USDJPY regained traction in early trading on Monday but remains with the recent range and looks for firmer direction signal.

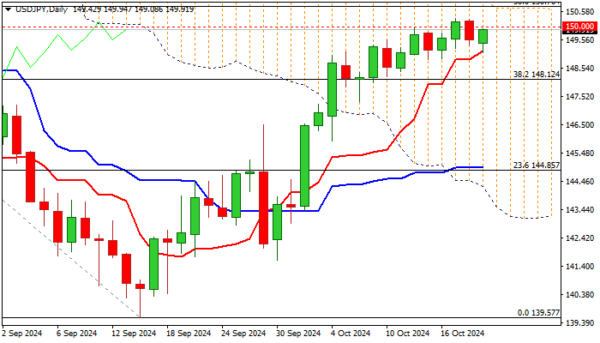

Near term bias is expected to remain bullish while the price action stays above rising daily Tenkan-sen (149.16) which contained today’s dip, but the upside attempts were so far limited.

Probes through psychological 150 barrier failed to register weekly close above this level, lacking fresh bullish signal for extension towards more significant barriers at 150.69/76 (daily cloud top / 100DMA / 50% retracement of 161.95/139.57 downtrend) violation of which to signal continuation of an uptrend from139.57 (2024 low, posted on Sep 16).

Daily studies are mixed as positive signals from strong bullish momentum and diverging daily Tenkan / Kijun-sen after creating bull-cross) were partially offset by formation of 100/200DMA death cross).

The dollar remains supported by wide gap between Fed/BoJ monetary policies and growing market expectations of election victory of Donald Trump, whose pro-business policy is expected to boost the economy and further support dollar.

On the other hand, more signals that Fed may remain dovish on monetary policy would increase pressure on the US currency.

Initial negative signals to be expected on potential loss of 149.16/00 pivots, which would risk deeper pullback, and expose supports at 148.12 and 147.28 (broken Fibo 38.2% / rising 20DMA).

Res: 150.00; 150.76; 151.00; 151.40.

Sup: 149.16; 149.00; 148.86; 148.12.