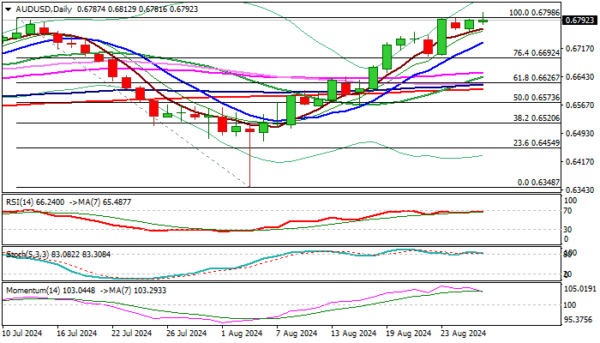

AUDUSD hit new 8-month high in Asian session on Wednesday, lifted by higher than expected Australian July CPI, but was so far unable to hold gains above 0.6800 mark.

Although subsequent dip was shallow, it sends initial warning that larger rally from 0.6348 (Aug 5 spike low) might be running out of steam.

Triple consecutive failure to clear previous top at 0.6798 (July 11) and today’s (so far) false break, contribute to such scenario in addition to initial negative signals from fading positive momentum and Stochastics’ bearish divergence on daily chart, as well as Thursday’s twist of daily cloud.

Immediate bias is expected to remain firmly bullish as long as the price stays above 0.6761 (Aug 21 former top/Aug 27 low/upper 20-d Bollinger band), while break here to generate initial bearish signal and risk dip towards 0.6734/00 (rising 10DMA / Aug 22/23 higher base) which guards more significant supports (a cluster of daily MA’s at 0.6655/10 zone / Fibo 38.2% of 0.6348/0.6812 rally).

Res: 0.6812; 0.6839; 0.6871; 0.6904.

Sup: 0.6761; 0.6734; 0.6700; 0.6655.