Markets

Friday’s Jackson Hole speech by Fed chair Powell seems to have given the nod for a final holiday week stretching until the September 2nd Labour Day Holiday. US yields rebound 1.9 bps (2-yr) to 4.2 bps (30-yr), strengthening our bottoming out case after they failed to set a new bottom in the wake of Powell’s rather soft comments. The proof of the pudding will be in the eating though, with ISM’s and payrolls lined up after Labour Day. German Bunds underperformed even somewhat with yields up to 6 bps for higher at the 30-yr tenor. Hawkish Dutch ECB member Knot said that he wants to wait until he has the full data and information going into the September meeting to decide what outcome is appropriate. He wants to do the same again in October and December, suggesting the central bank will not be pre-committing to any policy action in advance. It’s likely a lesson learnt from flagging the June rate cut in advance and eventually having to implement it together with an increase of inflation forecasts and coming off the back of sticky Q1 wage data. We nevertheless align with money markets discounting a second 25 bps rate cut by the ECB at the September meeting. Weekend comments from for example chief economist Lane (“the return to target is not yet secure”) strengthen our feeling that an October follow-up move is not a done deal and that they could stick to a quarterly cutting pace barring any mayor downside economic surprises. In FX space, the dollar has more difficulties getting away from sell-off lows as looser global financial conditions are set to kick in. Especially against a rather strong sterling. The UK currency seems to benefiting from the interest rate advantage in coming months. Markets have taken clues from stronger activity data and from BoE Bailey comments in Jackson Hole suggesting that the inflation battle isn’t won. Taking the ECB’s advantage and moving when updated quarterly forecasts are available suggest a September skip and only a next move in November.

News & Views

The Hungarian central bank (MNB) left the policy rate unchanged at 6.75% today. Markets and analysts weren’t all at the same page with some expecting a reduction to 6.5%. The MNB noted the uptick of inflation in July to 4.1% on a headline level and 4.7% in core gauges, adding that the disinflation in market services continues to be slow. It anticipates core inflation to rise close to 5% by the end of the year. The central bank mentioned the early August turmoil as having affected domestic financial markets and risk perception vis-à-vis the country, despite improving fundamentals (including the persistent C/A surplus and the government deficit reduction measures). The MNB believes disciplined monetary policy, anchored inflation expectations and financial market stability are crucial for CPI to sustainably return to target. It did say that there may still be some scope for cautiously lowering interest rates in the coming period but that’s no new information per se. Deputy governor Virag earlier flagged an end of year target rate of 6.25-6.5%. The Hungarian forint marginally appreciated in the wake of the decision from EUR/HUF 394 to around 393 currently. Hungarian swap yields slightly pared earlier losses with changes now ranging between -2.2 bps at the front and +1 bp at the long end.

Bulgaria’s president Rumen Radev signed a decree today to hold another snap parliamentary election on October 27th. It’s the seventh one in just three years and follows the failure of the largest party GERB, PP and the ITN party to form a stable coalition government after the inconclusive June 8 elections. That June vote was the result of the GERB and PP coalition collapsing in March amid persistent infighting. Radev also appointed a caretaker government led by current caretaker prime minster Dimitar Glavchev for the interim period.

Graphs

EUR/HUF: forint marginally stronger as MNB holds policy rates level amid an inflation uptick

EU 30y swap rate: very long end of core yield curves underperforms following test of support levels.

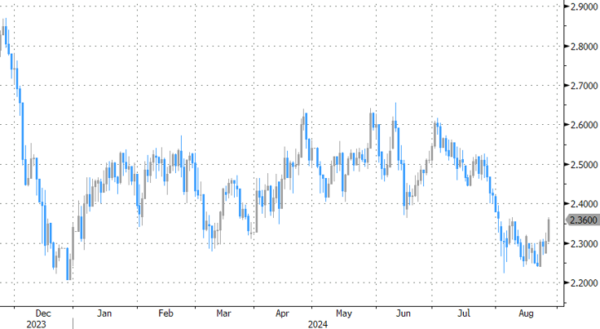

Trade-weighted dollar (DXY): more difficulties getting out of trouble as looser financial conditions are about to set in

S&P 500: the last mile is always the hardest