Euro declined broadly today after ECB Governing Council member Olli Rehn became the first official to openly indicate that risks are now tilted toward another rate cut in October. Additionally, data showed that Eurozone’s headline CPI fell below the ECB’s 2% target for the first time since 2021, even though core inflation remains elevated.

A 25 bps cut at this month’s ECB meeting is now nearly fully priced in, with major banks forecasting this outcome too. Market focus is also shifting to actions beyond October, with Deutsche Bank considering a 50 bps cut in December a close call.

Meanwhile, Dollar is gaining momentum, continuing to build on Fed Chair Jerome Powell’s comments from yesterday. While Powell acknowledged that additional rate cuts are forthcoming, he emphasized there is no hurry to proceed with rapid policy easing. Robust ISM data and non-farm payroll figures due this week could reinforce expectations that Fed will opt for only a 25 bps cut in November.

In the currency markets, Japanese Yen remains the weakest performer for the week so far, but the gap is narrowing as it rebounds following declines in US and European yields. Swiss Franc is the second weakest, with Euro potentially overtaking it. Australian Dollar remains the strongest, buoyed by optimism in Chinese markets. Dollar is now the second strongest, followed by the Canadian Dollar, while New Zealand Dollar and British Pound are positioned in the middle.

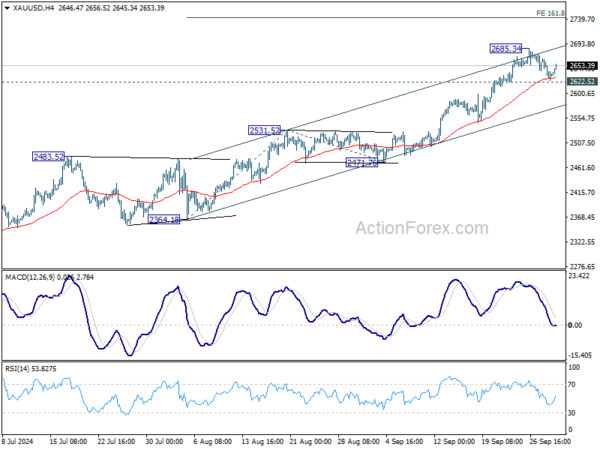

Technically, Gold’s bounce today argues that pullback from 2685.34 has completed ahead of 2622.52 support, and that keeps near term outlook bullish. Break of 2685.34 will resume the long term up trend. Next target is 161.8% projection of 2364.18 to 2531.52 from 2471.76 at 2742.51.

In Europe, at the time of writing, FTSE is up 0.38%. DAX is up 0.59%. CAC is up 0.11%. UK 10-year yield is down -0.065 at 3.942. Germany 10-year yield is down -0.081 at 2.048. Earlier in Asia, Nikkei rose 1.93%. Japan 10-year JGB yield fell -0.0041 to 0.853. Singapore Strait Times fell -0.12%. Hong Kong and China were on holiday.

ECB’s Rehn sees growing case for Oct rate cut

ECB Governing Council member Olli Rehn suggested today that slowing inflation and weaker growth prospects in Eurozone has provided “more grounds” for another rate cut at the October meeting.

Additionally, Rehn pointed to the “prevailing headwinds” facing economic growth in the Eurozone, noting that these challenges “tilt the scales” toward a more accommodative policy stance.

He also cautioned that it is too early to declare a “soft landing” for the economy, as risks to growth remain prominent.

Rehn repeated ECB’s data-driven approach, adding, “let’s follow the figures closely and make a comprehensive analysis before making decisions, as always.”

Eurozone CPI falls to 1.8% in Sep, CPI core down to 2.7%

Eurozone CPI fell from 2.2% yoy to 1.8% yoy in September, below ECB’s 2% target for the first time since 2021. CPI core (ex-energy, food, alcohol & tobacco), ticked down from 2.8% yoy to 2.7% yoy. Both matched expectations.

Looking at the main components, services is expected to have the highest annual rate in September (4.0%, compared with 4.1% in August), followed by food, alcohol & tobacco (2.4%, compared with 2.3% in August), non-energy industrial goods (0.4%, stable compared with August) and energy (-6.0%, compared with -3.0% in August).

Eurozone PMI manufacturing finalized at 45, output and orders decline

Eurozone’s PMI Manufacturing was finalized at 45.0 in September, down from 45.8 in August, marking a 9-month low and reflecting further deterioration in the region’s manufacturing sector. Germany posted the weakest performance with a 12-month low PMI of 40.6, while Spain led with a 4-month high of 53.0.

According to Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, Eurozone industrial production is expected to decline by around -1% in Q3, with further contractions likely by year-end as new orders continue to fall sharply.

While lower oil and gas prices helped reduce input costs in September, de la Rubia warned that this relief could be temporary given ongoing geopolitical risks in the Middle East, which may lead to another spike in energy prices.

