Risk aversion continues to dominate the global financial markets today, although the weakness in US futures has been relatively contained. While some volatility could arise from the US JOLTS labor market data, traders would largely be holding off for tomorrow’s ISM services data and Friday’s non-farm payroll report. As a result, market movements are expected to be relative limited as caution remains the prevailing sentiment.

Canadian Dollar is among the weaker performers today as traders await BoC’s rate cut decision. A key focus will be whether BoC provides any guidance on the extent of the current easing cycle or if it will reserve further details for the October Monetary Policy Report, which will include updated economic forecasts.

So far this week, Yen has emerged as the strongest currency, followed by Dollar and then Euro. On the other end, New Zealand Dollar is the weakest, followed by Australian Dollar and Canadian Dollar. Swiss Franc and British Pound are trading in the middle, with the Franc giving back some of its earlier gains.

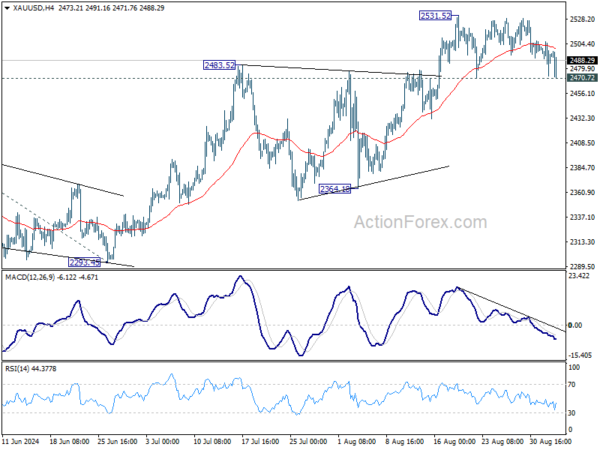

Technically, while Gold dipped notably earlier today it’s continuing to draw support from 2470.72. Price actions from 2531.52 are viewed as sideway consolidation, which might be near to completing a three wave pattern. Strong rebound from current level, followed by break of 2531.62 resistance will confirm long term up trend resumption. However, decisive break of 2470.72 will complete a double top pattern, and bring deeper pull back, with risk of falling further towards 2364.18 support.

In Europe, at the time of writing, FTSE is down -0.56%. DAX is down -0.88% CAC is down -1.13%. UK 10-year yield is up 0.013 at 3.982. Germany 10-year yield is down -0.036 at 2.242. Earlier in Asia, Nikkei fell -4.24%. Hong Kong HSI fell -1.10%. China Shanghai SSE fell -0.67%. Singapore Strait Times fell -1.12%. Japan 10-year JGB yield fell -0.0362 to 0.890.

Eurozone PPI rises 0.8% in Jul, driven by energy costs

In July, Eurozone PPI rose 0.8% mom, surpassing expectations of 0.3% mom increase. On a yearly basis, however, PPI was down by -2.1% yoy, though better than the expected -2.5% yoy decline. Energy costs were the primary driver, with prices surging by 2.8% mom during the month, while other sectors showed more modest or negative price movements. Intermediate goods fell by -0.1% mom, durable consumer goods rose 0.1% mom, and non-durable consumer goods dipped by -0.1% mom. Prices for capital goods remained unchanged.

EU-wide PPI also saw significant movement, falling -0.8% mom and -19% yoy. The biggest monthly price increases were recorded in Bulgaria (+3.6%), Greece (+2.9%), and Romania (+2.7%), while the largest decreases occurred in Sweden (-0.9%), Finland (-0.7%), and Austria (-0.2%).

Eurozone PMI services finalized at 52.9, cost pressures ease

Eurozone’s services sector showed improved growth in August, with PMI Services index rising to 52.9 from July’s 51.9, while the PMI Composite increased to 51.0 from 50.2. Both readings marked three-month highs, signaling a strengthening in overall economic activity. According to HCOB, input cost inflation eased to its lowest point in 2024, though the rate of increase in output charges ticked up slightly.

Country-specific data revealed a mixed picture, with Spain leading the pack with a Composite PMI of 53.5, a two-month high, followed by France at 53.1, a 27-month high. Ireland’s Composite PMI hit 52.6, its highest in five months, while Italy recorded a two-month high at 50.8. On the other hand, Germany saw its Composite PMI fall to 48.4, a five-month low.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, pointed to the “Olympic effect” as a key factor ensuring GDP growth in Eurozone for Q3. While services sector is performing well across all major Eurozone economies, the manufacturing sector remains in recession, with worsening conditions in key countries like Germany and France.

On the inflation front, service providers slightly increased their prices in August, but cost pressures, particularly those driven by wages, have eased. This will likely be a positive signal for ECB, which may “breathe a small sigh of relief” as it weighs its policy decisions. Combined with favorable inflation data from Eurostat, these factors could provide the ECB with further justification to cut interest rates at its upcoming meeting on September 12.

UK PMI services finalized at 53.7, inflation pressures ease

UK services sector continued its expansion in August, with the PMI Services index finalized at 53.7, up from 52.5 in July, marking the 10th consecutive month of growth. PMI Composite also showed improvement, climbing to 53.8 from 52.8, indicating the fastest pace of overall economic growth since April.

Tim Moore, Economics Director at S&P Global Market Intelligence, noted that “August data highlighted a recovery in UK service sector performance” as improving economic conditions and domestic political stability supported customer demand. New business saw a robust increase after a summer slowdown in decision-making, fueling the strongest service sector activity in months.

