Yen continues to strengthen broadly today, maintaining its position as the best-performing currency of the week so far. Renewed speculation around a possible 50bps rate cut by the Fed has provided an extra lift to the Japanese currency. Additionally, renewed weakness in US and European benchmark yields further supports the Yen’s rally.

BoJ is widely expected to keep interest rates unchanged at its upcoming meeting, though the long-term path suggests rates could eventually target a neutral level of 1%. However, the BoJ’s slow pace of tightening means that Yen’s movement is likely to remain driven by the pace of policy easing in other major economies.

Swiss Franc is also showing strength today, although it remains the weakest currency for the week. The recent rebounds in EUR/CHF and GBP/CHF seem to be losing momentum, signaling potential completion of these recoveries. However, a stronger risk-off sentiment would be needed for Franc to resume its recent rally.

Elsewhere, Australian Dollar follows Yen as the second strongest currency of the week, with US Dollar edging out Euro for third place. Canadian Dollar and New Zealand Dollar are competing for the second-worst position, just ahead of Swiss Franc. Sterling is positioned in the middle of the performance chart for now.

In Europe, at the time of writing, FTSE is up 0.19%. DAX is up 0.59%. CAC is up 0.24%. UK 10-year yield is down -0.0072 at 3.776. Germany 10-year yield is down -0.008 at 2.148. Earlier in Asia, Nikkei fell -0.68%. Hong Kong HSI rose 0.75%. China Shanghai SSE fell -0.48%. Singapore Strait Times rose 0.17%. Japan 10-year JGB yield fell -0.020 to 0.846.

Eurozone industrial production falls -0.3% mom in Jul, weighed down by capital and durable consumer goods

Eurozone industrial production fell by -0.3% mom in July, missing expectations of 0.2% mom rise. The decline was driven by significant drops in production across key sectors: intermediate goods fell by -1.3%, capital goods by -1.6%, and durable consumer goods by -2.8%. On the positive side, energy production saw a slight increase of 0.3%, while non-durable consumer goods rose by 1.8%.

In the broader EU, industrial production slipped by -0.1% momh. Notably, Malta (-5.5%), Estonia (-4.8%), and Romania (-3.4%) reported the largest production declines. Conversely, Ireland led gains with a robust +9.2% increase, followed by Croatia at +8.0% and Belgium at +7.3%.

ECB officials stress data-driven approach as inflation and growth weigh on policy

ECB officials shared varied perspectives on the economic outlook and monetary policy today, following yesterday’s 25bps rate cut. This move was largely anticipated as ECB continues its cautious approach to address both inflation and slowing growth.

ECB Deputy Governor Olli Rehn highlighted the “good reasons” behind the rate cut, amid declining inflation. He also stressed that “current uncertainties further emphasize the dependence on fresh data and analysis” to guide policy decisions.

Bundesbank President Joachim Nagel, another member of the Governing Council, struck a positive tone, stating, “We assume that core inflation will improve, especially with the declining wage trend in the eurozone.” He added that in Germany, “things are moving in the right direction.”

Meanwhile, Bank of France President François Villeroy de Galhau acknowledged the challenges posed by weaker-than-expected activity data, particularly in France. However, he maintained a cautious outlook, noting the potential for “a very gradual recovery” beyond the short-term boost from the Olympics. He emphasized that the pace of monetary easing “has to be highly pragmatic” and that ECB “keeps full optionality” for future meetings.

Bank of Slovenia President Bostjan Vasle reiterated ECB’s data-dependent approach, adding that “we are not committed to any predetermined rate path,” with inflation still largely driven by core components and services.

Bank of Estonia Governor Madis Muller, echoing these views, expressed concerns over services inflation but noted growing confidence in the broader inflation outlook, despite expectations of a temporary acceleration.

NZ BNZ manufacturing rises to 45.8, 18th month of contraction

BNZ Performance of Manufacturing Index for New Zealand edged higher in August, rising from 44.4 to 45.8. Despite the improvement, the sector remains in deep contraction, well below its long-term average of 52.6, marking the 18th consecutive month of declining activity.

A closer look at the data reveals that production increased from 44.2 to 46.3, while employment also saw a slight rise, moving from 43.5 to 46.6. New orders climbed from 43.3 to 46.8, signaling some improvement in demand. However, finished stocks dipped slightly from 46.3 to 46.2, while deliveries improved marginally from 44.7 to 45.6.

BusinessNZ’s Director of Advocacy, Catherine Beard, commented on the situation, noting that while the PMI is “heading back in the right direction,” the sector’s return to expansion is still distant after 18 months in contraction.

The ongoing challenges in the manufacturing sector were reflected in the proportion of negative comments, which, although improved, remained high at 64.2% in August, down from 71.1% in July and 76.3% in June. These negative sentiments were largely driven by concerns over the broader economic recession, with manufacturers citing weak demand and rising living costs as significant hurdles to recovery.

USD/JPY Mid-Day Outlook

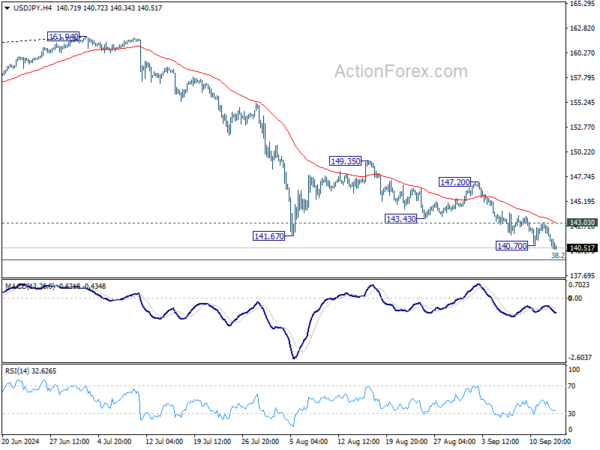

Daily Pivots: (S1) 141.35; (P) 142.20; (R1) 142.66; More…

USD/JPY’s decline resumed by breaking through 140.70 and intraday bias is back on the downside. Further fall should be seen to 139.26 fibonacci level. Decisive break there would carry larger bearish implications. On the upside, above 143.03 minor resistance will turn intraday bias neutral again first. But outlook will stay bearish as long as 147.20 resistance holds.

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. Strong support could be seen there to bring rebound. But in any case, risk will stay on the downside as long as 55 W EMA (now at 148.93) holds. Sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Aug | 45.8 | 44 | ||

| 04:30 | JPY | Industrial Production M/M Jul F | 3.10% | 2.80% | 2.80% | |

| 09:00 | EUR | Eurozone Industrial Production M/M Jul | -0.30% | 0.20% | -0.10% | 0.00% |

| 12:30 | CAD | Capacity Utilization Q2 | 79.10% | 78.40% | 78.50% | 78.60% |

| 12:30 | CAD | Wholesale Sales M/M Jul | 0.40% | -1.10% | -0.60% | -0.50% |

| 12:30 | USD | Import Price Index M/M Aug | -0.30% | -0.20% | 0.10% | |

| 14:00 | USD | Michigan Consumer Sentiment Index Sep P | 68 | 67.9 |