Adding to the challenges, supply-chain disruptions have worsened, despite weakening demand. For the first time since February, businesses reported longer wait times for goods, indicating that geopolitical tensions are affecting both supply chains and production across the Eurozone.

UK PMI manufacturing finalized at 51.5, confidence drops and price pressures rise

UK manufacturing sector expanded at a slower pace in September, with the PMI finalizing at 51.5, down from 52.5 in August.

According to Rob Dobson, Director at S&P Global Market Intelligence, the sector continues to expand at a “solid, albeit slightly slower, pace,” supported by steady domestic demand. However, growing concerns are emerging, as business confidence for the year ahead has dropped to its lowest level in nine months.

The decline in optimism was notable, with only March 2020, just before COVID lockdowns, seeing a sharper fall. Uncertainty surrounding government policy ahead of the Autumn Budget is weighing heavily on sentiment, alongside broader concerns about global geopolitical risks and economic growth risks.

Inflationary pressures have intensified, with input cost inflation reaching a 20-month high. Manufacturers are being forced to raise prices as a result, with rising freight costs cited as a major contributor. Ongoing supply chain disruptions, driven by the Red Sea crisis and global conflicts, are exacerbating these price increases, keeping inflationary pressures elevated across the sector.

BoJ opinions highlight divergence over timing of future rate hikes

The Summary of Opinions from BoJ’s meeting on September 19 and 20 acknowledged that while outlook for Japan’s economic activity and inflation will guide future changes in monetary accommodation, policymakers remain vigilant about developments in overseas economies, particularly the US, and their potential impact on Japan’s financial markets and price stability.

With Yen’s depreciation retracing and import price pressures easing, one view noted that BoJ has “enough time to assess the situation”. Another opinion stressed that Japan’s economy is not at risk of “falling behind the curve” if interest rates are not raised swiftly. BoJ should not raise interest rate when “financial and capital markets are unstable”.

Another member suggested that while price stability has not yet been achieved and uncertainties persist, a shift to “full-fledged monetary tightening” would be undesirable at this stage.

However, a contrasting opinion within the BoJ indicated that if economic conditions remain stable and the outlook is confirmed, it would be preferable for the bank to raise rates “without taking too much time.”

This divergence highlights the ongoing debate within BoJ about the timing of future rate hikes.

Japan’s Q3 Tankan shows stability in manufacturing, slight gains in non-manufacturing

Japan’s Q3 Tankan Large Manufacturing Index remained steady at 13, unchanged from Q2 and in line with market expectations, indicating stability in the country’s manufacturing sector. Manufacturers’ outlook for the next three months improved slightly to 14, signaling cautious optimism about future business conditions.

Large Non-Manufacturers Index showed a modest rise to 34, up from 33 in June, surpassing expectations of 32. However, the outlook for non-manufacturers over the next three months dipped to 28, reflecting some uncertainty in the service and retail sectors.

Capital spending plans by big companies were revised down, with firms now expecting a 10.6% increase for the fiscal year ending in March 2025. This is below the median forecast of an 11.9% rise and down from an 11.1% forecast three months ago, suggesting some cooling in business investment intentions.

The Tankan survey results will be closely monitored by BoJ as it prepares for its monetary policy meeting on October 30-31, where it will set new growth and inflation forecasts.

Japan’s PMI manufacturing PMI finalized at 49.7, output and new orders in contraction

Japan’s Manufacturing PMI for September was finalized at 49.7, marginally lower than August’s reading of 49.8, signaling continued contraction in the sector.

According to Usamah Bhatti from S&P Global Market Intelligence, the data reflected “muted trends” in Japan’s manufacturing industry. Both output and new orders remained in negative territory, while the rate of job creation “slowed to a crawl.”

While businesses expressed optimism about output growth over the next 12 months, the level of optimism softened, marking the weakest positive outlook since the end of 2022. Some manufacturers highlighted concerns over the “timing of a demand recovery,” reflecting cautiousness in the face of global and domestic uncertainties.

Australia’s retail sales rises 0.7% mom in Aug, driven by record warm weather

Australia’s retail sales turnover increased by 0.7% mom in August, surpassing the expected rise of 0.4% mom. On a year-over-year basis, retail sales were up 3.1%. This stronger-than-expected growth was largely attributed to unusually warm weather, which boosted spending on items typically associated with spring.

Robert Ewing, head of business statistics at the Australian Bureau of Statistics (ABS), explained that “this year was the warmest August on record since 1910, which saw more spending on items typically purchased in spring.” Categories that saw increased demand included summer clothing, liquor, outdoor dining, hardware, gardening supplies, camping gear, and outdoor equipment.