Service providers responded to this uptick by increasing staff levels, with job creation outpacing the first half of 2024. However, businesses still faced challenges from shortage of candidates and rising wage pressures. Despite higher salary payments, the rate of input price inflation continued to fall, reaching its lowest level since January 2021. In addition, prices charged by service providers rose at the slowest pace in three-and-a-half years, further indicating easing inflationary pressures in the sector.

Japan’s PMI services finalized at 53.7, expansion continues

Japan’s services sector continued its expansion in August, with PMI Services index finalized at 53.7, unchanged from July’s figure. This marks the 23rd month of growth out of the past 24. PMI Composite, which includes both services and manufacturing, rose to 52.9 from 52.5 in July, reflecting the strongest overall growth since May 2023.

The services sector showed solid performance, while manufacturing output posted its most significant increase since May 2022. According to Usamah Bhatti, economist at S&P Global Market Intelligence, August saw ongoing growth in activity, new business, and employment in the service sector. However, the pace of employment growth and business optimism slowed to seven- and 19-month lows, respectively.

Australia’s GDP grows 0.2% qoq in Q2, per capita down for sixth quarter

Australia’s GDP grew by 0.2% qoq in Q2, aligning with market expectations. However, GDP per capita declined for the sixth consecutive quarter, falling by -0.4% qoq. For the 2023-24 financial year, the economy expanded by 1.5%.

Katherine Keenan, head of national accounts at the Australian Bureau of Statistics, noted, “The Australian economy grew for the eleventh consecutive quarter, although growth slowed over the 2023-24 financial year.”

Keenan also pointed out that excluding the pandemic period, annual financial year growth was the lowest since 1991-92, a year marked by the recovery from the 1991 recession.

China’s Caixin PMI services falls to 51.6, composite unchanged at 51.2

China’s Caixin PMI Services fell to 51.6 in August, down from 52.1 in July and below expectations of 52.2. While this marked the continuation of an expansion that began in January 2023, the rate of growth is among the slowest seen this year. PMI Composite remained steady at 51.2, indicating ten consecutive months of expansion.

According to Wang Zhe, Senior Economist at Caixin Insight Group, the services sector experienced a slight slowdown in supply and demand growth, in contrast to a recovery in manufacturing. One key concern was the services sector’s shrinking labor market, which pulled the composite employment indicator below the 50.0 mark, signaling a marginal contraction in employment.

On the pricing front, while input costs increased in both sectors, prices charged by manufacturers and service providers fell, adding pressure to business profitability. This combination of slower services growth and declining prices suggests increasing challenges for Chinese businesses as they contend with rising costs and shrinking profit margins.

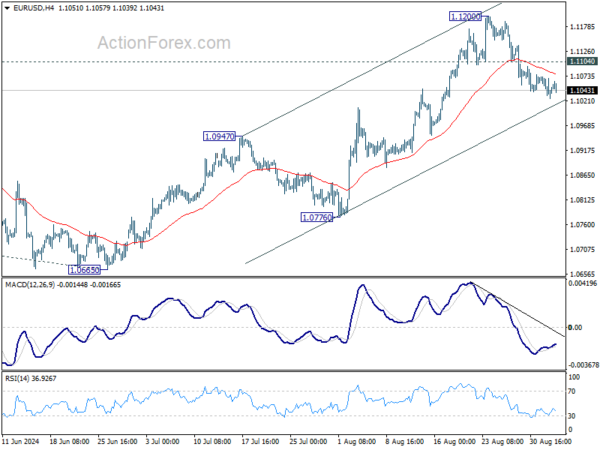

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1018; (P) 1.1051; (R1) 1.1075; More….

Intraday bias in EUR/USD stays neutral at this point. While retreat from 1.1200 might extend lower, rally from 1.0665 is in favor to continue as long as 1.0947 resistance turned support holds. Above 1.1104 minor resistance will bring retest of 1.1200 first. Break there will target 1.1274 high next. However, firm break of 1.0947 will indicate reversal and turn bias back to the downside.

In the bigger picture, prior break of 1.1138 resistance indicates that corrective pattern from 1.1274 has completed at 1.0665 already. Decisive break of 1.1274 (2023 high) will confirm whole up trend from 0.9534 (2022 low). Next target will be 61.8% projection of 0.9534 to 1.1274 from 1.0665 at 1.1740. This will now be the favored case as long as 1.0947 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | GDP Q/Q Q2 | 0.20% | 0.20% | 0.10% | |

| 01:45 | CNY | Caixin Services PMI Aug | 51.6 | 52.2 | 52.1 | |

| 07:50 | EUR | France Services PMI Aug F | 55 | 55 | 55 | |

| 07:55 | EUR | Germany Services PMI Aug F | 51.2 | 51.4 | 51.4 | |

| 08:00 | EUR | EurozoneServices PMI Aug F | 52.9 | 53.3 | 53.3 | |

| 08:30 | GBP | Services PMI Aug F | 53.7 | 53.3 | 53.3 | |

| 09:00 | EUR | Eurozone PPI M/M Jul | 0.80% | 0.30% | 0.50% | 0.60% |

| 09:00 | EUR | Eurozone PPI Y/Y Jul | -2.10% | -2.50% | -3.20% | -3.30% |

| 12:30 | USD | Trade Balance (USD) Jul | -78.8B | -76.4B | -73.1B | -73.0B |

| 12:30 | CAD | Trade Balance (CAD) Jul | 0.7B | -0.3B | 0.6B | -0.2B |

| 13:45 | CAD | BoC Interest Rate Decision | 4.25% | 4.50% | ||

| 14:30 | CAD | BoC Press Conference | ||||

| 18:00 | USD | Fed’s Beige Book |