Dollar weakened broadly overnight after the latest JOLTS report showed significant drop in job openings, hitting the lowest level since January 2021. Economists are increasingly worried that the US labor market is cooling not just to pre-pandemic levels but potentially beyond. Such outlook could raising the possibility that the Federal Reserve may need to act more decisively in its easing policy to prevent further labor market deterioration. With concerns mounting over labor market weakness, fed fund futures now reflect a 45% probability of a 50bps rate cut by Fed later this month, up from 38% a day earlier.

However, attention is shifting to the health of the services sector, which has been a key economic driver amid the ongoing manufacturing recession. Today’s ISM services report will be a critical indicator, but the deciding factor for Fed will likely be tomorrow’s non-farm payroll report.

In other markets, 10-year US Treasury yield dropped sharply following the JOLTS data today. Meanwhile, US stock markets were relatively stable, with major indexes closing with small gains or losses only.

In the currency markets, despite the overnight selloff, the Dollar remains in a middle position for the week. Japanese Yen leads as the strongest performer as pushed up from the fail in US yields, followed by Swiss Franc and Euro. On the other hand, New Zealand Dollar and Australian Dollar are the weakest performers, with Canadian Dollar also lagging. These rankings are typical in a general risk-off environment.

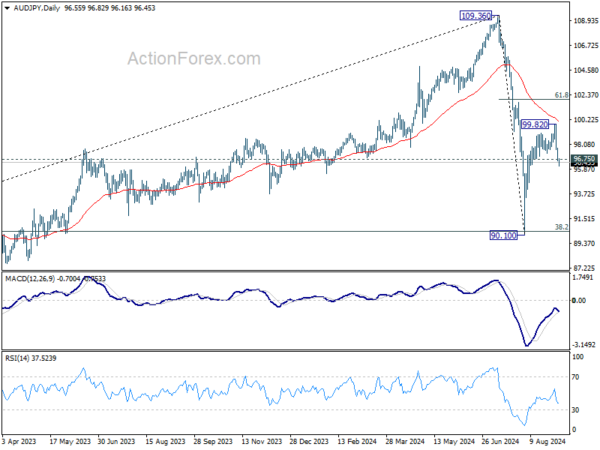

Technically, AUD/JPY’s break of 96.75 support suggests that rebound from 90.10 has completed at 99.82, ahead of falling 55 D EMA. Risk will now stay on the downside as long as 99.82 resistance holds, even in case of recovery. Deeper fall is now in favor back to retest 90.10 low.

In Asia, at the time of writing Nikkei is down -1.24%. Hong Kong HSI is down -0.53%. China Shanghai SSE is up 0.03%. Singapore Strait Times is down -0.08%. Japan 10-year JGB yield is down -0.0105 at 0.879. Overnight, DOW rose 0.09%. S&P 500 fell -0.16%. NASDAQ fell -0.30%. 10-year yield fell -0.076 to 3.768.

Real wages rise for second month in Japan, boosted by summer bonuses

Japan’s real wages rose by 0.4% yoy in July, down from June’s 1.1% yoy, but still marking the second consecutive month of growth after 27 months of decline.

Nominal wages increased by 3.6% yoy, surpassing expectations of 3.1%, but slowing from June’s 4.5% yoy. Regular pay, which rose 2.7% yoy, achieved its fastest growth in nearly 32 years. However, overtime pay, often seen as a gauge of corporate strength, dipped slightly by -0.1% yoy.

Special payments, such as bonuses, played a significant role in lifting wage growth during the summer, with a 6.2% yoy increase in July, following a 7.8% yoy rise in June.

A labor ministry official noted, “From August and thereafter, monthly wages will be a deciding factor” in sustaining real wage growth, as the contribution from special payments will diminish in the coming months.

BoJ board member Hajime Takata said in a speech today:

If inflation moves roughly in line with forecasts, and companies continue to boost spending, wages and pass on costs through price hikes, then “we need to adjust the degree of monetary easing further,”

While US and European central banks are moving toward rate cuts, the effect of their past aggressive monetary tightening could appear with a lag and weigh on Japan’s economy, Takata said.

The difference in monetary policy stance between that of the BOJ and other central banks could also cause market turbulence, Takata said. “As such, we must carefully monitor domestic and overseas developments,” he said.

The stock and currency market saw big volatility in early August and “the fallout continues”. As such, we need to scrutinise market developments and their impact.

RBA’s Bullock reiterates no rate cuts soon, stresses vigilance on inflation risks

In a speech today, RBA Governor Michele Bullock reaffirmed that the central bank is unlikely to cut interest rates in the near term, provided the economy evolves as anticipated.

Bullock emphasized that the Board remains “vigilant to upside risks to inflation” and that monetary policy will need to stay “sufficiently restrictive” until there is clear evidence that inflation is moving sustainably towards the target range.

Although inflation has fallen significantly from its peak, it remains above the midpoint of RBA’s 2–3% target range, with underlying inflation, as measured by the trimmed mean, still at 3.9% in June.

RBA aims to bring inflation back to target without jeopardizing the labor market gains made in recent years, navigating what Bullock described as the “narrow path.”

