ECB is widely expected to cut the deposit rate by 25bps to 3.25% today, marking the first back-to-back rate reduction in 13 years. This step reflects ECB’s growing urgency to accelerate monetary easing as inflation cools faster than anticipated and persistent manufacturing struggles spill over into services and employment.

Although December had initially been considered the optimal time for the next cut, recent economic data has heightened concerns among ECB officials. Nevertheless, the December meeting remains significant, with updated economic projections that will shape the policy direction in 2025.

While the market is almost fully pricing in three further cuts through March 2025, ECB President Christine Lagarde is unlikely to offer explicit guidance today. However, the underlying message will likely suggest that another cut in December is likely unless the economic outlook improves.

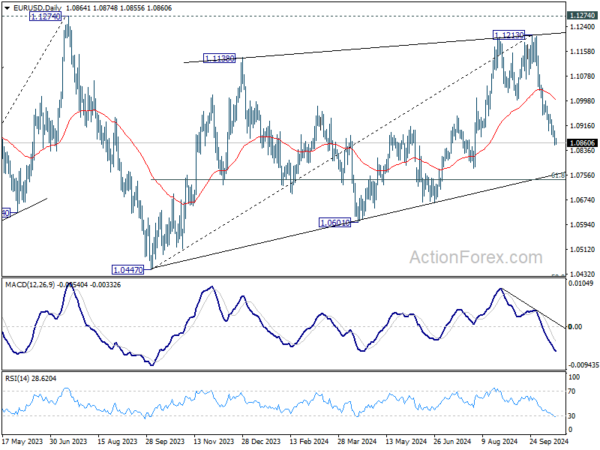

Technically, EUR/USD’s fall from 1.1213 short term top is in progress. Near term outlook will stay bearish as long as 55 D EMA (now at 1.0999) holds. This decline is seen as the third leg of the corrective pattern from 1.1274 (2023 high). Next target is 61.8% retracement of 1.0447 to 1.1213 at 1.0740. Any further dovish tone from the ECB today could accelerate this downward movement.