S&P Global Market Intelligence, Japan’s economic slowdown has become more pronounced, with firms attributing the downturn to a “muted economy and subdued new order inflows.”

Business confidence for the coming year also took a hit, softening to the lowest level since August 2020. Bhatti noted that the “stubbornness of high prices” and ongoing economic weakness are weighing on overall sentiment.

Australian’s PMI manufacturing hits 53-month low, inflation pressures easing

Australia’s manufacturing sector continues to struggle, with PMI Manufacturing index slipping slightly from 46.7 to 46.6 in October, marking its lowest point in 53 months. According to Judo Bank’s Matthew De Pasquale, key indicators such as output and new orders have dropped to levels that signal the sector is “on the verge of recession.”

However, services sector, which accounts for over 80% of the country’s economic output, showed modest improvement. PMI Services ticked up from 50.5 to 50.6, and new business activity rose to its highest level since May, suggesting some resilience. De Pasquale noted that while business growth remains “soft,” the outlook for the services sector is improving with new business activity at the highest level since May

Inflation also appears to be moderating. Input cost pressures fell to their lowest levels since the onset of pandemic-induced inflation in 2021. Final prices, particularly in services, are also trending downward. De Pasquale added that inflation “remains on track” to return to RBA’s target range of 2% to 3%.

BoE’s Bailey: Disinflation surprising, but structural Economic changes pose uncertainty

At an event hosted by the Institute of International Finance, BoE Andrew Bailey acknowledged that disinflation in the UK is progressing “faster than we expected”. However, he expressed concerns about potential “structural changes” in the economy that could sustain price pressures.

Specifically, Bailey highlighted uncertainty around the labor market and whether shifts in employment dynamics might keep inflation elevated.

He pointed to services inflation, which remains high at just under 5%, and emphasized that it “has to come further down” to meet the 2% target. Despite some signs of labor market loosening, Bailey noted it remains tight, contributing to ongoing inflationary pressures.

“We’ve got a very unbalanced mix of inflation components and services inflation remains higher than is consistent with the target,” Bailey said.

Looking ahead

PMI data from Eurozone and the UK are the main focus in European session. Later in the day, US will release jobless claims, new home sales, and PMIs.

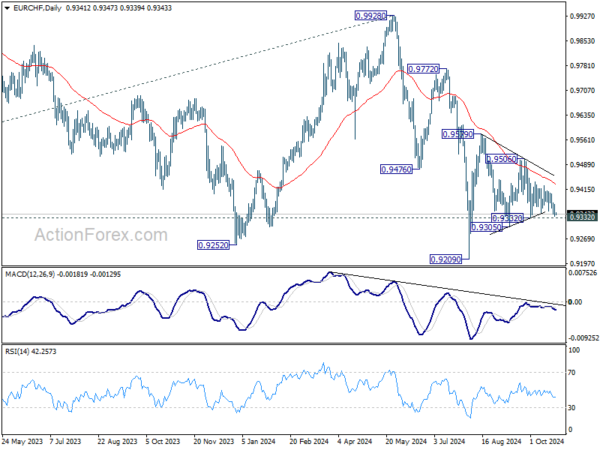

EUR/CHF Daily Outlook

Daily Pivots: (S1) 0.9328; (P) 0.9351; (R1) 0.9366; More….

Intraday bias in EUR/CHF remains neutral first, with immediate focus on 0.9332 support. Firm break there will resume the fall from 0.9579 towards 0.9209, and argue that larger down trend might be ready to resume too. On the upside, though, break of 0.9506 will turn intraday bias to the upside for 0.9579 resistance and above.

In the bigger picture, fall from 0.9928 is seen as part of the long term down trend. Repeated rejection by 55 D EMA (now at 0.9432) keeps outlook bearish for breaking through 0.9209 low at a later stage. Nevertheless, sustained trading above 55 D EMA will confirm medium term bottoming and bring stronger rebound back towards 0.9928 key resistance.