Hong Kong markets experienced another day of intense volatility, with benchmark HSI plunging over -5% during the morning session as traders rushed to lock in profits from the recent rally. The sell-off came as disappointment spread among investors after China’s National Development and Reform Commission failed to deliver concrete details on further stimulus measures, following weeks of anticipation. China’s stock market, which reopened after the Golden Week holiday, initially surged by more than 10%, but momentum fizzled, leaving gains halved by the session’s end.

The state planner’s chairman, Zheng Shanjie, made several pledges to support the struggling property market and bolster domestic demand. However, the market’s reaction turned sour as the announcement lacked significant new stimulus initiatives. A senior official added that a CNY 100B investment plan for 2025 would be unveiled by the end of this month, but that reassurance fell short of calming investor concerns. Without fresh, larger-scale measures, sentiment remains fragile.

Australian Dollar was notably hit in the wake of the risk-off mood, leading declines across commodity currencies. Despite positive domestic data showing strong rebound in consumer sentiment and improving business confidence, the Aussie couldn’t escape the regional downturn. RBA’s meeting minutes also confirmed that the central bank was not yet close to considering a rate cut. However, optimism around domestic fundamentals was easily overshadowed by the souring risk sentiment across Asia, pulling the Aussie lower.

In the currency markets, Euro stood out as the strongest performer for the day so far, followed by Yen and British Pound, as investors shifted away from riskier assets. Dollar was on the softer side, with traders taking a more cautious stance ahead of key US inflation data later this week. Overall, the focus was primarily on selling off commodity-linked currencies amid the risk aversion.

Technically, US 10-year yield extended the rebound from 3.603 and closed above 4% mark overnight. For now, further rally is expected as long 55 D EMA (now at 3.885) holds. Next target is 38.2% retracement of 4.997 to 3.603 at 4.135. Strong resistance could be seen there to limit upside, at least first attempt. However, decisive break there will affirm that whole correction from 4.997 has completed with three wave down to 3.603. This development would have bullish implications for yields and will be a focal point as US CPI data release approaches this week.

In Asia, at the time of writing, Nikkei is down -1.25%. Hong Kong HSI is down -5.58%. China Shanghai SSE is up 4.81%. Singapore Strait Times is flat. Japan 10-year JGB yield is up 0.004 at 0.930. Overnight, DOW fell -0.94%. S&P 500 fell -0.96%. NASDAQ fell -1.18%. 10-year yield rose 0.045 to 4.026.

RBA minutes: Inflation vigilance remains key focus

Minutes from RBA’s September meeting revealed the consensus to keep the cash rate unchanged, as members felt there had been no significant changes since the previous meeting to justify a shift in policy.

Members discussed scenarios that could lead to policy being “held restrictive for a prolonged period or tightened further”. One scenario involved stronger-than-expected “consumption growth”, driven by rising household disposable income. Another involved more “constrained” than expected “aggregate supply” outlook. Financial conditions could turn out to be “insufficiently restrictive”.

Conversely, they acknowledged scenarios where policy could become less restrictive, such as the economy proved to be “significantly weaker than expected”. Or, “inflation proved less persistent than assumed”, even without significant economic weakness.

The board reiterated their vigilance to “upside risks to inflation” and emphasized that policy will remain sufficiently restrictive until inflation is clearly moving toward target. They reiterated that future rate changes could not be “ruled in or ruled out” based on current data, leaving the door open for adjustments if necessary.

Australian Westpac consumer sentiment hits 2.5-year high as rate hike fears ease

Australia’s Westpac Consumer Sentiment surged by 6.2% yoy in October to 89.8, marking the highest reading since RBA began its tightening cycle two and a half years ago.

Westpac noted that consumer sentiment has been buoyed by interest rate cuts overseas and improving inflation conditions domestically. “Consumers are no longer fearful that the RBA could take interest rates higher,” Westpac commented.

In particular, the Mortgage Rate Expectations Index, which tracks expectations for variable mortgage rates over the next 12 months, saw a significant drop of -14.1% mom to 106.4. The index has now declined by one-third since July, as households feel less pressure from future rate increases.

Westpac anticipates that RBA’s cash rate target will remain unchanged for the rest of the year. While Q3 CPI data, due on October 30, is expected to show inflation tracking lower, it may not be enough for RBA to “shift to an explicit easing bias” at the November meeting. However, Westpac believes the Board could begin easing its “hawkish hold” and adopt a more neutral policy stance as inflation pressures show signs of abating.

Australia’s NAB business confidence improves to -2, inflation pressures still high despite easing costs

Australia’s NAB Business Confidence improved in September, rising from -5 to -2. Business conditions also increased from 4 to 7, with key components such as trading conditions rising from 8 to 12, profitability up from 2 to 5, and employment conditions also climbing from 1 to 5.

A key positive development was the continued easing in input cost pressures. Labour cost growth slowed to 1.7% in quarterly equivalent terms, down from 1.8% in August. Purchase cost growth eased to 1.2%, from 1.6%.

