- WTI oil futures seek buyers around strong support trendline near 69.00

- Short-term bias remains bearish; a bounce above 74.00 is needed

WTI oil futures edged up to 71.44 on news that OPEC members are discussing a potential delay in a planned output hike in October.

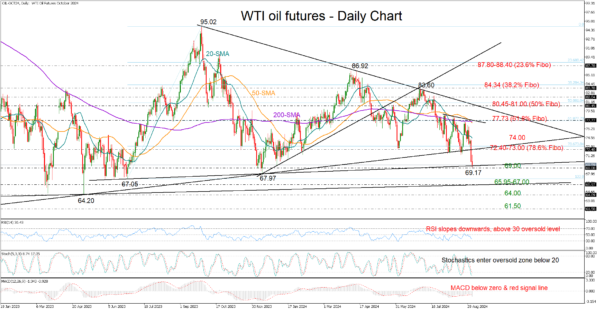

Technically, the price rotated higher after marking a nine-month low of 69.17, near the important support trendline, which joins the lows from the end of May 2023. Recall that oil set a strong footing near that line to stage an impressive rally in June and December 2023. Hence, although it missed the opportunity to pivot near the 72.40 level, it would be interesting to see if the bulls will manage to come into full force again near 69.00.

The stochastic oscillator is already near its 20 oversold level, suggesting downside pressures may soon fade, though some caution is necessary as the RSI has yet to reach its 30 level. Adding to the negative risks is the death cross between the 50- and 200-day simple moving averages (SMAs), which is also in progress in the weekly chart.

Should the 69.00 floor crack, the sell-off could intensify towards the 65.95-67.00 zone, where the flat support trendline from 2021 is located. A drop below it could take a breather somewhere between the April 2023 low of 64.20 and the 64.00 psychological mark, while lower, the price could sink towards the 61.50 region last seen in spring 2021. A break of the latter could significantly worsen the broader outlook.

On the upside, a bounce above 72.40-73.00 could immediately stall near 74.00. Another close higher will be needed for an acceleration towards the 200-day SMA and the 61.8% Fibonacci retracement of the June-September upleg at 77.73. If there are more gains, the spotlight will fall on the critical resistance trendline at 80.45 and the 50% Fibonacci of 81.00.

In brief, WTI oil futures might have another chance to get on its feet near the 69.00 level. Otherwise, selling interest could pick up pace.