Canadian inflation data is set to take center stage today, particularly after dovish signals from BoC Governor Tiff Macklem hinted at the potential for accelerated monetary easing should the economy weaken further. Progress in disinflation could provide the BoC with more leeway to shift toward a more aggressive policy stance.

Headline CPI is forecasted to decelerate from 2.5% yoy in July to 2.1% yoy in August, edging just above BoC’s 2% target. If realized, this would mark the lowest inflation rate since March 2021. While the bulk of the inflation slowdown is attributed to falling gasoline prices, core inflation metrics are expected to reflect improvement too, with the three-month annualized growth rate projected to ease from July’s 2.6% yoy.

In a recent Financial Times interview, Macklem voiced growing concerns about the labor market’s softening and the impact of lower crude oil prices on the broader economy. He emphasized that as inflation approaches target levels, the “risk management calculus changes,” and the focus shifts toward downside risks.

BoC’s current forecast anticipates 2% economic growth in 2024 and 2.1% in 2025. However, Macklem acknowledged that if these growth projections falter, “it could be appropriate to move faster [on] interest rates.”

Presently, economists expect BoC to cut rates by 25bps at every meeting through mid-2025, bringing the policy rate down to 2.50%. However, weaker economic data could prompt a faster pace of cuts or even a lower terminal rate.

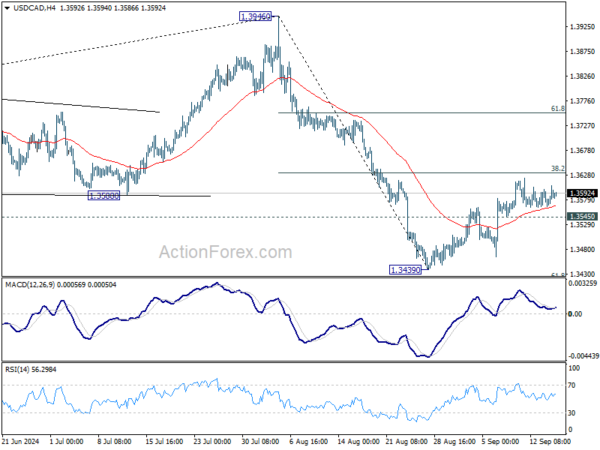

Technically, Canadian Dollar has been sluggish to rally against the greenback even though the latter has been pressured across the board on speculation of a 50bps rate cut by Fed this week. Decisive break of 38.2% retracement of 1.3946 to 1.3439 at 1.3633 in USD/CAD could argue that the decline from 1.3946 has completed. Stronger rally would then be seen to 61.8% retracement at 1.3752 and above.