NAB’s Head of Australian Economics, Gareth Spence, noted that while business conditions have been trending lower over the past 24 months due to slower economic growth, capacity utilization remains significantly above its long-run average.

Spence remarked, “This remains an important dynamic for the RBA where, despite slow growth, inflation remains too high, suggesting that the balance of supply and demand in the economy is yet to fully normalize.”

Japan’s real wages fall -0.6% yoy in Aug as inflation outpaces wage growth

Japan’s real wages declined by -0.6% yoy in August, marking the first drop in three months. Nominal wages rose for the 32nd consecutive month, increasing by 3.0% yoy, slightly missed market expectations of 3.1% .

The wage growth was not enough to offset inflationary pressures. The CPI used to calculate real wages, which includes fresh food prices but excludes owners’ equivalent rent, surged by 3.5% yoy in August, the highest increase since October 2023.

On a positive note, base wages (excluding bonuses and overtime) saw a significant 3.0% yoy increase, the largest rise in nearly 32 years. Overtime pay grew by 2.6% yoy. However, these gains were still outpaced by inflation.

In other data, household spending fell -1.9% yoy in August, but the decline was less severe than the market’s expected drop of -2.6%.

Fed’s Musalem urges patience as Kashkari flags shifting balance of risks

In a speech overnight, St. Louis Fed President Alberto Musalem noted last week’s employment report, despite exceeding expectations, did not prompt him to alter his baseline outlook for the economy. He added that both inflation and the labor market are currently in a “good place,” with risks to the Fed’s dual mandate—price stability and full employment—”roughly balanced.”

Nevertheless, Musalem expressed caution, arguing that the “costs of easing too much too soon” would outweigh the risks of easing too little. He added that should maintain its approach of “gradual reductions” in interest rates over time, highlighting that “patience” has been key to Fed’s progress on inflation. He maintained that this approach “has served the FOMC well” but was careful not to commit to any specifics regarding the size or timing of future rate cuts.

Separately, Minneapolis Fed President Neel Kashkari echoed Musalem’s sentiment regarding the resilience of the labor market, noting, “It looks like it is still a strong labor market.”

Kashkari acknowledged that traditionally, Fed’s aggressive rate hikes would have led to more significant weakness in employment, but so far, that hasn’t materialized. “We have not seen that, so that’s a really good fact that the job market has stayed strong while inflation has come down,” Kashkari said.

However, Kashkari did caution that the balance of risks is now shifting “away from higher inflation towards maybe higher unemployment”.

ECB’s Cipollone sees slower growth and faster inflation deceleration

ECB Executive Board member Piero Cipollone suggested in an interview that growth may come in “a little bit slower” than previously expected. Weak PMI data is also raising concern. The “signals coming from the real side of the economy are a little bit weak”, he added.

Cipollone also noted that inflation is “decelerating faster” than anticipated. “So we will get all this information and reassess the situation on the next monetary policy meeting,” he said.

Separately, Governing Council member Robert Holzmann emphasized that, while inflation is “on the right track,” core inflation remains problematic. He attributed much of the recent inflation drop to lower energy costs but warned that the underlying inflation picture still “doesn’t look so good.” Holzmann, who backed the September rate cut, cautioned against assuming that further rate cuts are imminent.

Looking ahead

Germany industrial production and France trade balance will be released in European session. Later in the day, both the US and Canada will publish trade balance too.

EUR/AUD Daily Outlook

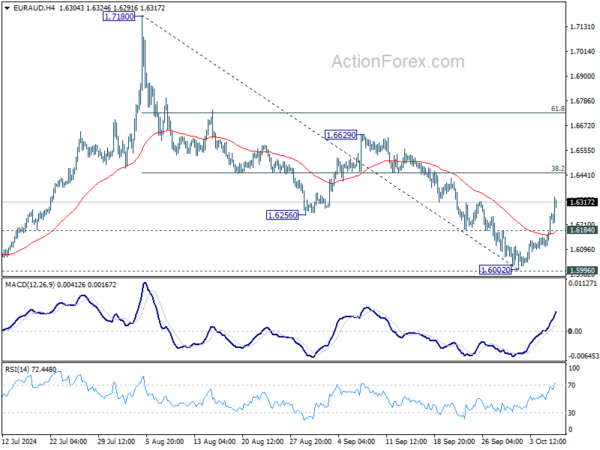

Daily Pivots: (S1) 1.6144; (P) 1.6204; (R1) 1.6302; More…

EUR/AUD’s strong break of 1.6184 resistance confirms short term bottoming at 1.6002, after defending 1.5996 support. Intraday bias is back on the upside for 38.2% of 1.7180 to 1.6002 at 1.6452. Decisive break there will strengthen the case that whole corrective fall from 1.7180 has completed with three waves down to 1.6002. Further rally should then be seen to 61.8% retracement at 1.6730 next.

In the bigger picture, as long as 1.5996 support holds, up trend from 1.4281 (2022 low) is still expected to resume at a later stage. However, decisive break of 1.5996 will argue that the medium term trend has reversed and turn outlook bearish.