- Aggressive interest rate cuts by PBoC coupled with potential expansionary fiscal policies that target consumer spending have stoked positive animal spirits.

- Market breadth has improved on China CSI 300 and Hong Kong Hang Seng Index.

- Watch the key medium-term support of 18,290 on the Hang Seng Index.

Since the start of last week, a change of fortunes has occurred in the China and Hong Kong stock markets due to a revival of positive animal spirits driven by a fresh aggressive monetary policy stance adopted by China’s central bank, PBoC together with hints of upcoming expansionary fiscal policies that target consumer spending.

CSI 300 and Hang Seng Index outperformed

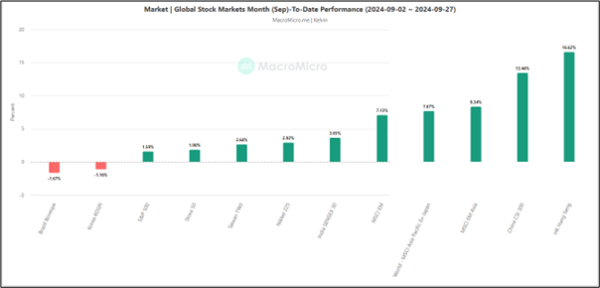

Fig 1: Monthly performance of global benchmark stock indices as of 27 Sep 2024 (Source: Macro Micro, click to enlarge chart)

Based on a month-to-date performance as of 27 September, the China CSI 300 (+13.44%) and Hang Seng Index (+16.62%) outperformed the regional stock markets excluding Japan (+7.67%), and other major benchmark stock indices such as US S&P 500 (+1.59%), and Japan Nikkei 225 (+2.92%) (see Fig 1).

A significant portion of the gains seen in the China and Hong Kong benchmark stock indices came from last week when the CSI 300 recorded a weekly return of 15.70% and the Hang Seng Index rose by 13%, notching their biggest weekly gains since November 2008 and 1998 respectively.

Desperate times call for more aggressive accommodating policies

Recent key economic data such as PMI (manufacturing and services), retail sales, industrial productions, consumer inflation, and producers’ prices have indicated persistent internal demand weakness in China that will be a challenge for China to hit its annual 2024 economic growth target of 5%.

In an attempt to halt the deflationary spiral in China, PBoC has announced a slew of simultaneous interest rate cuts on its key monetary policy tools this week; 50 basis points (bps) cut to banks’ reserve requirement ratio (with a possibility of an additional 25 bps to 50 bps in the near future), 20 bps cut on its seven-day repo rate to lower it to1.5%, reduced the one-year medium-term loan rate by 30 bps to 2%, and lowered housing mortgage rates.

In addition, PBoC has announced at least 500 billion yuan of liquidity support for stocks via a swap facility that allows securities, fund management, and insurance companies to tap the PBoC to buy stocks that include a stock stabilization fund.

Also to cushion the potential rising level of non-performing loans of Chinese commercial banks that are tied to the weak real estate market, China’s top policymakers are considering injecting up to 1 trillion yuan of capital into the biggest state banks to shore up their respective balance sheet to support the struggling economy.

Expansionary fiscal policies are needed to prevent a liquidity trap

Fig 2: China’s total loans growth & Credit Impulse Index as of 30 Aug 2024 (Source: Macro Micro, click to enlarge chart)

Due to lacklustre consumer and business confidence in China, credit growth in China has declined significantly as seen in the total loans from banks that have plummeted from 12.5% y/y in April 2023 to 8.50% in August 2024. A similar downtrend can also be seen in the Credit Impulse Index (see Fig 2).

Hence, opening more of the liquidity floodgates via an aggressive accommodating monetary policy may not be able to have an additional positive impact on economic growth due to a liquidity trap issue that arises from a lack of credit demand from consumers and businesses.

To address the crux of reversing the deflationary spiral environment in China, expansionary fiscal policies need to be implemented alongside aggressive interest rate cuts.

After almost a year-long of piecemeal expansionary policies, China’s Politburo (the top leadership) concluded its monthly September last Thursday, 26 September with much more “forceful” tonality in the ex-post meeting statement such as a vow to make the real estate market “stop declining”.

Also, there is a potential issuance of 2 trillion yuan of special sovereign bonds to be allocated for fiscal spending where there is a possibility for the proceeds to be utilized to boost consumer spending as a rare one-off cash handout for needy Chinese residents was announced last Wednesday, 25 September.

The deployment of such one-time handouts within a short period has appeared to be a change in stance from China’s top policymakers who in the past eschewed consumer welfarism, prompting potentially more forceful expansionary fiscal policies to be enacted soon to stimulate consumer spending and confidence that have been dragged down by a persistent weak property market.

Market breadth has improved for China and Hong Kong

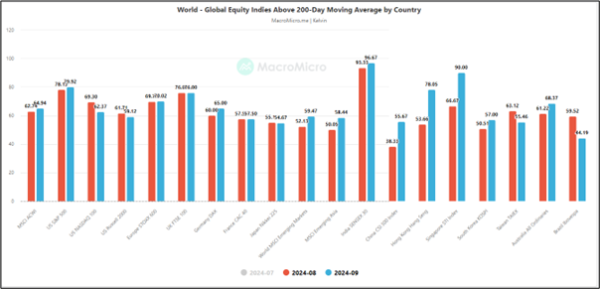

Fig 3: Month-on-month comparison on the percentage of stocks above 200-day MA for global benchmark stock indices as of 27 Sep 2024 (Source: Macro Micro, click to enlarge chart)

Several market breadth indicators have improved for the China and Hong Kong stock indices such as the percentage of component stocks that are trading above the key long-term 200-day moving average.

Measured on a month-on-month basis as of 27 September 2024, the percentage of stocks above their respective 200-day moving averages in the CSI 300 and Hang Seng Index have increased from 38% to 56% (+18 percentage points), and from 54% to 78% (+24 percentage points) respectively (see Fig 3).

The CSI 300, Hang Seng Index, together with the Singapore STI Index have seen the most significant improvement in the percentage of stocks above their respective 200-day moving averages versus other global major benchmark stock indices.

Weekly MACD trend indicator of the Hang Seng Index has turned bullish

Fig 4: Hang Seng Index medium-term & major trends as of 30 Sep 2024 (Source: TradingView, click to enlarge chart)

The clearance of the 20 May 2024 swing high of 19,706 on the Hang Seng Index coupled with a higher low reading being flashed out on its weekly MACD trend indicator above its centreline suggests that the Index is likely undergoing a new medium-term (multi-week) uptrend phase.

Key medium-term pivotal support stands at 18,290 with next medium-term resistances coming in at 22,690 and 26,200 (also the long-term secular descending trendline from the January 2018 all-time high) (see Fig 4).

On the other hand, a break with a daily close below 18,290 invalidates the bullish scenario for another round of corrective decline to revisit the next medium-term support at 16,725 (also close to the 200-day moving average).