Risk sentiment is a little bit subdued as US futures trade in the red ahead of North American session. Yen is recovering broadly, partly supported by Japan’s renewed verbal intervention efforts, with traders closely monitoring the possibility of action if USD/JPY breaches 150 psychological level. Swiss Franc and Dollar are also on the firmer side. On the other hand, Sterling, Kiwi and Loonie are the weaker ones. Meanwhile, Euro and Aussie are mixed in the middle.

Looking ahead, the upcoming Asian session will focus on the release of the RBA minutes, Australia’s Westpac consumer sentiment, and NAB business confidence data. Speculation continues around the timing of the first rate cut by the RBA, with three of the country’s four major banks—Westpac, ANZ, and NAB—forecasting a February cut next year. Commonwealth Bank remains the outlier, predicting a rate cut as early as December. Any sharp deterioration in consumer and business sentiment could prompt a rethink by the RBA. However, the key indicator will still be Q3 CPI data, set to be released on October 30.

Aussie has been in a mixed path this month, outperforming Kiwi, but lagging behind Loonie. Technically, As long as 0.9195 resistance turned support holds, rise from 0.8562 is still expected to continue through 0.9375 at a later stage. However, firm break of 0.9195 will open up deeper pullback to 0.9016 support, or even further to medium term channel support (now at 0.8912).

In Europe, at the time of writing, FTSE is up 0.48%. DAX is down -0.04%. CAC is up 040%. Germany 10-year yield is up 0.037 at 2.251. UK 10-year yield is up 0.071 at 4.203. Earlier in Asia, Nikkei rose 1.80%. Hong Kong HSI rose 1.60%. China was on the last day of holidays. Singapore Strait Times rose 0.28%. Japan 10-year JGB yield rose 0.040 to 0.926.

Eurozone Sentix rises to -13.8, expectations jump on ECB cut and China stimulus

Eurozone Sentix Confidence Improves Slightly, Expectations Rise Amid Stimulus and Rate Cuts

Eurozone Sentix Investor Confidence edged up in October, rising from -15.4 to -13.8, slightly better than the forecast of -13.9. Current Situation Index saw its fourth consecutive decline, down from -22.5 to -23.3, its lowest level since December 2023. Expectations Index improved notably from -8.0 to -3.8.

Sentix remarked, “The downward economic trend has been halted for the time being,” as Eurozone economy attempts to “find its way out of recession/stagnation”. Investors are finding renewed optimism, not only due to ECB’s recent rate cuts but also the stimulus measures coming out of China.

The Sentix central bank theme barometer remains supportive, although it has pulled back from the higher levels seen last month. This more moderate outlook is tied to expectations that inflation declines will slow.

Eurozone retail sales rise 0.2% mom in Aug, EU up 0.3%…

Eurozone retail sales volume rose 0.2% mom in August, matched expectations. The increase was driven by a 0.2% rise in food, drinks, and tobacco sales, a 0.3% boost in non-food products (excluding automotive fuel), and a 1.1% jump in sales of automotive fuel from specialised stores.

In the wider EU, retail sales grew by 0.3% month-on-month. Luxembourg led the gains with a 5.3% increase in total retail trade volume, followed by Cyprus at 2.2% and Romania at 1.6%. On the downside, Denmark saw the steepest drop at -1.5%, while Slovakia, Bulgaria, and Croatia also posted declines in retail trade volume.

BoJ upgrades economic outlook for two regions, cautions on wage pressures for small firms

In its latest Regional Economic Report, BoC indicated that all nine regions in the country are “recovering moderately, picking up, or picking up moderately”. Also, BoJ upgraded its economic assessments for the Hokuriku and Tokai regions, reflecting stronger local conditions.

In a separate release summarizing discussions among branch managers, BoJ noted that many business leaders increasingly believe wages need to continue rising into next year. This reflects growing wage pressure, which has been a key driver of consumption. Younger workers, in particular, have seen “fairly big pay hikes”, boosting their spending power and supporting the broader economy.

However, the central bank cautioned that smaller and medium-sized businesses are struggling to generate sufficient profits to sustain wage hikes. BoJ emphasized that this situation “required vigilance.”

NZIER shadow board evenly split on size of RBNZ rate cut this week

The NZIER Shadow Board is evenly divided on whether RBNZ should lower the OCR by 25 or 50 basis points in its upcoming meeting this week.

Those advocating for a 50bps cut highlighted ongoing economic weakness and rising excess capacity, as well as easing headline inflation and inflation expectations, which they believe justify a larger reduction in rates.

Other members preferred a more cautious 25bps cut, citing persistent risks from non-tradable inflation and recommending a more measured approach.

Looking ahead, the Shadow Board agrees that RBNZ should continue with its easing cycle over the next year, with most members expecting OCR to settle between 3.5% and 4.5%.Some members urged a gradual, data-driven approach, while others argued for more rapid cuts, pointing to weak economic conditions that may require further stimulus.

GBP/USD Mid-Day Outlook

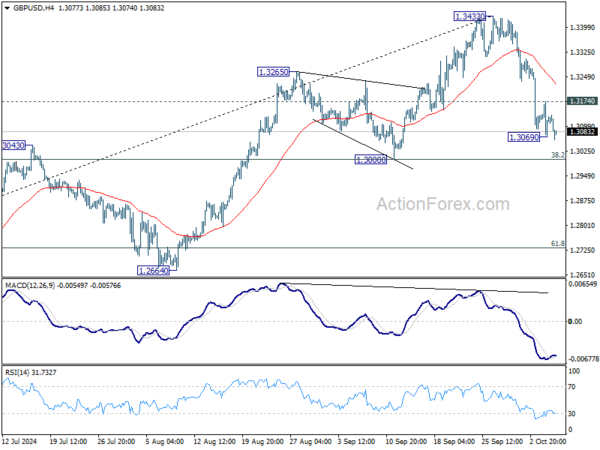

Daily Pivots: (S1) 1.3072; (P) 1.3123; (R1) 1.3177; More…

Intraday bias in GBP/USD is back on the downside with breach of 1.3069 temporary low. Fall from 1.3433 is in progress for 1.3000 cluster support (38.2% retracement of 1.2298 to 1.3433 at 1.2999). Strong support should be seen there to bring rebound. On the upside, above 1.3174 minor resistance will turn intraday bias neutral again first.

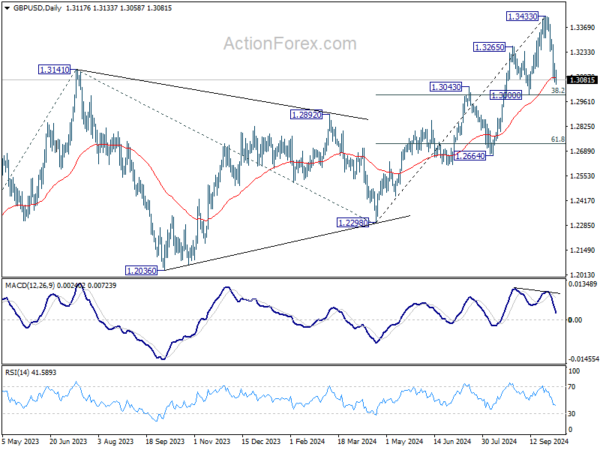

In the bigger picture, as long as 1.3000 support holds, the up trend from 1.0351 (2022 low) is still in progress. Next target is 61.8% projection of 1.0351 to 1.3141 from 1.2298 at 1.4022. However, considering mild bearish divergence condition in D MACD, decisive break of 1.3000 will argue that a medium term top is already in place, and bring deeper fall back to 1.2664 support next.