- US 500 index climbed to new record highs last week

- But got rejected and has retreated a little since

- MACD and RSI look overbought

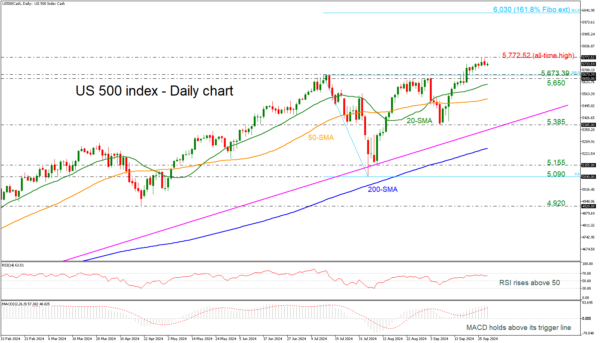

Following the bounce off the 5,385 support level, the US 500 (cash) index added more than 7%, reaching an all-time high of 5,772.52 last week. Technically, the index is sailing near overbought waters, according to the MACD oscillator. The RSI is also flagging a potential downfall, as it’s losing impetus slightly below 70.

If buyers stay in play, the door will open for the next round numbers, such as 5,800 and 5,900, until the price moves up to the 161.8% Fibonacci extension level of the downward wave from 5,673.39 to 5,090 at 6,030.

If the bears press the price below 5,673.39-5,650, the 20- and 50-day simple moving averages (SMAs) may prevent a downfall towards the 5,385 support level. If the latter gives way, the decline could continue toward the 200-day SMA at 5,250.

In a nutshell, despite the latest exciting rebound in the US 500 index, the momentum oscillators are indicating a bearish correction in the short-term view.