The central bank’s August forecast anticipates underlying inflation returning to the target range by the end of 2025, a “slightly slower” timeline than previously projected. While the labor market remains relatively tight, Bullock noted that it is expected to “ease gradually” over the next few years as the economy adjusts.

Fed’s Beige Book signals slowdown with widespread stagnation across districts

Fed’s latest Beige Book report highlights a growing economic slowdown across the US. While economic activity grew slightly in three Districts, the number of Districts reporting flat or declining activity increased from five in the previous period to nine in the current period, indicating broader stagnation.

Employment levels were generally “flat to up slightly”, with five Districts noting modest increases in headcounts. However, some Districts reported that firms are reducing shifts, leaving positions unfilled, or trimming headcounts through attrition, though layoffs remain uncommon. Wage growth continues at a modest pace, consistent with the recent trend of slowing wage increases.

Overall, prices increased modestly during the reporting period, but three Districts saw only slight rises in selling prices. Nonlabor input costs were mostly described as modest to moderate and generally easing, though one District reported a slight uptick in input cost increases.

Fed’s Daly to assess upcoming data before finalizing rate cut size

In an interview with Reuters, San Francisco Fed President Mary Daly acknowledged that a rate cut is widely expected this month, but emphasized that the exact size of the cut remains uncertain.

“We don’t know yet, right?” Daly said, noting that key data such as the upcoming labor market and CPI reports will play a critical role in the decision-making process. She added, “I want more time to do all the work that’s needed to make the best decision.”

Daly also warned of the risks of over-tightening, particularly as inflation eases while the economy slows. “As inflation falls, we’ve got a real rate of interest that’s rising into a slowing economy; that’s a basic recipe for over-tightening,” she explained.

Highlighting the importance of protecting the labor market, she stressed that further slowing would be “unwelcome” and a key factor in shaping future policy decisions.

Looking ahead

Swiss unemployment rate, Germany factor orders, UK PMI construction and Eurozone retail sales will be released in European session. Later in the day, US ADP employment, jobless claims and ISM services will the focuses.

EUR/USD Daily Outlook

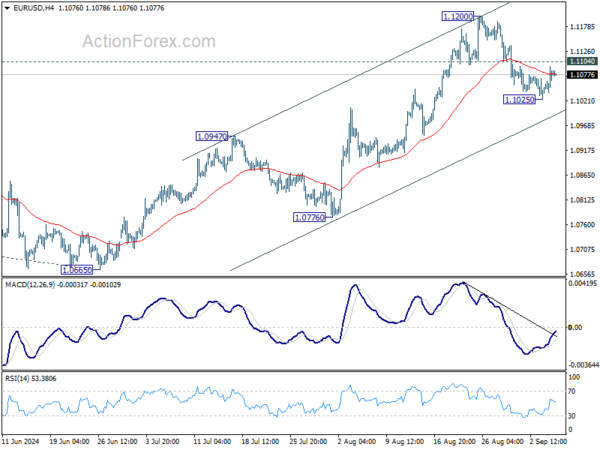

Daily Pivots: (S1) 1.1048; (P) 1.1071; (R1) 1.1107; More….

Outlook in EUR/USD remains unchanged and intraday bias stays neutral. While retreat from 1.1200 might extend lower, rally from 1.0665 is in favor to continue as long as 1.0947 resistance turned support holds. Above 1.1104 minor resistance will bring retest of 1.1200 first. Break there will target 1.1274 high next. However, firm break of 1.0947 will indicate reversal and turn bias back to the downside.

In the bigger picture, prior break of 1.1138 resistance indicates that corrective pattern from 1.1274 has completed at 1.0665 already. Decisive break of 1.1274 (2023 high) will confirm whole up trend from 0.9534 (2022 low). Next target will be 61.8% projection of 0.9534 to 1.1274 from 1.0665 at 1.1740. This will now be the favored case as long as 1.0947 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Jul | 3.60% | 3.10% | 4.50% | |

| 01:30 | AUD | Trade Balance (AUD) Jul | 6.01B | 4.95B | 5.59B | 5.43B |

| 05:45 | CHF | Unemployment Rate Aug | 2.50% | 2.50% | ||

| 06:00 | EUR | Germany Factory Orders M/M Jul | -1.50% | 3.90% | ||

| 08:30 | GBP | Construction PMI Aug | 54.4 | 55.3 | ||

| 09:00 | EUR | EurozoneRetail Sales M/M Jul | 0.10% | -0.30% | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Aug | 9.20% | |||

| 12:15 | USD | ADP Employment Change Aug | 150K | 122K | ||

| 12:30 | USD | Initial Jobless Claims (Aug 30) | 233K | 231K | ||

| 12:30 | USD | Nonfarm Productivity Q2 | 2.30% | 2.30% | ||

| 12:30 | USD | Unit Labor Costs Q2 | 0.90% | 0.90% | ||

| 13:45 | USD | Services PMI Aug F | 55.2 | 55.2 | ||

| 14:00 | USD | ISM Services PMI Aug | 51.5 | 51.4 | ||

| 14:30 | USD | Natural Gas Storage | 26B | 35B | ||

| 15:00 | USD | Crude Oil Inventories | -0.6M | -0.8M |