Dollar is broadly stronger today, though the momentum behind the move is not particularly robust. Markets are awaiting insights from several Fed officials and the release of September FOMC minutes later in the US session. While Fed’s direction on monetary easing is well understood, the pace of future rate cuts remains uncertain and is unlikely to be definitively answered by today’s minutes.

At present, Fed funds futures suggest an 86.6% likelihood of a 25bps rate cut at the November meeting, with a slim 13.4% chance of no change. However, these probabilities could be significantly altered by tomorrow’s US CPI report. While today’s FOMC minutes are important, the inflation data is expected to carry much more weight in shaping near-term expectations about Fed’s next steps.

So far this week, Dollar is currently the strongest currency, followed by Swiss Franc and Yen. On the other end, Kiwi has been the weakest, trailed by Aussie and Canadian Dollar. It should be noted that, Dollar, Euro, Sterling, Swiss Franc, and Yen are holding within last week’s ranges against each other. Commodity currencies, on the other hand, have broken to the downside. It’s more about risk aversion for now.

The direction of Aussie and Kiwi will largely depend on upcoming developments in Asia, particularly in China and Hong Kong. The markets were left unimpressed by the lack of concrete stimulus measures from China’s National Development and Reform Commission earlier this week. Attention is now shifting to a press conference from China’s finance ministry, expected on Saturday, where more fiscal stimulus could be announced.

Technically, HSI is now eyeing a key cluster support level at around 20k mark. There lies 38.2% retracement of 14794.16 to 23241.75 at 20014.76, and 19706.12 resistance turned support is not far away. Strong bounce from this zone will keep near term outlook bullish for another rise through 23241.74 at a later stage. However, decisive break of 20k mark would sign that whole rise from this year’s low at 14794.16 might be over.

In Europe, at the time of writing, FTSE is up 0.13%. DAX is up 0.14%. CAC is up 0.22%. UK 10-year yield is down -0.011 at 4.176. Germany 10-year yield is down -0.003 at 2.247. Earlier in Asia, Nikkei rose 0.87%. Hong Kong HSI fell -1.38%. China Shanghai SSE fell -6.62%. Singapore Strait Times rose 0.56%. Japan 10-year JGB yield rose 0.0076 to 0.934.

In Europe, at the time of writing, FTSE is up 0.13%. DAX is up 0.14%. CAC is up 0.22%. UK 10-year yield is down -0.011 at 4.176. Germany 10-year yield is down -0.003 at 2.247. Earlier in Asia, Nikkei rose 0.87%. Hong Kong HSI fell -1.38%. China Shanghai SSE fell -6.62%. Singapore Strait Times rose 0.56%. Japan 10-year JGB yield rose 0.0076 to 0.934.

ECB’s Kazaks reaffirms call for further rate cuts

ECB Governing Council member Martins Kazaks reiterated his support for lowering interest rates further, pointing to the ongoing economic weakness in the Eurozone.

Speaking during a webcast, Kazaks emphasized the need for continued monetary easing, suggesting that rates should be adjusted step by step.

“If inflation in the next year really returns to a sustainable 2%, interest rates have to be on a neutral level,” he said.

ECB’s Kazimir not completely convinced on Oct rate cut

ECB Governing Council member Peter Kazimir struck a cautious tone today, signaling that while a rate cut next week is possible, he remains “not completely convinced” that ECB should move based on just one positive inflation reading.

Speaking to reporters, Kazimir acknowledged that September’s CPI dip below 2% for the first time since 2021 has fueled expectations of a rate cut, but he emphasized the need for a more comprehensive view of the economic data. “And we’ll have that key information in December,” he added

He also downplayed concerns about the risk of inflation undershooting the 2% target, stating, “I definitely don’t wake up in a sweat thinking that the inflation rate should be well below 2%.”

“On the contrary, we still lack sufficient confidence that we’re out of the woods and that the goal of sustainably being at 2% is entirely realistic,” he warned.

ECB’s Villeroy signals likely rate cut next week, more to follow gradually

ECB Governing Council member François Villeroy de Galhau indicated today that a rate cut is “very probable” at the upcoming meeting next week.

Speaking on Franceinfo radio, Villeroy emphasized that this move “won’t be the last” in the current easing cycle. However, he added that the pace of future cuts will depend on how inflation evolves over time.

Villeroy stressed ECB’s commitment to gradual policy adjustments, saying the central bank will avoid making any “volatile moves.” He remarked, “We are used to acting with gradualism, which means resolutely but without making too significant steps.”

On inflation, Villeroy expressed confidence that price levels will stabilize at ECB’s 2% target by early next year in France, and later in 2025 across Europe. However, he noted that fluctuations could still occur in the coming months.

RBNZ cuts rates by 50bps, citing weak economic conditions and excess capacity

As widely expected, RBNZ cut its Official Cash Rate by 50bps to 4.75%. In its accompanying statement, the central bank emphasized that this move was deemed “appropriate” to achieve and maintain low, stable inflation while minimizing “unnecessary instability” in output, employment, interest rates, and the exchange rate.

RBNZ highlighted that economic activity in New Zealand remains “subdued,” with both business investment and consumer spending showing signs of weakness. Employment conditions are also softening, and low productivity growth is acting as a further constraint on activity.

The central bank pointed out that the economy is now in a state of “excess capacity,” which is encouraging adjustments in price- and wage-setting behavior, aligning with a low-inflation environment. Falling import prices are aiding the disinflation process.

Additionally, RBNZ noted that despite the rate cut, OCR of 4.75% is still “restrictive” and leaves monetary policy well-positioned to handle any near-term surprises.

EUR/USD Mid-Day Outlook

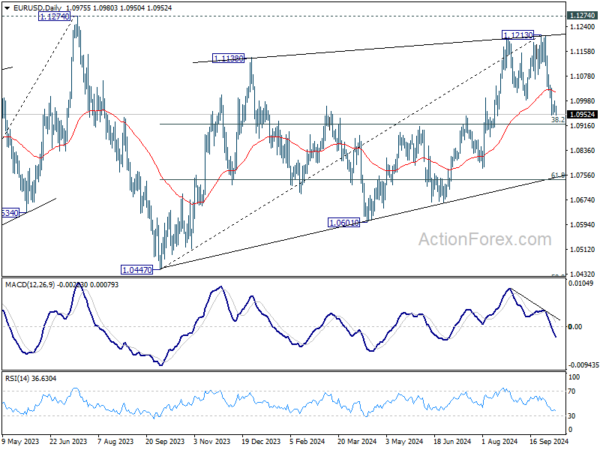

Daily Pivots: (S1) 1.0962; (P) 1.0980; (R1) 1.0998; More….

EUR/USD dips mildly today but stays above 1.0950 temporary low. Intraday bias remains neutral at this point. Further decline is expected as long as 1.1043 resistance holds. Below 1.0950 will target 38.2% retracement of 1.0447 to 1.1213 at 1.0920. Sustained break there will argue that fall from 1.1213 is the third leg of the corrective pattern from 1.1274. In this case, deeper decline would be seen to 61.8% retracement at 1.0740 next.

In the bigger picture, rejection by 1.1274 resistance suggests that corrective pattern from 1.1274 (2023 high) is not completed yet. Instead, decline from 1.1213 might be another falling leg. Sustained break of 55 W EMA (now at 1.0877) will validate this case, and bring deeper fall towards 1.0447 support again.