‘The euro rose, approaching a six-week high, as political concerns in the region were seen as easing after a poll showed anti-euro candidate Marine Le Pen losing ground in the French presidential debate.’ – Chikako Mogi, Bloomberg

Pair’s Outlook

On Tuesday morning the common European currency surged against the US Dollar and managed to break through the resistance put up by the monthly R1, which is located at the 1.0772 level. The currency pair has set its course to the next resistance level, where it is likely to stop or even change direction. Above the rate there is a resistance cluster consisting of two notable levels of significance, as the weekly R1 is located at 1.0814, and the 38.20% Fibonacci retracement level is at the 1.0826 level. Moreover, the Fibonacci retracement level is strengthened by the upper Bollinger band, which is located at 1.0827.

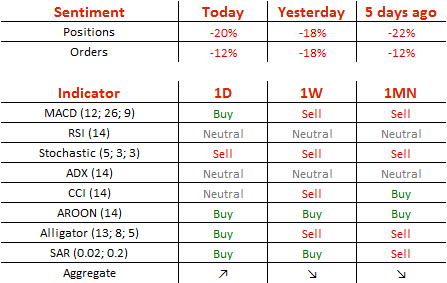

Traders’ Sentiment

Traders remain bearish on the pair, as 60% of open positions are short, and 56% of trader set up orders are to sell the Euro.