Euro surges broadly today as supported by solid economic data that supports ECB’s tapering plan next year. Growth in Germany was particularly impressive. Technically, EUR/USD’s strong break of 1.1689 resistance now indicates near term reversal. And more upside would likely be seen back to 1.18 level. Euro’s strength also helps lift its cousin Swiss Franc, which follows as the second strongest one. On the other hand, Sterling remains one of the weakest as CPI was unchanged at a five year high but didn’t accelerate. Both Dollar and Yen are also struggling.

Eurozone GDP Solid, Germany and Italy accelerated

Eurozone GDP grew 0.6% qoq in Q3, in line with consensus and maintained same pace as prior quarter. German GDP grew more than expected by an impressive 0.8% qoq, up from 0.6% in Q2, beat consensus at 0.6% qoq. The steam engine of Eurozone is now on track for the best year since 2011. Italy GDP grew 0.5% qoq, up from Q2’s 0.3%, in line with consensus. Eurozone industrial production dropped -0.6% mom in September. German CPI was finalized at 1.6% yoy in October. Also from Europe, Swiss PPI rose 0.5% mom, 1.2% yoy in October.

ZEW: Prospects remain encouragingly positive

German ZEW economic sentiment rose to 18.7 in November, up from 17.6 but missed expectation of 19.5. Current situation gauge rose to 88.8, up from 87.0 and beat expectation of 88.0. Eurozone ZEW economic sentiment rose to 30.9, up from 26.7 and beat expectation of 30.9. ZEW President Achim Wambach noted in the release that "the prospects for the German economy remain encouragingly positive. Overall high levels of growth across Europe in the third quarter are supporting further growth in Germany and boosting expectations for the coming six months. This favorable economic climate should be used to create a stronger and more robust basis for future growth."

Draghi, Yellen, Carney, Kuroda speak at ECB conference

Speaking in a ECB conference in Frankfurt, ECB President Mario Draghi declared that "forward guidance" is a success and has now "become a full-fledged monetary policy instrumental". Still-Fed chair Janet Yellen also said that forward guidance is useful but "all guidance should be conditional and related to the outlook for the economy. Yellen also said that Fed could be confusing the public with the voices of so many officials and "this is really one of the challenges of our system". BoJ Governor Haruhiko Kuroda urged policy makers to communicate and explain in a straightforward manner to the public. BoE Governor Mark Carney urged a reasonable transition period post Brexit.

UK CPI didn’t accelerate in October

UK headline CPI was unchanged at five year high of 3.0% yoy in October, below expectation of 3.1%. Core CPI was also unchanged at 2.7% yoy, below expectation of 2.8% yoy. RPI accelerated to 4.0% yoy, below expectation at 4.1% yoy. PPI input slowed to 4.6% yoy versus expectation of 4.7% yoy. PPI output slowed to 2.8% yoy versus expectation at 3.3% yoy. PPI output core slowed to 2.1% yoy, below expectation of 2.2% yoy. House price index rose 5.4% yoy in September, above expectation of 5.2% yoy.

Chicago Fed Evans advocates price-level targeting

Chicago Fed President Charles Evans called for a new approach in setting interest rates. One option that becomes handy during time that interest rates alone are not enough to responds to market shock is "price-level targeting". This echoes comments from San Francisco Fed President John Williams, who also embraced price-level targeting. The key idea is that inflation would be allowed to run high for a period of time in situation when inflation is too low. Evan’s main message is that "we should be planning for these inevitable future situations today."

Dallas Fed President Robert Kaplan said he is "actively considering" to vote for another rate hike in December. He said in an interview that "history has shown that normally when we have a substantial overshoot the Fed ultimately needs to take actions to play catch-up". For now, unemployment rate at 17 year low in October required additional vigilance.

Released from US, PPI accelerated to 2.8% yoy in October, above expectation of 2.3%. PPI core accelerated to 2.4% yoy, above expectation of 2.2% yoy.

Australia NAB: Better than expected performance for the economy ahead

In Australia, NAB business conditions jumped 7 points to 21 in October, hitting the highest level the series began back in 1997. It’s also nearly four times the historical average. Business confidence, on the other hand, was unchanged at 8. NAB chief economist Alan Oster noted that "this is an extremely strong result and of itself would suggest a better than expected performance for the economy." However, he also warned that "it is unclear just how long conditions can remain at these record levels given that the result was driven by a surprise jump in manufacturing, while some of the leading indicators such as forward orders – which have been giving a more accurate read on the strength of the economy – have actually softened a little in recent months."

Bond yields jump in China

Notwithstanding disappointing headlines, China’s economic activities and credit conditions in October were a result of the government’s regulatory tightening and the "neutral and prudent" monetary policy with a tighter bias. China’s 10 year yields jumped to a 3-year high, approaching 4%, while 5-year yields breached 4% the first time in over 3 years, on Tuesday.

The surge in yields can be attributed to a confluence of factors, including a selloff of sovereign bonds after softer-than-expected macroeconomic data and a reflection of tightened liquidity in the financial system. However, we believe the most critical factor is the rallies in US yields, on expectations of a December rate hike, and UK yields, amidst BOE’s rate hike earlier this month.

