Markets

We have a big day and big week ahead in terms of eco data and central bank speeches. EMU headline inflation (tomorrow) is on track to drop below the ECB’s 2% inflation target for the first time since June 2021 following downward surprises in French and Spanish readings end last week. German figures are released today. The September drop is mainly energy-inspired though as ECB President Lagarde suggested already at the Q&A session of the previous ECB meeting: “We are looking at a whole battery of indicators. And I’m saying that in particular because September will certainly deliver a low reading of inflation. Very likely. We expect, because of the base effect, particularly on energy, our inflation numbers to be up in the fourth quarter, so the last three months of 2024. But September is going to deliver a low reading.” While EMU money markets have been eager to nearly fully discount a 25 bps October ECB rate cut on the back of these softer national CPI readings and weak September PMI’s, we still tend to err on the side of the status quo. Unless the ECB president herself convinces us otherwise at an hearing in front of the European parliament later today.

The US eco calendar kicks off with the September Chicago PMI and with a speech by Fed Chair Powell at the National Association for Business Economics after European close. We are looking for clues in the comments (and the rest of this week’s figures) to strengthen our 50 bps Fed rate cut call for November. US money markets are currently evenly split between a 25 bps and a 50 bps scenario. That means room for market moves with a potential bull steepening of the US yield curve, a narrowing of the short-term spread differential between the US and Europe and a continuation of the sell-on-upticks in the greenback. Other eco data to spark volatility later this week are JOLTS job openings and manufacturing ISM (tomorrow), ADP employment change (Wednesday), weekly jobless claims and services ISM (Thursday) and payrolls (Friday). Unionized dockworkers are likely to start with strikes in many East Coast and Gulf Coast ports as their labor contracts expire today which is a wildcard for this week. They remain at odds with employers over the level of pay increases, with unions pushing for a 77% increase for workers over six years. West Coast port workers last year secured a 32% increase.

Chinese stock markets surge another whopping 8-10% this morning after three major cities eased rules on housing purchases. That makes a 25% gain for the CSI 300 since authorities started rolling out stimulus measures last week.

News & Views

Austria’s Freedom Party emerged as the biggest party after yesterday’s national elections. The far-right party is estimated to have secured 56 seats out of the 183 up for grabs. All other traditional parties, however, have vowed not to work with the group and instead look to each other for creating an at least 92-seat majority. The People’s Party and the Social Democrats have been the default option, making up more than half of Austria’s governments since WWII. This time around, though, they won 93 seats, making it a very fragile coalition. They could include a third party, most likely the liberal NEOS (18 seats) but finding common ground won’t be easy. Austria already has a tradition for negotiations to take months and talks may stretch well into next year. The outgoing coalition (People’s Party and the Greens) continues to govern in the meantime.

Flanders has formed a government over the weekend, almost four months since the June 9 elections. Matthias Diependaele from the Flemish nationalists N-VA will lead a coalition government that also include Vooruit’s Socialists and the Christian-Democrats. All parties have greenlighted the coalition agreement in the meantime. Some of the most high-profile policy changes include lower taxes for first-home buyers and for small-to-medium sized inheritances, job placement reforms & an easing of the home energy efficiency renovation rules. In addition, the new Flemish government will introduce a traffic tax for EV’s while removing the subsidies for buying one. A previously made pledge to ban the sale of combustion engines by 2029 is scrapped. A whopping €1bn is rolled out for daycare and another €300mln for elder care. The Flemish government also announced an industrial strategy (R&D and innovation). The agreement on the Flemish level potentially strengthens the three-party bloc in the still-ongoing negotiations on a federal level.

Graphs

GE 10y yield

The ECB cut policy rates by 25 bps in June and in September. Stubborn inflation (core, services) make follow-up moves less evident. We expect the central bank to stick with the quarterly reduction pace. Disappointing US and unconvincing-to-outright-weak EMU activity data dragged the long end of the curve down. The move accelerated during the early August market meltdown.

US 10y yield

The Fed kicked off its easing cycle with a 50 bps move. It is headed towards a neutral stance now that inflation and employment risks are in balance. Conservative SEP unemployment forecasts risk being caught up by reality and with it the dot plot (50 bps more cuts in 2024). We hold our call for two more 50 bps cuts this year. Pressure on the front of the curve and weakening eco data keeps the long end in the defensive for now as well.

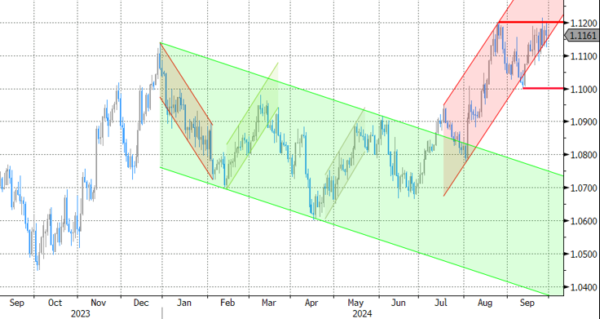

EUR/USD

EUR/USD moved above the 1.09 resistance area as the dollar lost interest rate support at stealth pace. US recession risks and bets on fast and large rate cuts trumped traditional safe haven flows into USD. An ailing euro(pean economy) only briefly offset some of the general USD weakness. EUR/USD’s dollar-driven ascent is nearing resistance around 1.12 again.

EUR/GBP

The BoE delivered a hawkish cut in August. Policy restrictiveness will be further unwound gradually on a pace determined by a broad range of data. The strategy similar to the ECB’s balances out EUR/GBP in a monetary perspective. But the economic picture is increasingly diverging to the benefit of sterling. EUR/GBP succumbed to horrible European September PMI’s. Support at 0.84 broke and brings the 2022 low (0.8203) on the radar.