NZ business confidence surges as firms anticipate more RBNZ rate cuts

NZIER Quarterly Survey of Business Opinion reveals significant improvement in business confidence in New Zealand during Q3. A net 5% of firms now expect deterioration in general economic conditions, a stark improvement from the net 40% expressing pessimism in the June quarter.

Firms are still facing challenges in demand. A net 31% of businesses reported weaker trading activity. However, looking ahead, only a net 2% of firms expect activity to decline in the next quarter.

This shift in sentiment comes as firms anticipate more supportive economic conditions following RNBZ’s decision to begin cutting interest rates in August, with expectations of further reductions in the coming year.

Cost pressures remained present, with a slight increase in the proportion of firms reporting higher costs. However, pricing power has diminished significantly, with only a net 3% of firms able to pass on these costs to consumers, compared to 23% in the previous quarter.

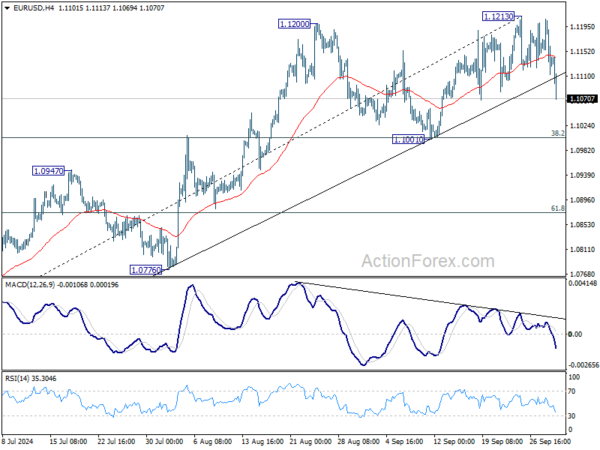

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1096; (P) 1.1153; (R1) 1.1191; More….

EUR/USD’s pullback from 1.1213 accelerated lower today, and the break of trend line support indicates short term topping. While deeper fall might be seen outlook will stay bullish as long as 1.1001 cluster support holds (38.2% retracement of 1.0665 to 1.1213 at 1.1004). Break of 1.1213 will target 1.1274 high. However, decisive break of 1.1001/4 will confirm near term bearish reversal.

In the bigger picture, corrective pattern from 1.1274 should have completed at 1.0665 already. Decisive break of 1.1274 (2023 high) will confirm resumption of whole up trend from 0.9534 (2022 low). Next target will be 61.8% projection of 0.9534 to 1.1274 from 1.0665 at 1.1740. This will now be the favored case as long as 1.1001 support holds.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Aug | -5.30% | 26.20% | 26.40% | |

| 22:00 | NZD | NZIER Business Confidence Q3 | -1 | -44 | ||

| 23:30 | JPY | Unemployment Rate Aug | 2.50% | 2.60% | 2.70% | |

| 23:50 | JPY | Tankan Large Manufacturing Index Q3 | 13 | 13 | 13 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q3 | 14 | 14 | ||

| 23:50 | JPY | Tankan Non – Manufacturing Index Q3 | 34 | 32 | 33 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q3 | 28 | 27 | ||

| 23:50 | JPY | Tankan Large All Industry Capex Q3 | 10.60% | 11.90% | 11.10% | |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 00:30 | JPY | Manufacturing PMI Sep F | 49.7 | 49.6 | 49.6 | |

| 00:30 | AUD | Retail Sales M/M Aug | 0.70% | 0.40% | 0.00% | 0.10% |

| 00:30 | AUD | Building Permits M/M Aug | -6.10% | -4.30% | 10.40% | 11.00% |

| 06:30 | CHF | Real Retail Sales Y/Y Aug | 3.20% | 2.60% | 2.70% | 2.90% |

| 07:30 | CHF | Manufacturing PMI Sep | 49.9 | 48.2 | 49 | |

| 07:45 | EUR | Italy Manufacturing PMI Sep | 48.3 | 49.4 | 49.4 | |

| 07:50 | EUR | France Manufacturing PMI Sep F | 44.6 | 44 | 44 | |

| 07:55 | EUR | Germany Manufacturing PMI Sep F | 40.6 | 40.3 | 40.3 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Sep F | 45 | 44.8 | 44.8 | |

| 08:30 | GBP | Manufacturing PMI Sep F | 51.5 | 51.5 | 51.5 | |

| 09:00 | EUR | Eurozone CPI Y/Y Sep P | 1.80% | 1.80% | 2.20% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep P | 2.70% | 2.70% | 2.80% | |

| 13:30 | CAD | Manufacturing PMI Sep | 49.5 | |||

| 13:45 | USD | Manufacturing PMI Sep F | 47 | 47 | ||

| 14:00 | USD | ISM Manufacturing PMI Sep | 47.8 | 47.2 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Sep | 55 | 54 | ||

| 14:00 | USD | Construction Spending M/M Aug | 0.20% | -0.30% |