Released today, retail sales rose 10.0% yoy in October, below expectation of 10.5% and slowed from prior 10.3% yoy. Fixed asset investment rose 7.3% yoy, inline with expectation but slowed from prior 7.5% yoy. Industrial production rose 6.2% yoy, meeting consensus but also slowed from prior 6.6 yoy.

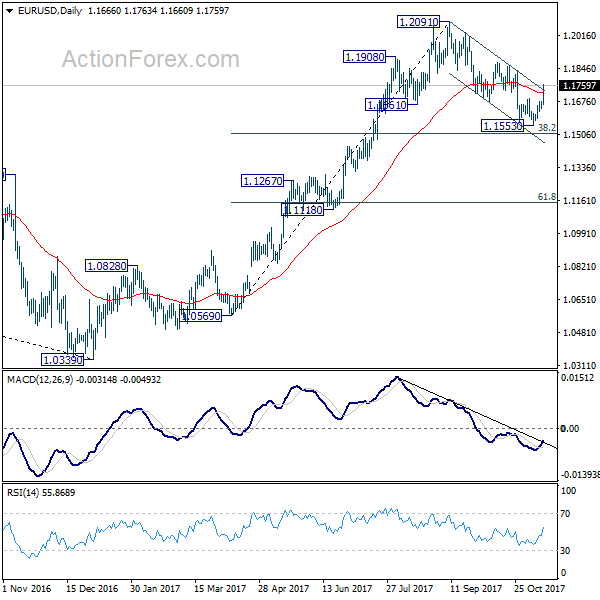

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1584; (P) 1.1631 (R1) 1.1708; More…

EUR/USD surges to as high as 1.1759 so far today. The strong break of 1.1689 minor resistance and near term falling channel indicates the correction from 1.2091 has completed at 1.1553 already. Intraday bias is now back on the upside for 1.1836 resistance first. Break there will pave the way to retest 1.2091 high. On the downside, below 1.1689 resistance turned support will turn bias back to the downside for 1.1553 low instead.

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be cautious on 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1346) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | NAB Business Confidence Oct | 8 | 7 | 8 | |

| 02:00 | CNY | Retail Sales Y/Y Oct | 10.00% | 10.50% | 10.30% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Oct | 7.30% | 7.30% | 7.50% | |

| 02:00 | CNY | Industrial Production Y/Y Oct | 6.20% | 6.20% | 6.60% | |

| 07:00 | EUR | German GDP Q/Q Q3 P | 0.80% | 0.60% | 0.60% | |

| 07:00 | EUR | German CPI M/M Oct F | 0.00% | 0.00% | 0.00% | |

| 07:00 | EUR | German CPI Y/Y Oct F | 1.60% | 1.60% | 1.60% | |

| 08:15 | CHF | Producer & Import Prices M/M Oct | 0.50% | 0.20% | 0.50% | |

| 08:15 | CHF | Producer & Import Prices Y/Y Oct | 1.20% | 0.80% | ||

| 09:00 | EUR | Italian GDP Q/Q Q3 P | 0.50% | 0.50% | 0.40% | 0.30% |

| 09:30 | GBP | CPI M/M Oct | 0.10% | 0.20% | 0.30% | |

| 09:30 | GBP | CPI Y/Y Oct | 3.00% | 3.10% | 3.00% | |

| 09:30 | GBP | Core CPI Y/Y Oct | 2.70% | 2.80% | 2.70% | |

| 09:30 | GBP | RPI M/M Oct | 0.10% | 0.20% | 0.10% | |

| 09:30 | GBP | RPI Y/Y Oct | 4.00% | 4.10% | 3.90% | |

| 09:30 | GBP | PPI Input M/M Oct | 1.00% | 0.80% | 0.40% | 0.20% |

| 09:30 | GBP | PPI Input Y/Y Oct | 4.60% | 4.70% | 8.40% | 8.10% |

| 09:30 | GBP | PPI Output M/M Oct | 0.20% | 0.30% | 0.20% | |

| 09:30 | GBP | PPI Output Y/Y Oct | 2.80% | 2.90% | 3.30% | |

| 09:30 | GBP | PPI Output Core M/M Oct | 0.10% | 0.20% | 0.00% | -0.10% |

| 09:30 | GBP | PPI Output Core Y/Y Oct | 2.10% | 2.20% | 2.50% | |

| 09:30 | GBP | House Price Index Y/Y Sep | 5.40% | 5.20% | 5.00% | |

| 10:00 | EUR | Eurozone Industrial Production M/M Sep | -0.60% | -0.60% | 1.40% | |

| 10:00 | EUR | German ZEW Economic Sentiment Nov | 18.7 | 19.5 | 17.6 | |

| 10:00 | EUR | German ZEW Current Situation Nov | 88.8 | 88 | 87 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Nov | 30.9 | 29.3 | 26.7 | |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | 0.60% | 0.60% | 0.60% | |

| 13:30 | USD | PPI M/M Oct | 0.40% | 0.10% | 0.40% | |

| 13:30 | USD | PPI Y/Y Oct | 2.80% | 2.30% | 2.60% | |

| 13:30 | USD | PPI Core M/M Oct | 0.40% | 0.20% | 0.40% | |

| 13:30 | USD | PPI Core Y/Y Oct | 2.40% | 2.20% | 2.20% |