Businesses sentiment rose strongly in August, as the prospect and then delivery of an OCR cut was brought forward.

Key results (August 2024)

- Business confidence: 50.6 (Prev: 27.1)

- Expectations for own trading activity: 37.1 (Prev: 16.3)

- Activity vs same month one year ago: -23.1 (Prev: -24.3)

- Inflation expectations: 2.92% (Prev: 3.20%)

- Pricing intentions: 41.0 (Prev: 37.6)

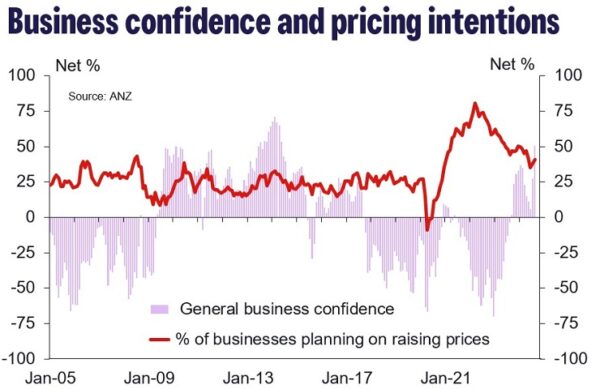

Business confidence has lifted sharply in the wake of the Reserve Bank’s turnaround on monetary policy. The ANZ survey of business opinion saw general confidence rise from 27.1 to 50.6 in August, the highest reading in a decade. Firms’ expectations for their own activity, which tends to correspond more closely with GDP growth, rose from 16.3 to 37.1, the highest since 2017.

Firms’ confidence was up across a range of measures, including hiring and investment intentions and expected profits. And to remove any doubt about the source of this newfound optimism, expectations about the availability of credit rose to their second-highest since this question was added to the survey in 2009.

Many of the survey responses will have been received before the RBNZ cut the OCR at its 14 August Monetary Policy Statement. However, the change of tone in its July policy review laid the groundwork for this move.

We wouldn’t suggest that a single OCR cut could make this degree of difference to the economic outlook. Rather, we think this shows how downbeat firms had become earlier in the year. We had noticed a distinct souring in the mood amongst businesses at the prospect that interest rate cuts might be another year or so away, as the RBNZ had been signalling in its February and May forecasts. With the economy having already been effectively flat for the last year and a half, the prospect of having to “survive until ‘25” would have been daunting for many.

While the outlook may be looking brighter, businesses are still doing it tough right now. A net 23% said that their output was down on a year ago, only slightly better than the net 24% in July. A net 15% said that their staff levels were down on a year ago, compared to a net 20% last month.

The improvement in confidence also came with a note of caution on the inflation front. Firm’s expectations of general inflation fell further from 3.2% to 2.9%, the lowest reading since July 2021. However, their own pricing intentions ticked up slightly for a second month, and their expectations for wages and other costs held steady.

The RBNZ emphasised the recent weakness of high-frequency activity indicators in its decision to cut the OCR in August. And indeed there was a marked deterioration across a range of measures for the June month. However, the updates for July and beyond have generally improved since then. We don’t think this will derail further OCR cuts in the months ahead, but the lift in business confidence along with other measures should see the market scale back the odds of larger 50bp moves.