- GBPJPY attempts to recover from recent 8-month low

- But the rebound falters after testing 200-day SMA

- RSI and MACD remain tilted to the bearish side

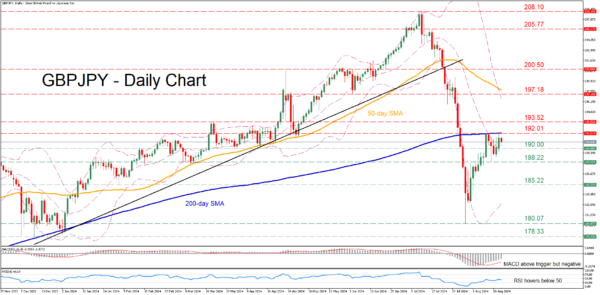

GBPJPY experienced a vast selloff in July, dropping from a 16-year peak of 208.10 to as low as 180.07 on August 5, which is also an eight-month low. Since then, the pair has been in a recovery mode, but its rebound seems to have paused for now at the 200-day simple moving average (SMA).

Should the bears attempt to erase the latest uptick, the April support of 190.00 could prove to be the first obstacle for them to overcome. Further declines may then cease at the recent support of 188.22 ahead of the February low of 185.22. Failing to halt there, the price may descend towards the eight-month low of 180.07.

Alternatively, if the rebound resumes, initial resistance could be found at the recent rejection region of 192.01, which overlaps with the 200-day SMA. A break above that zone could open the door for the March peak of 193.52. Conquering this barricade, the bulls might attack the June support of 197.18, which could serve as resistance in the future.

In brief, GBPJPY has been attempting to erase its recent slump, but its efforts have met strong resistance at the 200-day SMA. Hence, a break above that crucial hurdle is needed for the bulls to regain confidence for a full-scale recovery.