Dollar is broadly stronger today in what is otherwise a quiet trading session. With US markets closed for holiday, overall activity has been subdued. However, Dollar bulls seem to be taking advantage of the thinner liquidity to push the greenback higher. The anticipation of further interest rate cuts from ECB this week, and more to come, is providing additional support for Dollar. Additionally, the lack of clarity surrounding China’s fiscal stimulus continues to weigh on the Aussie and Kiwi, keeping both on the back foot.

In addition to ECB rate cut, attention is also on the UK, where a series of key economic releases are due throughout the week. Tomorrow’s employment and wage growth data kick off a lineup that also includes Wednesday’s CPI report and Friday’s retail sales figures. These indicators will be closely watched by market participants as they assess the potential for further rate cuts from the BoE. The BoE has been grappling with a split within its Monetary Policy Committee, with some members extended easing to counter slowing economy, while others advocate a more cautious approach.

Technically, there is prospect for a strong rebound in GBP/USD from 1.3000 cluster support level. Break of 1.3174 resistance will retain near term bullishness, and bring retest of 1.3433 high. However, sustained break of 1.3000 will raise the chance of bearish trend reversal, and bring deeper decline towards next structural support at 1.2664.

In Europe, at the time of writing, FTSE is up 0.11%. DAX is up 0.37%. CAC is down -0.16%. UK 10-year yield is up 0.0440 at 4.251. Germany 10-year yield is up 0.014 at 2.281. Earlier in Asia, Japan was on holiday. Hong Kong HSI fell -0.75%. China Shanghai SSE rose 2.07%. Singapore Strait Times rose 0.62%.

China’s Export Growth Slows Sharply, Misses Expectations

China’s export and import data for September painted a weaker-than-expected picture of the nation’s trade performance. Exports grew by just 2.4% yoy to USD 303.7B, well below expectations of 6.0% yoy and down from the 8.7% yoy rise in the previous month. Imports edged up a modest 0.3% yoy to USD 222B, missing expectations of 0.9% yoy increase and lower than August’s 0.5% yoy rise. Trade surplus narrowed to USD 81.7B, smaller than the expected USD 89.8B and down from USD 91.0B in August.

Breaking down the data by region, exports to the US, China’s largest trading partner, rose by 2.2% yoy, while imports saw a stronger 6.7% yoy growth. Trade with ASEAN remained more robust, with exports up 5.5% yoy and imports climbing 4.2%yoy. However, exports to the EU edged up by only 1.3%, while imports from the bloc fell by -4% yoy. Trade with Russia was mixed, with exports surging by 16.6% yoy, but imports declining by -8.4% yoy.

Customs spokesman Lu Daliang attributed the weaker export growth to “short-term incidental factors,” including frequent typhoons in key port cities, a high base from last year, and ongoing global shipping congestion. Lu noted that the peak export season for some Chinese products typically seen in Q3 had been moved forward by more than a month this year due to the shipping delays.

New Zealand BNZ services unchanged at 457, stuck in contraction

New Zealand’s BusinessNZ Performance of Services Index was unchanged at 45.7 in September, marking the seventh consecutive month in contraction and remaining well below the long-term average of 53.1.

Katherine Rich, CEO of BusinessNZ, noted that the services sector appears to be “stuck in a rut” and is struggling to get out of contraction.

The detailed data reflects mixed performance across key components. While activity/sales edged slightly higher from 44.3 to 45.6, employment saw a sharp decline, dropping from 49.4 to 45.7—reflecting further weakness in job creation. New orders/business also ticked down marginally from 46.9 to 46.7, while supplier deliveries dipped further to 43.2 from 43.5.

One small positive came from a reduction in the proportion of negative comments from respondents, which fell to 58.5% in September, compared to 60.8% in August and 67.0% in June and July. However, a significant number of businesses still cited the broader economic environment as a key negative factor impacting their performance.

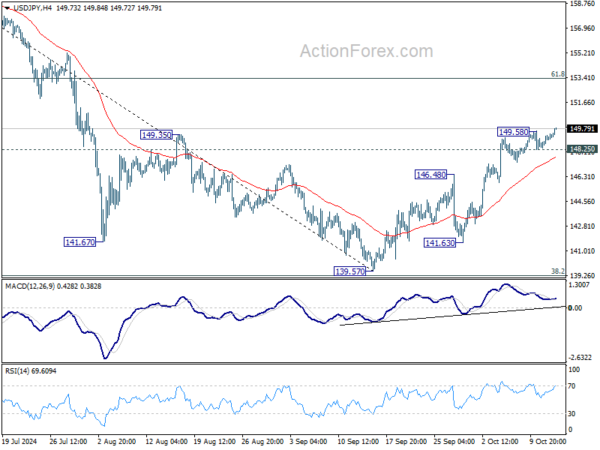

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 148.58; (P) 148.94; (R1) 149.46; More…

USD/JPY’s rise from 139.57 resumed after brief consolidations and intraday bias is back on the upside, This rally is seen as the second leg of the corrective pattern from 161.94, and should target 61.8% retracement of 161.94 to 139.57 at 153.39 next. On the downside, below 148.25 minor support will turn intraday bias neutral again first.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should now be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.