Trading in the early US session is relatively subdued, with little momentum driving market moves. Canadian Dollar, despite an initial attempt to rally on the back of stronger-than-expected job data, has not been able to attract sustained buying interest. The market continues to price in further easing from BoC, as expectations mount that the central bank will lower interest rates to a neutral level within a year’s time, from the current 4.25%. This sentiment persists even as Canada’s labor market displays resilience.

Meanwhile, Dollar has shown little reaction to PPI data released. US equity futures indicate a flat open as traders prepare for a long weekend, a scenario that typically leads to cautious positioning. On the bond front, 10-year Treasury yield has extended its near-term rally, pushing past the 4.1% mark. While rising yields have offered the greenback a mild lift against Yen, the critical 150 level for USD/JPY remains unbroken, as traders appear reluctant to test the psychological threshold before the weekend.

In Europe, at the time of writing, FTSE is down -010%. DAX is up 0.21%. CAC is up 0.08%. UK 10-year yield is up 0.0333 at 4.249. Germany 10-year yield is up 0.034 at 2.293. Earlier in Asia, Nikkei rose 0.57%. Hong Kong was on holiday. China Shanghai SSE fell -2.55%. Singapore Strait Times fell -0.32%. Japan 10-year JGB yield fell -0.007 to 0.952.

US PPI at 0.0% mom, 1.8% yoy in Sep

US PPI for final demand was unchanged for the month in September, below expectation of 0.1% mom rise. PPI services rose 0.2% mom but PPI goods fell -0.2% mom. PPI less foods, energy, and trade services rose 0.1% mom.

For the 12-month period, PPI rose 1.8% yoy, down from prior 1.9% yoy, but above expectation of 1.8% yoy. PPI less foods, energy, and trade services rose 3.2% yoy.

Canada’s employment grows 46.7k in Sep, unemployment rate falls to 6.5%

Canada’s employment grew 46.7k in September, above expectation of 34.5k. Full-time employment rose 112k or 0.7% mom, largest gain since March 2022. Part-time work fell -65k or -1.7%.

Unemployment rate fell from 6.6% to 6.5% better than expectation of 6.6%. Participation rate fell -0.2% to 64.9%. Total hours worked, however, fell -0.4% mom. Average hourly wages rose 4.6% yoy, slowed from 5.0% yoy.

UK GDP grows 0.2% mom in Aug, matches expectations

UK GDP grew 0.2% mom in August, matched expectations. Services output grew by 0.1% mom. Production output grew by 0.5% mom. Construction output grew by 0.4% mom.

In the three months to August compared with the three months to May, GDP grew 0.2%. Service output rose 0.1%. Production output showed no growth. Construction output rose 1.0%.

New Zealand BNZ PMI rises to 46.9, but stays in contraction for 19th month

New Zealand’s BusinessNZ Performance of Manufacturing Index rose slightly from 46.1 to 46.9 in September, marking the third consecutive month of improvement. Despite this, the sector remains in contraction for the 19th straight month, with the index still well below the long-term average of 52.6.

Catherine Beard, Director of Advocacy at BusinessNZ, highlighted that while it’s positive to see the highest PMI result since April, the sector faces a “long and slow road” to recovery.

The components painted a mixed picture: production improved from 46.6 to 48.0, while employment dipped slightly from 46.8 to 46.6. New orders also inched higher from 47.3 to 47.8, but deliveries fell further from 45.8 to 45.6.

Negative sentiment among respondents is gradually improving, with 63.5% expressing pessimism in September, down from 64.2% in August and significantly lower than the 76.3% seen in June. The main concerns continue to revolve around weak demand, with many businesses citing a lack of orders and sales as key issues.

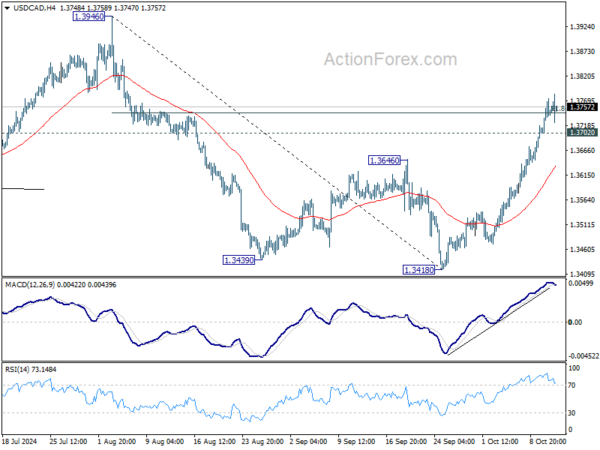

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3695; (P) 1.3735; (R1) 1.3782; More…

Outlook in USD/CAD is unchanged and intraday bias stays on the upside for the moment. Sustained trading above 61.8% retracement of 1.3946 to 1.3418 at 1.3559 will extend the rise from 1.3418 to 1.3946 high again. On the downside, below 1.3702 minor support will turn intraday bias neutral first.

In the bigger picture, sideway consolidation pattern from 1.3976 (2022 high) might still extend further. While another decline cannot be ruled out, strong support should emerge above 1.2947 resistance turned support to bring rebound. Rise from 1.2005 (2021 low) is still in favor to resume at a later stage.