Influential financial media are promoting the need for a 50-basis point rate cut. The Fed’s blackout period starts 10 days before the rate decision is released, so the main influence on the markets during this time comes from traders’ interpretation of data and commentary from influential speakers in major financial media.

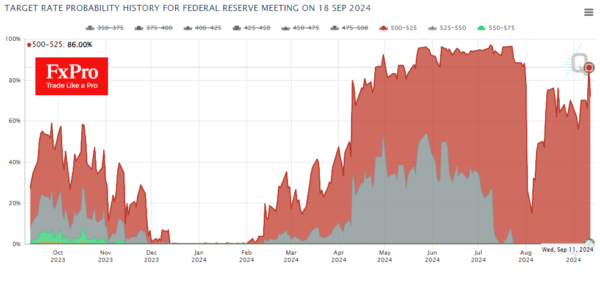

Employment and inflation figures were the defining data. The brief conclusion is that the US economy continues to create jobs, albeit at a slower rate. Inflation, meanwhile, is slowing but remains at elevated levels. The latest CPI report convinced markets that the first decline in the cycle would be 25 points. The odds of this outcome exceeded 85% on Wednesday, but the situation changed dramatically at the end of the week.

An influential speaker – former New York FRB head Bill Dudley – points to the need for a decisive rate cut. On Thursday, the WSJ published an extensive article by influential observer Nick Timiraos, who is considered by many to be a ‘Fed insider’ and points out that this is a ‘close call.’ The Financial Times speaks in the same terms in an editorial. An influential guest speaker and former manager of PIMCO’s largest bond fund – Mohamed El-Erian – who publicly accused the Fed of sleeping through inflation, now points out that the bond market is signalling a recession and is setting up for a 200-point rate cut in the next 12 months.

The press bombardment affected the markets, with the dollar going down and the stock market going up. This also served Gold well, which managed to break out of a prolonged consolidation.

Now, there is intrigue: is this really a hint that the Fed is preparing us for a hike? It is also possible that the FOMC will not dare to go directly against such strong confidence in Fed softness. This shift in narrative is spurring gains in equities and could potentially take the S&P500 back to the highs near 5675 before the meeting. The dollar index is also on its way to the August lows, from where it has reversed to the upside. What happens next – breakout or pullback – the markets will decide in Wednesday night’s statement.