- USDJPY holds below key resistance levels as October’s session starts

- Technical signals cannot warrant a bullish trend reversal

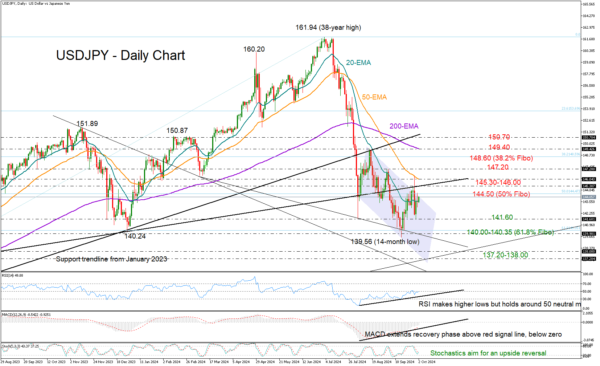

USDJPY had a lackluster beginning to October, with a neutral close around its 20-day EMA and previously a rejection near the 50% Fibonacci retracement of the 2023-2024 upleg at 144.50.

Currently, the pair is attempting to reach the 144.50 territory again, but there may be more hurdles to overcome. Another challenge could emerge somewhere between the broken support trendline at 145.30 and the 50-day EMA at 146.00, while higher, the bulls may face a wall near September’s high of 147.20. If the latter proves easy to overcome, the spotlight might next shift to the 38.2% Fibonacci mark of 148.60 and then towards the 200-day EMA at 149.40.

Should the bears take control once more and push the price below its 20-day EMA at 143.60, there is a possibility of a new downward movement towards the 141.60 floor. Breaking lower, the pair could initially seek shelter around the critical 61.8% Fibonacci area of 140.35 and the 140.00 psychological mark. A failure to bounce back may result in a significant sell-off towards the 137.20-138.00 area, which was last seen in July 2023.

While trend signals are stagnant, there is encouraging movement in technical indicators like the RSI and MACD, indicating bullish divergence. Yet, an imminent upside reversal in the price cannot be warranted as long as the RSI is still around its 50 neutral mark and the latter is hovering below zero.

Overall, the short-term outlook for USDJPY is not favorable. For the pair to resume its previous upward trajectory, it must successfully climb sustainably above 150.70. On the downside, a close below 140.00 could further worsen the bearish trend.